Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

When most people think of car insurance perks, they think of protection in accidents, theft, and the like.

That coverage, however, usually isn’t included in the state-mandated minimum property damage liability coverage.

That’s where comprehensive and collision coverage comes in.

While optional, they give you added peace of mind and financial protection.

They protect you from the costs of damage to your vehicle.

What does comprehensive cover?

There’s a reason 77% of all drivers carry the comprehensive coverage as an add-on to their regular policy.

If nothing else, it gives you peace of mind in the event of a covered accident.

Illustrated above are examples of things that comp is going to cover. For example, if you hit an animal. But if you swerve to miss the animal and crash into a tree that would fall under collision.

Illustrated above are examples of things that comp is going to cover. For example, if you hit an animal. But if you swerve to miss the animal and crash into a tree that would fall under collision.

Comprehensive insurance covers the things you can’t control while driving.

It protects you from having to pay to repair vehicle damage caused by natural disasters.

That means that you won’t have to pay for the cost of damage from:

•Hurricanes, earthquakes, tornados, or hailstorms.

•Failing objects.

•Vandalism and theft.

•Hitting an animal while driving.

•Shattered or broken windows

This add-on to your auto policy ensures that you’ll be covered if a tree falls on your car.

You’ll also be covered if your car is vandalized or stolen.

As a driver, you know how frustrating it is to hit an animal like a deer while driving.

It’s just as frustrating to deal with major damage from a rock or object that falls off a vehicle in front of you.

To put it simply, those are out of pocket costs that you shouldn’t have to deal with.

Why should you have to pay for the repair costs of vehicle damage or glass damage from a flying object or rock on the road?

It provides you with the type of protection you need to file damage claims.

Some additional examples of items covered by your insurance company might be:

•damage to one of your insured vehicles from an act of terrorism

•damage to your vehicle from floodwaters

•damage as a result of a fire or an explosion

Making a Claim

The process for making a comprehensive claim is the same as when you file most any claim.

The first thing you should do is call your carrier or insurance company.

You’ll connect with the policyholder service center so you can describe the damage and what happened.

The company representative will determine if the vehicle damage is covered.

They will walk you through the claims process and help you get an estimate to repair your vehicle.

They will also let you know if you have to pay as an out of the pocket expense.

In most cases, making a claim will not cause your insurance rates to increase.

Average cost by state

Below is the average premium cost for each state.

Each covered vehicle had a deductible of $250—the higher your deductible, the lower your premium.

Many drivers raise their deductible to lower the collision price since it can be expensive for any motor vehicle coverage with an extremely low or zero deductible.

| State | Liability Limits** | Comprehensive | Collision | UMP Required?* |

|---|---|---|---|---|

| Alabama | 25/50/25 | $149 | $566 | No |

| Alaska | 50/100/25 | $141 | $644 | No |

| Arizona | 15/30/10 | $160 | $480 | No |

| Arkansas | 25/50/25 | $239 | $588 | No |

| California | 15/30/5 | $159 | $1,001 | No |

| Colorado | 25/50/15 | $240 | $516 | No |

| Connecticut | 20/40/10 | $120 | $690 | Yes |

| Delaware | 15/30/10 | $111 | $534 | No |

| Florida | 10/20/10 | $165 | $498 | No |

| Georgia | 25/50/25 | $160 | $548 | No |

| Hawaii | 20/40/10 | $101 | $560 | No |

| Idaho | 25/50/15 | $133 | $436 | No |

| Illinois | 20/40/15 | $118 | $487 | No |

| Indiana | 25/50/10 | $144 | $515 | No |

| Iowa | 20/40/15 | $250 | $399 | No |

| Kansas | 25/50/10 | $427 | $470 | Yes |

| Kentucky | 25/50/10 | $280 | $580 | No |

| Louisiana | 15/30/25 | $251 | $670 | No |

| Maine | 50/100/25 | $89 | $410 | Yes |

| Maryland | 30/60/15 | $135 | $580 | Yes |

| Massachusetts | 20/40/5 | $164 | $555 | Yes |

| Michigan | 20/40/10 | $246 | $960 | No |

| Minnesota | 30/60/10 | $255 | $398 | Yes |

| Mississippi | 25/50/25 | $221 | $492 | No |

| Missouri | 25/50/10 | $298 | $473 | Yes |

| Montana | 25/50/10 | $331 | $540 | No |

| Nebraska | 25/50/25 | $343 | $408 | No |

| Nevada | 15/30/10 | $152 | $596 | No |

| New Hampshire | 25/50/25 | $92 | $478 | Yes |

| New Jersey | 15/30/5 | $102 | $450 | Yes |

| New Mexico | 25/50/10 | $203 | $456 | No |

| New York | 25/50/10 | $145 | $700 | Yes |

| North Carolina | 30/60/25 | $116 | $416 | Yes |

| North Dakota | 25/50/25 | $333 | $431 | Yes |

| Ohio | 25/50/25 | $106 | $403 | No |

| Oklahoma | 25/50/25 | $372 | $541 | No |

| Oregon | 25/50/20 | $100 | $443 | Yes |

| Pennsylvania | 15/30/5 | $146 | $618 | No |

| Rhode Island | 25/50/25 | $120 | $728 | No |

| South Carolina | 25/50/25 | $310 | $609 | No |

| South Dakota | 25/50/25 | $461 | $417 | Yes |

| Tennessee | 25/50/15 | $155 | $513 | No |

| Texas | 30/60/25 | $230 | $536 | No |

| Utah | 25/65/15 | $116 | $422 | No |

| Vermont | 25/50/10 | $144 | $476 | Yes |

| Virginia | 25/50/20 | $103 | $397 | Yes |

| Washington | 25/50/10 | $103 | $387 | No |

| Washington D.C. | 25/50/10 | $168 | $649 | Yes |

| West Virginia | 20/40/10 | $180 | $465 | Yes |

| Wisconsin | 25/50/10 | $216 | $467 | Yes |

| Wyoming | 25/50/20 | $348 | $655 | No |

*Uninsured Motorists Protection is not required in all states. This is good protection if you are hit and run with motorists who drive off or don’t have coverage. If you can’t use uninsured motorists protection, you should be able to use collision. It will depend on the insurer and the circumstances.

**Minimum coverage requirements including bodily injury liability, property damage liability, underinsured motorist coverage, medical payments coverage, personal injury protection, etc., and any other auto liability to keep financial responsibility laws for a registered vehicle.

What does collision cover?

Collision covers the damage to your vehicle as a result of an accident.

It doesn’t matter who is at fault; the damage will be covered when you file a claim.

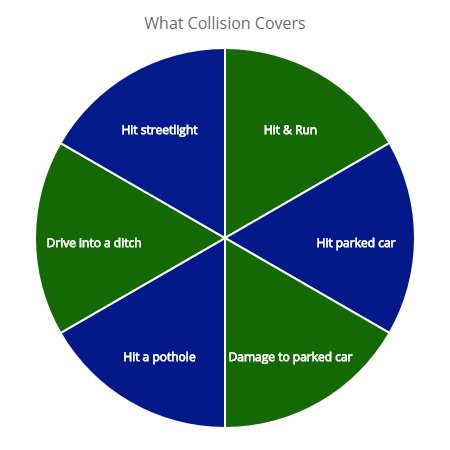

Illustrated above are the items covered when you have collision added to your policy. As an example, if you have a hit and run accident, you would use the protection. If the hit and run are with an uninsured motorist, you will use uninsured motorist coverage.

Illustrated above are the items covered when you have collision added to your policy. As an example, if you have a hit and run accident, you would use the protection. If the hit and run are with an uninsured motorist, you will use uninsured motorist coverage.

You can claim with your insurer under this type of insurance if your car sustained damage from:

•a hit-and-run accident

•hitting a parked car

•a vehicle hitting your parked car

•hitting a streetlight, utility pole, or tree

•hitting a pothole

•driving into a ditch

If an uninsured motorist hits you, you will still be able to file a claim for the damage.

You can check your insurance contract, but your insurer will pursue reimbursement from the uninsured motorist in most cases.

At worst, you’ll have to pay your deductible.

Making a Claim

If you are involved in an accident, you should get a police report.

It will protect you if the other party makes a false claim about your accident.

If you’re at fault, making a claim is simple.

You need to call your insurer and connect with the policyholder service center.

A representative will likely have you send them a copy of the police report and walk you through the claims process.

If the damage to your vehicle exceeds the total loss threshold, they will deem the car totaled.

That means the repair damage cost is greater than the vehicle’s actual cash value or fair market value.

Your insurer will cut you a check for the maximum payout or actual cash value of the vehicle minus the deductible.

If you are thinking of dropping the optional protection use the 10% rule. For example, if you have a $4,000 vehicle and you are paying more than $400 for comp and collision – consider dropping the additional add-ons. Compare RatesStart Now →

You can use that money to purchase a new vehicle.

If you still want to drive the totaled vehicle, you can use that check and pay the rest of the repairs bill out of pocket if you are in the financial position to do so.

In some cases, an at-fault claim will cause your auto insurance premiums to increase.

However, you should check your insurance contract to see if it includes a forgiveness option as part of your auto insurance policy contract.

The following insurers have comprehensive auto insurance policies that include accident forgiveness:

– State Farm

– Allstate

– Geico

– Liberty Mutual

– Progressive

The claims process for an accident when you’re not at-fault differs slightly.

You’ll have two options when filing your insurance claims.

With both options, I highly recommend getting a police report.

The first option you have when you’re not at fault is to file the claim through the other party’s motorist property damage.

However, if the other party’s damage liability limits are low, then you are out of luck.

They may not be able to cover the cost of the repairs damage.

If the damage exceeds the total loss threshold required to reimburse you for your vehicle’s actual cash value amount, they might not be able to offer the full potential payout.

In other words, it isn’t wise to rely on the physical damage coverage of the other party.

The other option is to file a claim through your own policy.

This process is a lot easier and saves you from the headache of fighting for your potential payout.

That’s because your insurer will do the legwork for you.

Your insurer will pursue the at-fault insurance provider to be compensated.

With the police’s accident motor vehicle report, your carrier can even fight to recoup your deductible.

That should be a major factor in how you file a claim.

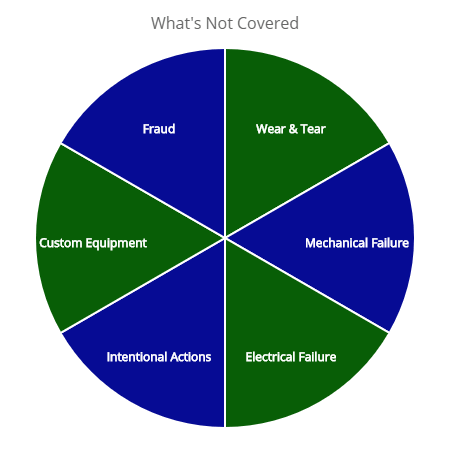

Illustrated above are the items not covered by the optional add-ons to your policy. Normal wear and tear, custom equipment, and mechanical or electrical failure are some of the things you will not be able to recoup money if you file with either.

Illustrated above are the items not covered by the optional add-ons to your policy. Normal wear and tear, custom equipment, and mechanical or electrical failure are some of the things you will not be able to recoup money if you file with either.

What isn’t covered?

Some examples of items not covered by these types of coverage include:

•Wear and tear

•Mechanical failure that is not related to an accident

•Electrical failure

•Intentional actions or other attempts at insurance fraud

•Custom equipment not listed or specifically covered as outlined in your insurance contract policy

Differences between the two types of protection

The main difference between comprehensive and collision insurance, according to Benzinga is:

•Damage incurred in events within your control while driving is covered by collision.

•Damage incurred in events that are out of your control while driving is covered by comprehensive.

•If another driver collides with you, it’s out of your control, yet it is still a collision claim if no uninsured motorist (UM) or underinsured motorist (UIM) coverage exists.

Both types of insurance will cover the cost of repair up to the total loss threshold.

Do I need comprehensive and collision?

You may not need these kinds of protection. They are considered optional, extra coverage, or an add-on.

Most states require only liability insurance.

With that said, you may be required by your leasing company to purchase both insurance products.

You may need to pay the additional premium if you are financing your vehicle.

In either case, you should talk to insurance agents in your area to confirm.

In general, it is worth getting both kinds of protection as add-ons to your liability coverage if you lease or finance your car, your car is less than 10 years old, or your car is worth more than $3,000.

Many insurance agents recommend using the ten percent rule when deciding if you should buy both add-ons.

This unwritten rule states that you should drop collision and comprehensive if the protection cost is more than ten percent of your vehicle’s fair market book value.

That means that if your vehicle is valued at $3,000 and you’re paying $300 for both add-ons, then you are paying too much, and you might as well drop the extra coverage.

There are some instances where you may want to purchase one of these insurance products without the other.

Comprehensive is usually more affordable and covers more than collision.

It is the perfect option for you if you want to store your vehicle without driving it.

What happens if I don’t have the coverage?

Property damage liability, the policy you are required to have, does not cover your vehicle.

Without the extra add-on, your car will be left unprotected by your car insurance policy.

That means that you have an accident and you are at fault; you won’t claim damage.

You’ll have to pay for the cost of repairs.

That’s an out-of-pocket expense you’ll avoid.

How much does the coverage cost?

The cost of both add-ons runs about $600 to $700 per year, depending on your insurance provider, driving history, and car type.

If the cost is less than ten percent of your vehicle’s book value, they are worth the additional fees.

| Car Type | Basic Liability | With Comprehensive | With Collision & Comprehensive |

|---|---|---|---|

| Ford F-150 | $1,329 | $1,643 | $2,324 |

| Tesla Model 3 | $1,987 | $2,176 | $2,877 |

| Chevrolet Silverado | $1,544 | $1,745 | $2,465 |

| Toyota Camry | $1,766 | $2,011 | $2,467 |

| Honda Civic | $2,121 | $2,402 | $2,987 |

| Ram 1500 | $1,700 | $1,804 | $2,342 |

| Nissan Altima | $1,632 | $1,881 | $2,534 |

| Toyota Corolla | $1,603 | $1,933 | $2,521 |

| Honda CR-V | $1,877 | $2,133 | $2,711 |

| Ford Escape | $1,411 | $1,628 | $2,203 |

About 6% of drivers with collision insurance file claims each year valued at $3,350 on average.

Nearly 3% file comprehensive claims valued at more than $1,500 on average.

Sources

The California Department of Insurance

https://www.edmunds.com/

Quadrant Information Services

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.