Maine Cheapest Car Insurance Quotes & Best Coverage Options

Drivers looking for the Maine cheapest car insurance policies can find them at Travelers and Geico. Travelers has the cheapest minimum coverage rates in Maine, with average rates of $29 per month. Geico has the cheapest full coverage rates in Maine, as Geico's rates only average $73 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florida. ...

Certified Financial Planner

UPDATED: Dec 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Travelers has the cheapest minimum liability insurance in Maine

- Geico has the cheapest full-coverage insurance in Maine

- Full coverage provides the most protection for Maine drivers

Maine cheapest car insurance rates can be found at Travelers and Geico. In addition to shopping at the best auto insurance companies for cheap Maine auto insurance, drivers can also save by looking for discounts, keeping a clean driving record, and more.

Read on to learn how to get cheap auto insurance in Maine. To find affordable Maine rates now, enter your ZIP code in our free quote tool.

Affordable Maine Car Insurance Rates

How much is car insurance in Maine? You can find out by comparing a car insurance quote from at least three to five insurance carriers, as this is the best way to ensure you find the best deals to save money monthly.

| Cheapest Car Insurance in Maine - Key Takeaways |

|---|

The cheapest Maine car insurance options are: The cheapest Maine car insurance options are:Cheapest for minimum coverage: Travelers Insurance Cheapest for full coverage: Geico Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Geico Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Geico For younger drivers with a speeding violation: Concord Group For younger drivers with an at-fault accident: Concord Group |

This guide will take a closer look at car insurance providers and the types of auto insurance coverage available to drivers in Maine and help you determine which one is best for your individual needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Maine for Minimum Coverage

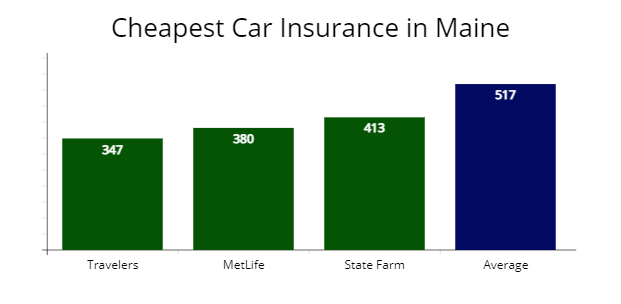

Our recent research found the cheapest auto insurer in Maine for minimum liability insurance requirements is Travelers, which provided our agents a $347 insurance rate for our sample driver.

The average quote is $517 per year, and Travelers’ rate at $347 per year is 33% cheaper, making them the best option for drivers in Maine needing minimum liability insurance.

| Company | Average annual rate |

|---|---|

| USAA | $289 |

| Travelers | $347 |

| MetLife | $380 |

| State Farm | $413 |

| Geico | $457 |

| Progressive | $488 |

| Allstate | $569 |

| Concord Group | $615 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Military members, their spouses, or family members qualify for cheaper car insurance through USAA. Buying minimum coverage insurance requirements at $289 annually through USAA is 45% less expensive than the state average $517 rate.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in Maine

If you are interested in having extra coverage options in Maine while you are on the road, the cheapest full coverage rates are with Geico at $876 per year or $73 per month.

Quotes from this car insurance carrier are 25% less expensive than Maine’s average of $1,160.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $876 | $73 |

| Travelers | $981 | $81 |

| State Farm | $1,060 | $88 |

| Maine average | $1,160 | $96 |

*Your rates may vary when you get quotes.

Full coverage car insurance in Maine costs more than double the amount that minimum coverage insurance costs.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

While many drivers may instantly turn away from taking out full coverage due to the higher car insurance rates, others appreciate the peace of mind and reassurance they receive by having collision and comprehensive coverage along with their liability coverage.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Our agents recommend full coverage insurance in Maine to protect your vehicle and the other drivers. Collision coverage pays for damage to your vehicle no matter who is at fault. And comprehensive insurance pays for non-collision damage, such as from hitting a traffic sign or an animal such as a deer.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

Cheapest Car Insurance With Speeding Tickets in Maine

The best coverage rate for drivers with speeding tickets in Maine is Geico, which offered us a quote at $998 per year or $83 per month for full coverage. The average cost of insurance for Mainers with a speeding ticket is $1,517, but Geico is $519 cheaper.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $998 | $83 |

| Travelers | $1,147 | $95 |

| Concord Group | $1,366 | $113 |

| Maine average | $1,517 | $126 |

Speeding tickets will cause your auto insurance rates to increase regardless of coverage levels. According to the State of Maine Judicial Branch, most drivers expect rate increases by 24% on average for traffic violations in the Pine Tree State.

Cheapest Car Insurance in Maine With Car Accidents

In Maine, drivers with one at-fault accident on their driving record should consider State Farm, the cheapest auto insurance company, which provided our insurance agents with a quote at $1,309 per year or $109 per month.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,309 | $109 |

| Geico | $1,462 | $121 |

| Travelers | $1,681 | $140 |

| Maine average | $1,879 | $156 |

The average cost of car insurance for drivers in Maine after being involved in an accident is $1,879 per year or $156 per month. State Farm’s rate for those with an auto accident is 31% cheaper than the state average.

One at-fault accident on your driving record in Maine, you can expect your car insurance rates to go up by 39% over three years. Depending on the severity of the car accident, you may have to file an SR-22 in the state of Maine, according to Maine’s Bureau of Insurance.

Read more: Understanding SR-22 Insurance: What Is It and Who Is It For?

Cheapest Car Insurance With a DUI in Maine

One of the best car insurance companies after a DUI in Maine is Progressive. Progressive’s quote of $1,584 per year or $132 per month is 33% less expensive than average and $159 less than the next best option Concord Group.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,584 | $132 |

| Concord Group | $1,743 | $145 |

| Geico | $1,962 | $163 |

| Maine average | $2,350 | $195 |

Drivers in Maine caught driving under the influence (OUI) are expected to pay car insurance premiums 51% more than drivers who have clean driving records.

According to Maine’s Bureau of Highway Safety, after a DUI (called an OUI in ME), drivers in Maine will have an administrative license suspension proceeding before the Maine Bureau of Motor Vehicles (BMV) to determine the severity of operating a vehicle under the influence.

Cheapest Car Insurance For Drivers with Poor Credit in Maine

According to our analysis, the Maine car insurance company offering the best rates with poor credit is Geico.

Geico’s quote of $1,147 per year is 38% less expensive than the $1,843 average premium.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,147 | $95 |

| Progressive | $1,661 | $138 |

| State Farm | $1,787 | $148 |

| Maine average | $1,843 | $153 |

Even if you are a good driver in Maine, your credit report and score can increase car insurance rates by 38%. That’s because many auto insurers look at a person’s ability to pay off their debts or credit cards to reflect their ability to make their monthly car insurance payments. To find a company without credit checks, take a look at our guide to auto insurance companies that don’t check credit.

Cheapest Car Insurance for Young Drivers in Maine

Our analysis found that Geico is the cheapest insurance company for young drivers in Maine looking for full coverage insurance. Our insurance agents received a rate of $2,056 annually from Geico, which is 51% more affordable than Maine’s state average rate.

Teen drivers looking for the best car insurance for teens in Maine should consider Allstate ($1,160) and State Farm ($1,490). Both auto insurers are 10% cheaper than the average $1,640 Maine auto insurance rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $1,923 | $871 |

| Geico | $2,056 | $1,580 |

| Concord Group | $2,144 | $1,517 |

| State Farm | $2,743 | $1,490 |

| Allstate | $3,648 | $1,160 |

| MetLife | $4,632 | $1,641 |

| Progressive | $5,132 | $2,355 |

| Maine average | $4,132 | $1,640 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Our agents recommend a teen driver in Maine carry full coverage insurance and be added to an adult or parent’s policy to save the most money. Adding high school or college students to their parent’s policy is $900 in annual savings and up to 30% if they qualify for a good student discount with “B” average grades.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young or teen drivers in Maine who have a speeding violation will find affordable insurance rates with Concord Group, which provided us a quote at $188 per month or 51% less expensive than the state average rate.

State Farm proved affordable Maine insurance with a $239 monthly rate for full coverage for similar driver profiles.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Concord Group | $2,260 | $188 |

| State Farm | $2,873 | $239 |

| Geico | $3,142 | $261 |

| Maine average | $4,543 | $378 |

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Maine drivers with an at-fault accident can get cheaper rates by getting auto insurance coverage from Concord Group with a quote at $224 per month or $2,694 per year, 46% less than average rates.

The next best coverage option is Geico, quoted at a $301 monthly rate or 27% less expensive than a typical rate for a teen driver with a car accident in their driver history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Concord Group | $2,694 | $224 |

| Geico | $3,621 | $301 |

| Allstate | $3,678 | $306 |

| Maine average | $4,931 | $410 |

Best Car Insurance Companies in Maine

AutoInsureSavings.org agent’s survey of the best car insurance carriers in Maine found Nationwide performed the best overall customer service and claims satisfaction. Other best auto policy options based on customer service are USAA and State Farm.

We studied data to help you find the best coverage choices and insurance decisions during our analysis of Maine’s best auto insurers. The data we use is from the National Association of Insurance Commissioners (NAIC), J.D. Power’s customer satisfaction survey, and AM Best financial strength ratings.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | A.M. Best Financial Strength Rating |

|---|---|---|---|

| Concord Group | 0.44 | n/a | A |

| Progressive | 0.60 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Nationwide | 0.92 | 870 | A |

| Geico | 1.01 | 871 | A++ |

| MetLife | 1.13 | 886 | A |

*NAIC complaint index, the lower, the better, JD Power’s claims satisfaction study, the higher, the better, AM Best Ratings, A+ is “excellent,” and A++ is “superior” financial strength.

Concord Group (0.44) and Progressive Insurance (0.60) perform best with NAIC’s complaint index. Both scored less than the national average of 1.00 with lower than average complaints based on their market share.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Deciding on the best car insurance company in Maine is not a simple task. That is because the risk factors that make one car insurance company the best for one driver may make them the worst choice for another. Finding the best auto insurance rates for you will depend on many factors like your age, your driving history, where you live, and your vehicle’s make or model, to name a few.

A recent insurance survey from ValuePenguin reached similar results for Maine car insurance carriers.

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Nationwide | 78% | 52% |

| USAA | 76% | 60% |

| Progressive | 74% | 34% |

| State Farm | 72% | 47% |

| Allstate | 71% | 47% |

| Geico | 64% | 42% |

Your best resource for finding the most affordable car insurance rates in Maine is an insurance quote comparison tool like AutoInsureSavings.org.

Average Car Insurance Costs by City in Maine

Auto insurers in Maine use your zip code to calculate your insurance rate, as well as many other risk factors such as marital status, credit score, type of vehicle, and driving history. Your rates can vary by $413 or more, depending on your zip code in Maine,

AutoInsureSavings.org licensed insurance agents analyzed cities with the cheapest insurance coverage in Maine.

Cheapest Car Insurance in Portland, ME

Portland’s cheapest insurance is with Concord Group, which provided our agents a $963 per year quote or $80 per month with a $500 deductible for comprehensive and collision insurance. Concord’s rate is 32% less expensive than the $1,401 Portland, ME average rates.

| Portland Company | Average Premium |

|---|---|

| Concord Group | $963 |

| Geico | $1,076 |

| Travelers | $1,214 |

| Portland average | $1,401 |

Cheap Auto Insurance in Lewiston, ME

Lewiston’s least expensive auto insurance is with Travelers, which offered us a $923 per year rate for our sample 30-year-old driver with full coverage. Travelers’ quote is 31% cheaper than the Lewiston average rates of $1,328 per year.

| Lewiston Company | Average Premium |

|---|---|

| Travelers | $923 |

| State Farm | $1,047 |

| Geico | $1,096 |

| Lewiston average | $1,328 |

Cheapest Auto Insurance in Bangor, ME

In Bangor, cheaper car insurance coverage can be found with Travelers, which offered our agents a $916 per year quote for a full coverage policy. Travelers’ rate is 34% less expensive than Bangor’s average rates of $1,370 per year.

| Bangor Company | Average Premium |

|---|---|

| Travelers | $914 |

| Concord Group | $1,036 |

| Geico | $1,158 |

| Bangor average | $1,370 |

Cheapest Auto Insurance in Auburn, ME

Affordable insurance coverage in Auburn, Maine, is with Geico providing the best rate at $979 per year for a full coverage policy. Geico’s $73 a month rate is 35% less expensive than average rates for Auburn residents.

| Auburn Company | Average Premium |

|---|---|

| Geico | $879 |

| Concord Group | $1,077 |

| State Farm | $1,132 |

| Auburn average | $1,332 |

Cheap Auto Insurance in Biddeford, ME

Drivers in Biddeford can get cheaper insurance with Geico, which provided our licensed agents an $813 per year rate for a full coverage policy with $100,000 in liability limits. Geico’s quote is 37% less expensive than the average rates of $1,275 in Biddeford.

| Biddeford Company | Average Premium |

|---|---|

| Geico | $813 |

| Concord Group | $953 |

| State Farm | $1,051 |

| Biddeford average | $1,275 |

Cheapest Car Insurance in Brunswick, ME

The most affordable insurance rate our agents found in Brunswick is Travelers, with a $914 per year rate for a policy with collision and comprehensive coverage. Traveler’s quote is 31% less expensive than Brunswick’s average rates of $1,316 per year.

| Brunswick Company | Average Premium |

|---|---|

| Travelers | $914 |

| Geico | $988 |

| MetLife | $1,127 |

| Brunswick average | $1,316 |

Cheap Auto Insurance in Saco, ME

Drivers in Saco, ME can find the cheapest full coverage insurance policy with Travelers, which offered us a $920 per year rate for our sample 30-year-old driver. Travelers’ car insurance rate is $292 less per year than Saco’s average rates of $1,212 per year.

| Saco Company | Average Premium |

|---|---|

| Travelers | $920 |

| MetLife | $1,046 |

| Geico | $1,067 |

| Saco average | $1,212 |

Average Insurance Cost for All Cities in Maine

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Portland | $1,401 | Manchester | $988 |

| Lewiston | $1,328 | Hallowell | $1,010 |

| Bangor | $1,370 | Hancock | $1,038 |

| South Portland | $1,397 | Canaan | $1,068 |

| Auburn | $1,332 | Whitefield | $1,027 |

| Biddeford | $1,275 | West Paris | $1,056 |

| Sanford | $1,260 | Unity town | $1,100 |

| Brunswick | $1,316 | Eddington | $1,077 |

| Scarborough | $1,305 | Otisfield | $1,008 |

| Saco | $1,212 | Buckfield | $1,068 |

| Westbrook | $1,251 | Albion | $1,016 |

| Augusta | $1,164 | West Bath | $1,114 |

| Windham | $1,187 | Leeds | $1,140 |

| Gorham | $1,190 | Dayton | $1,027 |

| Waterville | $1,214 | Phippsburg | $1,136 |

| York | $1,019 | Palmyra | $988 |

| Falmouth | $1,068 | Livermore | $1,167 |

| Kennebunk | $1,178 | Orland | $1,043 |

| Orono | $1,219 | Corinna | $1,077 |

| Wells | $1,016 | Damariscotta | $1,056 |

| Standish | $1,103 | Machias | $1,008 |

| Kittery | $1,027 | Lincolnville | $1,114 |

| Cape Elizabeth | $1,136 | Limestone | $1,180 |

| Presque Isle | $1,016 | Veazie | $1,121 |

| Brewer | $1,043 | Dixfield | $1,159 |

| Lisbon | $1,056 | Boothbay Harbor | $1,136 |

| Old Orchard Beach | $1,008 | Mapleton | $1,103 |

| Topsham | $1,194 | Deer Isle | $1,016 |

| Yarmouth | $1,114 | St. Albans | $1,077 |

| Freeport | $1,121 | Van Buren | $1,148 |

| Bath | $1,116 | Parsonsfield | $1,190 |

| Skowhegan | $1,205 | Randolph | $1,027 |

| Buxton | $1,220 | Trenton | $1,043 |

| Gray | $1,148 | Northport | $1,056 |

| Cumberland | $1,241 | Hebron | $1,008 |

| Ellsworth | $988 | Mount Desert | $1,121 |

| Waterboro | $1,043 | Wales | $1,114 |

| Caribou | $1,159 | Newcastle | $1,077 |

| Berwick | $1,136 | Hiram | $1,205 |

| Winslow | $1,103 | Stockton Springs | $1,148 |

| Farmington | $1,192 | Bradley | $1,214 |

| Old Town | $1,027 | Dedham | $1,043 |

| South Berwick | $1,202 | Nobleboro | $1,213 |

| Hampden | $1,056 | Surry | $1,114 |

| Rockland | $1,212 | New Sharon | $1,136 |

| Belfast | $1,200 | East Millinocket | $1,008 |

| Eliot | $1,016 | Lamoine | $1,159 |

| Fairfield | $1,121 | Dresden | $1,103 |

| Oakland | $1,136 | Hartland | $1,027 |

| Lebanon | $1,217 | Pownal | $988 |

| Winthrop | $1,068 | Hope | $1,056 |

| Hermon | $1,043 | Appleton | $1,194 |

| Houlton | $1,148 | Sebago | $1,077 |

| Turner | $1,114 | Washburn | $1,136 |

| New Gloucester | $1,159 | Newburgh | $1,043 |

| Rumford | $1,205 | Tremont | $1,008 |

| Gardiner | $1,219 | Milbridge | $1,121 |

| Poland | $1,103 | Stetson | $1,199 |

| Bar Harbor | $1,205 | Gouldsboro | $1,016 |

| Bridgton | $1,027 | Owls Head | $1,077 |

| Paris | $1,136 | Waterford | $1,159 |

| Waldoboro | $988 | Charleston | $1,103 |

| Sabattus | $1,148 | Cushing | $1,193 |

| Norway | $1,056 | Cornville | $1,114 |

| Lincoln town | $1,043 | Baldwin | $1,136 |

| Bucksport | $1,159 | Hodgdon | $1,198 |

| Harpswell | $1,008 | Southwest Harbor | $1,043 |

| Camden | $1,205 | Mount Vernon | $1,027 |

| Warren | $1,016 | Palermo | $1,205 |

| North Berwick | $1,121 | Washington | $1,114 |

| Madison | $1,211 | Enfield | $1,136 |

| Jay | $1,027 | Baileyville | $1,056 |

| Hollis | $1,103 | Greenville | $1,008 |

| Glenburn | $1,068 | Porter | $1,016 |

| Raymond | $1,077 | Sangerville | $1,148 |

| Lyman | $1,043 | Greenbush | $1,159 |

| Sidney | $989 | Hudson | $1,103 |

| Greene | $1,027 | Mars Hill | $1,069 |

| Vassalboro | $1,056 | Brownfield | $990 |

| Millinocket | $1,136 | Franklin | $1,008 |

| Arundel | $1,114 | Newfield | $1,043 |

| China | $1,194 | Peru | $1,056 |

| Monmouth | $1,205 | East Machias | $1,077 |

| Dover-Foxcroft | $1,148 | Cornish | $1,027 |

| Oxford | $1,016 | Strong | $1,121 |

| Pittsfield | $1,223 | Eastport | $1,008 |

| Wilton | $1,159 | Searsmont | $1,136 |

| Naples | $1,043 | Lubec | $1,205 |

| Durham | $990 | Sullivan | $1,213 |

| Winterport | $1,027 | Denmark | $1,016 |

| Casco | $1,071 | Dixmont | $1,114 |

| Fort Kent | $1,205 | Sedgwick | $1,077 |

| Limington | $1,056 | Ashland | $990 |

| North Yarmouth | $1,103 | Jonesport | $1,043 |

| Madawaska | $1,194 | Swanville | $1,136 |

| Dexter | $1,008 | Easton | $1,027 |

| Wiscasset | $1,121 | Chesterville | $1,103 |

| Orrington | $1,159 | South Thomaston | $1,148 |

| Litchfield | $1,205 | Medway | $1,008 |

| Kennebunkport | $1,136 | Kenduskeag | $1,072 |

| Richmond | $1,016 | Steuben | $1,194 |

| Fryeburg | $1,114 | Penobscot | $1,056 |

| West Gardiner | $990 | Plymouth | $1,205 |

| Rockport | $1,077 | Addison | $1,159 |

| Clinton | $1,077 | Brownville | $1,008 |

| Fort Fairfield | $1,027 | Guilford | $1,016 |

| Newport | $1,148 | Howland | $1,114 |

| Norridgewock | $1,159 | Woodstock | $1,205 |

| Bowdoin | $1,043 | Hartford | $1,136 |

| Livermore Falls | $1,194 | Bradford | $1,159 |

| Belgrade | $1,205 | Friendship | $1,114 |

| Boothbay | $1,008 | Castine | $1,043 |

| Alfred | $1,056 | Edgecomb | $1,121 |

| Woolwich | $1,103 | Sumner | $1,068 |

| Holden | $1,136 | Wayne | $1,027 |

| Calais | $1,016 | Exeter | $990 |

| Milford | $1,205 | Burnham | $1,008 |

| Mechanic Falls | $1,200 | Fayette | $1,077 |

| Bowdoinham | $1,114 | Monroe | $1,148 |

| Levant | $1,136 | Stonington | $1,194 |

| Limerick | $1,172 | Morrill | $1,208 |

| Farmingdale | $1,205 | Etna | $1,056 |

| Corinth | $1,121 | Rangeley | $1,103 |

| Carmel | $990 | Frankfort | $1,008 |

| Harrison | $1,043 | Phillips | $1,114 |

| Thomaston | $1,068 | Ogunquit | $1,180 |

| Bristol | $1,027 | Garland | $1,136 |

| Union | $1,056 | Littleton | $1,016 |

| Chelsea | $1,077 | Montville | $1,027 |

| Shapleigh | $1,148 | Harrington | $1,068 |

| Benton | $1,194 | Lovell | $1,114 |

| Bethel | $1,154 | Woodland | $1,056 |

| Pittston | $1,134 | Rome | $1,148 |

| Blue Hill | $1,008 | Brooks | $1,130 |

| Searsport | $990 | Athens | $1,027 |

| Anson | $1,103 | New Vineyard | $1,043 |

| Mexico | $1,114 | Troy | $1,129 |

| Jefferson | $1,056 | Machiasport | $990 |

| Milo | $1,016 | Georgetown | $1,077 |

| Acton | $1,121 | Smithfield | $1,103 |

| Windsor | $1,027 | Brooksville | $1,070 |

| Minot | $1,073 | Belmont | $1,055 |

| St. George | $1,049 | Sherman | $1,016 |

| Readfield | $995 | Cherryfield | $1,008 |

Minimum Car Insurance Requirements in Maine

According to the State of Maine Professional and Financial Regulation, vehicle registration requires all drivers to carry a minimum amount of liability insurance, uninsured motorist coverage, and medical payments coverage (MedPay) in their car insurance policies.

The insurance requirements pay for bodily injury liability and property damage sustained to other people or motor vehicles. Uninsured motorist coverage pays for accidents with uninsured motorists, and medical payments (MedPay) cover injuries to you or other vehicle occupants.

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability coverage | $50,000 per person and $100,000 per accident |

| Property damage liability coverage | $25,000 per accident |

| Uninsured motorist coverage | $50,000 per person and $100,000 per accident |

| Medical payments coverage | $2,000 per person |

Ready to save on Maine car insurance? To find cheap car insurance in Maine, enter your ZIP code in our free quote tool.

Methodology

AutoInsureSavings.org comparison shopping study used a full coverage auto insurance policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Maine rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Frequently Asked Questions

Who has the cheapest car insurance in Maine?

We found the top car insurance companies that offer the lowest Maine drivers’ average rates are USAA at $24 per month, Travelers at $29 per month, and MetLife at $31 a month for a state minimum coverage policy for a 30-year-old with clean driving history.

How much is auto insurance in Maine per month?

On average, drivers pay around $40 per month for state minimum coverage in Maine and $96 per month for full coverage insurance. Based on our research, Geico ($876 per year) is one of the state’s most affordable car insurance companies. Most drivers’ average annual rate is around $517 per year for state minimum requirements and $1,160 per year, including comprehensive and collision coverage.

How much is full coverage auto insurance in Maine?

On average, most drivers in Maine pay for full coverage insurance is $96 per month or $1,160 per year. Maine’s top insurance companies that offer the lowest rate for drivers interested in full coverage auto insurance policies include Geico, Travelers, and State Farm. All three insurers provide auto insurance quotes 10% lower than average, depending on your driver profile.

How can I get cheap car insurance in Maine?

There are many things drivers can do to help save money on their car insurance rates in Maine. First, you will need to compare quotes from multiple insurance providers to find the right company that offers the exact level of coverage in Maine you need at the most affordable price.

Another thing drivers can do to help them save more on their car insurance rates is ask their auto insurance provider about a money-saving driver discount they may be eligible for. Many companies offer car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their driving records. Consider Usage-Based car insurance, such Traveler’s IntelliDrive program. You can get long-term savings up to 30% at renewal, depending on your safe driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florida. ...

Certified Financial Planner

UPDATED: Dec 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.