Michigan Cheapest Car Insurance & Best Insurance Options

The Michigan cheapest car insurance policies can be found at Frankenmuth, as the average rate for Michigan's minimum coverage is $80 per month at Frankenmuth. For full coverage insurance, however, drivers will find the cheapest rate at Progressive, where full coverage averages $145 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Dec 18, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 18, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The Michigan cheapest car insurance rates can be found at Frankenmuth, as well as Progressive. Because Michigan car insurance is expensive, drivers should take the time to compare quotes from the best auto insurance companies to find savings.

Read on to learn about the cheapest companies in Michigan and other ways to save on the best car insurance in Michigan. You can also enter your ZIP code into our free quote provider to get started right away on finding cheap Michigan car insurance.

Cheapest Auto Insurance in Michigan

Michigan car insurance shoppers should compare quotes with the same coverage level with at least three insurance companies to find the best Michigan car insurance and save more on their car insurance premiums.

| Cheapest Car Insurance in Michigan - Key Takeaways |

|---|

The cheapest Michigan car insurance options are: The cheapest Michigan car insurance options are:Cheapest for minimum coverage: Frankenmuth Cheapest for full coverage: Progressive Cheapest after an at-fault accident: Progressive Cheapest after a speeding ticket: Frankenmuth Cheapest after a DUI: Progressive Cheapest for young drivers: Auto-Owners For younger drivers with a speeding violation: Frankenmuth For younger drivers with an at-fault accident: Auto-Owners |

Enter your Zip Code or use this practical Michigan auto insurance guide which is the best way to find top car insurance providers in your area regardless of driving type or age group.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Michigan for Minimum Coverage

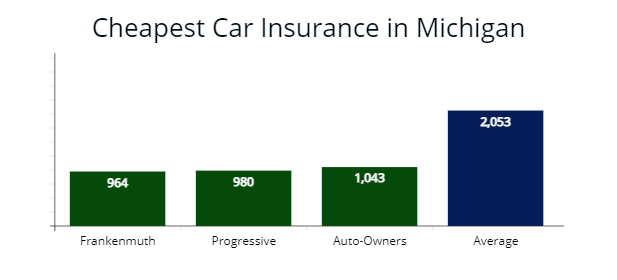

Frankenmuth offers the cheapest minimum coverage rates for drivers in Michigan with good driving records, which provided us a $964 per year rate or $1,089 cheaper than the $2,053 average rates for our 30-year-old sample driver.

Service members or a family member of military personnel can find the best car insurance rates with USAA, which offered our agents an $568 per year quote or $47 per month for minimum coverage liability insurance.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

Cheapest Michigan car insurance companies for minimum coverage, by quote

| Auto Insurer | Annual cost | Monthly cost |

|---|---|---|

| USAA | $568 | $47 |

| Frankenmuth | $964 | $80 |

| Progressive | $980 | $81 |

| Auto-Owners | $1,043 | $87 |

| Safeco | $1,089 | $91 |

| State Farm | $1,427 | $118 |

| MEEMIC | $1,562 | $130 |

| Hanover | $1,980 | $165 |

| MetLife | $2,243 | $186 |

| Liberty Mutual | $2,574 | $214 |

| Allstate | $4,175 | $347 |

*USAA is for qualified military members, their spouses, and direct family members. Your auto insurance rates may vary based on your driver profile.

Buying a minimum coverage policy is the cheapest way to meet Michigan car insurance requirements to ensure you stay legal.

State minimum coverage may not have sufficient coverage with the amount of bodily injury coverage and property damage coverage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

A state minimum auto policy in Michigan only covers up to $40,000 per accident in residual bodily injury liability and $10,000 per accident in residual property damage liability with $1 million per accident of property protection insurance and variable personal injury protection coverage under the new Michigan law.

Cheapest Full Coverage Car Insurance in Michigan

Progressive offers the cheapest auto insurance rates for drivers in Michigan with good driving records for full coverage. Progressive’s $1,741 per year rate is 45% less expensive than state average rates of $3,147 per year.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Cheapest Michigan car insurance companies for full coverage, by quote

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| USAA | $1,638 | $136 |

| Progressive | $1,741 | $145 |

| Frankenmuth | $2,038 | $169 |

| Auto-Owners | $2,246 | $187 |

| State Farm | $2,476 | $206 |

| Safeco | $2,842 | $236 |

| Hanover | $4,327 | $360 |

| MetLife | $4,487 | $373 |

| Allstate | $6,160 | $513 |

| Michigan average | $3,147 | $262 |

A full-coverage policy for drivers in Michigan costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included. Your motor vehicle is protected no matter who is at fault or property damage from hitting a street sign or fallen tree branch.

Cheapest Car Insurance in Michigan with a Speeding Ticket

Frankenmuth offers the cheapest car insurance for Michigan drivers with speeding tickets on their driving records. Frankenmuth’s $2,437 per year rate is 38% or $1,458 less expensive than state average rates.

Cheapest Michigan insurance companies for full coverage after a speeding ticket, by quote

| Auto Insurer | Annual cost | Monthly cost |

|---|---|---|

| Frankenmuth | $2,437 | $203 |

| Progressive | $2,576 | $214 |

| Auto-Owners | $2,723 | $226 |

| State Farm | $3,154 | $262 |

| Michigan average | $3,895 | $324 |

According to Michgan.gov, your auto insurance rates can increase by $748 per year or 20% with one traffic violation for speeding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Most auto insurers will increase car insurance rates after traffic tickets, so you want to make sure to shop around for cheaper insurance companies after any traffic violation on driving records.

Drivers in Michigan can take the Basic Driver Improvement Course, so the Secretary of State will not make points from speeding tickets available to car insurance companies.

Cheapest Car Insurance in Michigan With a Car Accident

According to our analysis, Progressive offers the cheapest insurance for Michigan drivers with an at-fault accident with a $2,281 per year car insurance premium for our sample driver.

Progressive’s rate is 62% less expensive than Michigan’s average rates ($6,154 per year) for drivers in Michigan with one accident in their driving history.

Cheapest Michigan insurance companies for full coverage after an accident, by quote

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,281 | $190 |

| State Farm | $2,954 | $246 |

| Auto-Owners | $3,150 | $262 |

| Frankenmuth | $3,366 | $280 |

| Michigan average | $6,154 | $512 |

Getting into an at-fault accident may cause a rate increase of 49% or $3,007 per year for two years, showing the importance of shopping for cheaper auto insurance in Michigan if you have a change in your driving record.

Learn more: Will car insurance rates increase after an accident?

To make sure you get the best rates, be sure to shop around and compare auto insurance quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance in Michigan with a DUI

Drivers in Michigan with DUI (OWI) offenses on their driving records can find the cheapest insurance with Progressive, which provided our insurance agents a quote at $2,072 per year or a $172 monthly rate for full coverage.

The average annual rate increase for drivers in Michigan with DUI violations is $6,511 per year, making Progressive’s rate 79% cheaper than Michigan’s average DUI rate.

Cheapest Michigan insurance companies for full coverage after a DUI, by quote

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,072 | $172 |

| State Farm | $3,246 | $270 |

| Auto-Owners | $3,954 | $329 |

| Frankenmuth | $5,127 | $427 |

| Michigan average | $9,658 | $804 |

According to the Insurance Information Institute, car insurance premiums increase by 68% on average for Michigan drivers with driving under the influence violations (DUI’s, called OWI’s in Michigan).

Read more: The Best Car Insurance Companies After a DUI

Along with significantly higher car insurance rates, the State of Michigan states you will have a suspended driver’s license for 30 days with a possible ignition interlock device (BAIID) installed in your motor vehicle and six points added to your driving record.

Cheapest Car Insurance in Michigan for Young Drivers

We found young drivers in Michigan with a good driving record can find the best car insurance for new drivers at Auto-Owners Insurance, which provided our agents a $4,174 per year quote or 57% less expensive than our sample young driver’s average car insurance rates in Michigan.

USAA is the best car insurance option for younger drivers with a good driving record who qualify, which offered AutoInsureSavings’ agents a $2,942 per year rate for full coverage car insurance.

The cheapest state minimum coverage in Michigan for teenage drivers is Auto-Owners Insurance, which offered us a quote at $2,152 per year or 52% cheaper than average rates. The next best option for younger drivers is State Farm, with a $2,265 per year rate for minimum liability insurance.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,942 | $1,046 |

| Auto-Owners Insurance | $4,174 | $2,152 |

| Frankenmuth | $4,923 | $2,417 |

| Progressive | $5,174 | $2,958 |

| State Farm | $6,236 | $2,265 |

| Geico | $7,258 | $3,387 |

| Hanover | $9,427 | $4,528 |

| Liberty Mutual | $10,327 | $4,881 |

| Allstate | $15,432 | $5,625 |

| Michigan average | $9,543 | $4,429 |

*USAA is for qualified military members, their spouses, and direct family members. Your car insurance rates may be different based on your driver profile.

Statistics show a teen driver is more prone to car accidents than older experience drivers, making car insurance rates higher. Our licensed agents recommend younger drivers in Michigan buy full coverage auto insurance policies to have motor vehicle coverage in an auto accident as an added layer of protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is best to shop around to find auto insurers that offer cheaper car insurance rates for young or teen Michigan drivers in The Great Lakes State, such as Auto-Owners Insurance or State Farm, to cut down on your car insurance costs.

Read more: The Best Car Insurance for Teens: A Comprehensive Guide

Cheapest Car Insurance in Michigan for Young Drivers with a Speeding Ticket

Young drivers in Michigan with a speeding violation should look to Frankenmuth for the cheapest auto insurance.

Learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Frankenmuth’s average car insurance cost is $4,923 per year or $5,507 less per year for car insurance policies in Michigan with comprehensive and collision coverage for young drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Frankenmuth | $4,923 | $410 |

| Auto-Owners | $5,367 | $447 |

| Progressive | $6,832 | $569 |

| Safeco | $7,067 | $588 |

| Michigan average | $10,430 | $869 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Young drivers in Michigan with an accident history can find the best car insurance premiums with Auto-Owners, which provided our agents a $5,167 per year rate for full coverage insurance.

Auto-Owners’ at-fault accident rate is 59% cheaper than Michigan’s average rates of $12,529 per year for teen drivers with a car accident.

| Auto Insurers | Annual cost | Monthly cost |

|---|---|---|

| Auto-Owners Insurance | $5,167 | $430 |

| Frankenmuth | $5,980 | $498 |

| Progressive | $8,433 | $702 |

| State Farm | $8,712 | $726 |

| Michigan average | $12,529 | $1,044 |

Best Car Insurance Companies in Michigan

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Michigan by customer satisfaction, insurance surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Auto-Owners Insurance and USAA are the best car insurance companies based on excellent customer satisfaction, claims service, and NAIC’s complaint index.

AutoInsureSavings.org licensed agents had similar results from their recent Michigan car insurance customer survey, with Auto-Owners and USAA scoring 96% and 86% respectfully with customers in claims satisfaction.

| Company | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 96% | 65% |

| USAA | 86% | 62% |

| Frankenmuth | 81% | 55% |

| State Farm | 76% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 35% |

| Geico | 74% | 59% |

| MetLife | 70% | 51% |

| Liberty Mutual | 63% | 30% |

Our licensed insurance agents also collected information on each car insurer in Michigan from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The company with the lowest NAIC complaint ratio is Auto-Owners Insurance, with a 0.07 complaint ratio compared to their market share and below the national average of 1.00. Frankenmuth is below the national average with a 0.17 NAIC complaint ratio.

| Insurer | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating |

|---|---|---|---|

| Auto-Owners | 0.07 | 890 | A++ |

| Frankenmuth | 0.17 | n/a | A |

| Progressive | 0.34 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.98 | 890 | A++ |

| Liberty Mutual | 1.05 | 786 | A- |

| MetLife | 1.15 | 861 | A+ |

The NAIC’s complaint ratio compares the number of complaints a car insurer has based on the Michigan market share. Any car insurance provider below 1.00 is better than the national average.

Auto-Owners and USAA have the highest J.D. Power claims satisfaction scores of 890 each.

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While comparison shopping for car insurance companies in Michigan, it is essential to remember that many factors contribute to your premium cost, as understanding how car insurance premiums are calculated will help you find the best rate. Your age, driving experience, and vehicle type can influence your total monthly or annual cost.

It is always best for drivers in Michigan to compare car insurance plans to find the best insurance company that offers the lowest rate.

Average Cost of Car Insurance by City in Michigan

We collected insurance quotes from Michigan zip codes from top insurance companies and found average rates can vary by $598 per year.

Typically, you will pay higher auto insurance rates if you live in urban cities rather than the state's rural areas.Dani Best Licensed Insurance Producer

Your Michigan insurance rate is based not only on your zip code but also on the type of vehicle, driver history, liability limits, and many other risk factors.

(Michigan law prohibits using your credit score or ability to pay credit cards to determine your car insurance rates).

Cheapest Car Insurance in Detroit, MI

Drivers in Detroit, Michigan can find the cheapest insurance quotes with Auto-Owners, which provided AutoInsureSavings.org agents a rate of $2,065 per year with $500 deductibles for comprehensive and collision insurance coverage. Auto-Owners quote is 38% less expensive than Detroit’s average rates.

| Detroit Company | Average Premium |

|---|---|

| Auto-Owners Insurance | $2,065 |

| Progressive | $2,131 |

| Frankenmuth | $2,348 |

| Detroit average | $3,287 |

Cheapest Car Insurance in Grand Rapids, MI

Drivers in Grand Rapids can look to Progressive for the cheapest auto quotes, with a rate of $1,846 per year with full coverage insurance. Progressive’s rate is 43% cheaper than Grand Rapids’ $3,189 average rates for 30-year-old drivers.

| Grand Rapids Company | Average Premium |

|---|---|

| Progressive | $1,846 |

| Auto-Owners Insurance | $2,240 |

| State Farm | $2,628 |

| Grand Rapids average | $3,189 |

Cheapest Car Insurance in Warren, MI

Good drivers in Warren, Michigan, can find the cheapest full coverage with Progressive, which offered us a $1,941 per year rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles. Progressive’s car insurance rate is 41% less per year than Warren’s average rates of $3,145 per year.

| Warren Company | Average Premium |

|---|---|

| Progressive | $1,941 |

| Auto-Owners Insurance | $2,163 |

| Frankenmuth | $2,555 |

| Warren average | $3,145 |

Cheapest Car Insurance in Sterling Heights, MI

Our insurance agents found the cheapest auto insurance rate in Sterling Heights, Michigan is Progressive, with a $2,046 per year rate for a full coverage auto policy. Progressive’s quote is 38% less expensive than Sterling Heights’ average rates.

| Sterling Heights Company | Average Premium |

|---|---|

| Progressive | $2,046 |

| Frankenmuth | $2,339 |

| State Farm | $2,645 |

| Sterling Heights average | $3,270 |

Cheapest Auto Insurance in Lansing, MI

Drivers in Lansing can get cheaper car insurance rates with Frankenmuth, which provided our licensed agents a $2,148 per year rate for full coverage with $100,000 in liability insurance. Frankenmuth’s quote is 36% less expensive than the average rates in Lansing, MI.

| Lansing Company | Average Premium |

|---|---|

| Frankenmuth | $2,148 |

| Progressive | $2,469 |

| Auto-Owners | $2,814 |

| Lansing average | $3,347 |

Cheapest Auto Insurance in Flint, MI

Good drivers in Flint, Michigan can find the least expensive policy with Progressive, which offered us a $1,857 per year rate for our sample 30-year-old male driver. Progressive’s full coverage quote is 40% cheaper than Flint’s average rates per year.

| Flint Company | Average Premium |

|---|---|

| Progressive | $1,857 |

| State Farm | $2,269 |

| Auto-Owners Insurance | $2,621 |

| Flint average | $3,054 |

Cheapest Car Insurance in Livonia, MI

Drivers in Livonia can shop around and get cheap auto insurance with Progressive, which provided our licensed agents a $1,963 annual rate for a full coverage policy with $100,000 in liability insurance. Progressive’s quote is 38% less expensive than the average rates in Livonia.

| Livonia Company | Average Premium |

|---|---|

| Progressive | $1,963 |

| Frankenmuth | $2,080 |

| State Farm | $2,613 |

| Livonia average | $3,128 |

Average Car Insurance Cost for All Cities in Michigan

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Detroit | $3,287 | Shelby Township | $3,003 |

| Grand Rapids | $3,189 | Kalamazoo | $3,139 |

| Warren | $3,145 | Wyoming | $3,013 |

| Sterling Heights | $3,270 | Rochester Hills | $3,054 |

| Ann Arbor | $3,217 | Southfield | $3,129 |

| Lansing | $3,347 | Waterford | $2,975 |

| Clinton charter | $3,290 | West Bloomfield | $2,907 |

| Flint | $3,054 | Taylor | $3,037 |

| Dearborn | $3,093 | Novi | $2,864 |

| Livonia | $3,128 | Pontiac | $3,047 |

| Canton | $2,976 | St. Clair Shores | $2,849 |

| Macomb | $2,836 | Royal Oak | $2,900 |

| Troy | $3,128 | Dearborn Heights | $3,003 |

| Westland | $3,183 | Ypsilanti | $2,932 |

| Farmington Hills | $2,840 | Georgetown | $2,743 |

| Kentwood car insurance | $2,944 | Frankenlust | $2,647 |

| Battle Creek car insurance | $2,886 | Buchanan car insurance | $2,698 |

| Portage car insurance | $2,921 | Brooks car insurance | $2,736 |

| East Lansing car insurance | $2,812 | Prairieville car insurance | $2,826 |

| Saginaw car insurance | $3,011 | Lexington car insurance | $2,798 |

| Rosevillecar insurance | $2,736 | Cottrellville car insurance | $2,840 |

| Redford car insurance | $2,987 | Woodstock car insurance | $2,863 |

| Chesterfield | $2,814 | Barry car insurance | $2,698 |

| Commerce | $2,647 | Hamlin car insurance | $2,886 |

| Meridian car insurance | $2,826 | China township | $2,771 |

| Bloomfield charter | $2,798 | Portland car insurance | $2,999 |

| Midland | $2,717 | Coldwater | $2,689 |

| Saginaw | $2,698 | Unadilla | $2,814 |

| Orion | $2,771 | Bowne | $2,886 |

| Pittsfield | $2,814 | Orangeville | $2,921 |

| Holland charter | $2,989 | Escanaba | $2,969 |

| Muskegon | $2,863 | Hamlin | $2,736 |

| Independence | $2,798 | LaGrange | $2,840 |

| Lincoln Park | $3,034 | Montcalm | $2,987 |

| Grand Blanc | $2,736 | Corunna | $2,647 |

| Plainfield charter | $3,009 | Menominee | $2,771 |

| Holland | $2,886 | Elkland | $2,698 |

| Bay | $2,847 | Irving | $2,717 |

| Delta | $2,689 | Burns | $2,736 |

| Jackson | $2,798 | Cohoctah | $2,826 |

| Eastpointe | $2,826 | Wayland | $2,921 |

| Brownstown | $2,736 | Essexville | $2,814 |

| Bedford | $2,840 | Durand | $2,798 |

| White Lake | $2,886 | Sherman | $2,967 |

| Flint | $2,698 | Riley | $2,863 |

| Madison Heights | $2,954 | Wright | $2,689 |

| Oak Park | $2,647 | Saugatuck | $2,717 |

| Southgate | $3,016 | Keego Harbor | $2,987 |

| Northville | $3,005 | Rollin | $2,698 |

| Port Huron | $2,771 | Cedar Creek | $3,054 |

| Burton | $2,798 | Pierson | $2,647 |

| Van Buren | $2,863 | Lawrence | $2,736 |

| Washington | $2,689 | Croton | $2,840 |

| Delhi | $2,814 | Onondaga | $2,798 |

| Allen Park | $2,921 | Fabius | $2,826 |

| Plymouth | $2,647 | Berlin | $2,863 |

| Gaines charter | $2,698 | Summerfield | $2,944 |

| Garden | $2,717 | Hartford | $2,798 |

| Mount Pleasant | $2,987 | Wales | $2,886 |

| Allendale | $3,016 | Bellevue | $2,698 |

| Wyandotte | $2,863 | Deerfield | $2,921 |

| Harrison | $2,736 | Rockwood | $2,689 |

| Walker | $2,840 | Franklin | $3,086 |

| Inkster | $2,826 | Portsmouth | $2,814 |

| Norton Shores | $2,689 | St. Charles | $2,771 |

| Byron Center | $2,798 | Fremont | $2,736 |

| Auburn Hills | $2,863 | Portage | $2,647 |

| Romulus | $2,698 | Silver Creek | $2,921 |

| Blackman | $2,944 | Easton | $3,098 |

| Oshtemo | $2,886 | Manlius | $3,041 |

| Kalamazoo | $2,717 | Marshall | $2,689 |

| Summit | $3,072 | Imlay | $2,698 |

| Oxford | $2,814 | Benton | $3,108 |

| Hamtramck | $2,647 | Negaunee | $2,840 |

| Hamburg | $3,047 | Soo | $2,951 |

| Birmingham | $2,736 | Arcadia | $2,921 |

| Ypsilanti township | $3,078 | Watervliet | $2,798 |

| Marquette | $2,771 | Chikaming | $2,647 |

| Genesee | $2,886 | Johnstown | $2,736 |

| Adrian | $2,689 | Coe | $2,717 |

| Mount Morris | $3,016 | Fraser | $2,698 |

| Genoa | $2,863 | Bennington | $2,826 |

| Ferndale | $2,698 | Clare | $3,048 |

| Highland | $2,840 | Danby | $2,814 |

| Frenchtown | $3,041 | Bloomingdale | $2,987 |

| Monroe | $2,689 | Littlefield | $2,863 |

| Lyon | $2,736 | Hastings | $2,950 |

| Davison | $2,798 | Casco | $3,042 |

| Oakland | $2,921 | Ferrysburg | $2,886 |

| Cascade | $2,647 | Jefferson | $2,826 |

| Green Oak | $2,717 | Sherman | $2,736 |

| Park Township | $3,041 | Suttons Bay | $3,116 |

| Brighton | $2,814 | Sylvan | $2,698 |

| Grand Rapids | $2,826 | Homer and Lake charter | $2,771 |

| Trenton | $2,948 | Overisel | $2,689 |

| Muskegon | $2,987 | Norvell | $2,647 |

| Scio | $2,698 | Arbela | $2,863 |

| Garfield charter | $2,736 | Alaiedon | $3,030 |

| Wayne | $3,026 | Liberty | $2,886 |

| Grand Haven | $2,921 | Ravenna | $2,840 |

| Texas | $2,798 | Grant | $2,698 |

| Milford | $2,647 | Bad Axe | $2,717 |

| Hazel Park | $3,041 | London | $2,736 |

| Mount Clemens | $2,689 | Mason | $2,826 |

| Huron charter | $2,698 | Tuscarora | $2,814 |

| Grandville | $2,717 | Pine Grove | $2,944 |

| Brandon | $2,771 | Gerrish | $2,698 |

| Traverse | $2,736 | Denmark | $2,826 |

| Comstock | $2,814 | Bingham | $3,025 |

| Grosse Pointe Woods | $2,863 | Manistique | $3,026 |

| Fenton | $2,698 | Munising | $2,736 |

| Berkley | $2,987 | Carmel | $2,717 |

| DeWitt | $2,840 | Otsego Lake | $2,798 |

| Spring Lake | $2,886 | Gladwin | $2,689 |

| Hartland | $3,041 | Mount Morris | $2,921 |

| Southfield | $2,698 | Evergreen | $2,647 |

| Cannon | $2,814 | Casnovia | $2,771 |

| Fraser | $2,736 | Waterloo | $2,944 |

| Lincoln charter | $2,826 | Covert | $3,028 |

| Ada | $2,717 | Iron River | $2,921 |

| Owosso | $2,886 | Benton | $2,736 |

| Mundy | $3,016 | Union city | $2,698 |

| Springfield charter | $2,863 | Lake | $2,798 |

| Caledonia | $2,921 | Richland | $2,987 |

| Benton | $2,689 | Bainbridge | $2,717 |

| Oceola | $3,026 | Beaver | $2,840 |

| Monroe | $2,647 | Ithaca | $2,863 |

| Fruitport | $3,040 | Whitewater | $2,886 |

| Bangor | $2,736 | Orleans | $2,717 |

| Superior charter | $2,944 | Lyndon | $2,814 |

| Alpine | $2,698 | Norway | $2,689 |

| Wixom | $2,771 | Grosse Pointe | $2,826 |

| Harper Woods | $2,798 | Sheridan | $2,736 |

| Niles | $2,689 | Shiawassee | $2,921 |

| Union charter | $2,987 | Baroda | $2,698 |

| Leoni | $2,717 | Cato | $2,863 |

| Sault Ste. Marie | $3,041 | Whitehall | $3,039 |

| Rochester | $2,826 | Resort | $3,047 |

| Bath | $2,886 | Fillmore | $2,647 |

| Vienna | $2,840 | Benzonia | $2,840 |

| Woodhaven | $2,736 | Big Creek | $2,944 |

| New Baltimore | $2,814 | East Tawas | $2,771 |

| Escanaba | $2,698 | Ashland | $2,717 |

| Coldwater | $2,921 | Potterville | $2,689 |

| Antwerp | $3,016 | Eagle | $2,736 |

| Riverview | $2,987 | Concord | $2,798 |

| Algoma | $2,647 | Parma | $2,698 |

| Clawson | $2,886 | Hopkins | $2,814 |

| South Lyon | $3,041 | Crystal | $2,863 |

| East Grand Rapids | $3,036 | Martin | $2,717 |

| Emmett | $3,047 | Wheeler | $3,026 |

| Holly | $2,698 | Rogers | $2,921 |

| Thomas | $2,736 | Mendon | $2,826 |

| East Bay | $2,798 | Ingersoll | $2,840 |

| Fenton | $2,717 | Hayes | $2,886 |

| Niles | $2,771 | Tompkins | $2,698 |

| Zeeland | $2,689 | McMillan | $2,736 |

| Grosse Pointe Park | $2,863 | Ensley | $2,647 |

| Ionia | $3,041 | Mecosta | $2,944 |

| Fort Gratiot | $2,826 | Filer | $2,921 |

| Grand Haven | $2,814 | Montague | $2,987 |

| Marion | $2,736 | Ganges | $3,016 |

| Sturgis | $3,026 | Monterey | $2,689 |

| Highland Park | $2,698 | Marcellus | $2,987 |

| Cooper | $2,840 | Burr Oak | $2,717 |

| Lenox | $2,863 | Berlin | $2,698 |

| Muskegon Heights | $3,041 | Bertrand | $2,736 |

| Farmington | $2,921 | Big Prairie | $2,798 |

| Monitor | $2,826 | Emmett | $2,840 |

| Tyrone | $2,886 | Hartford | $2,771 |

| Cadillac | $2,647 | Wayne | $2,814 |

| Port Huron | $2,736 | Sidney | $2,949 |

| Big Rapids | $2,689 | Pentland | $2,826 |

| Melvindale | $2,798 | Little Traverse | $3,016 |

| Flushing | $3,031 | Amber | $3,041 |

| Grosse Ile | $2,717 | Dallas | $2,736 |

| Egelston | $2,987 | Vassar | $2,647 |

| Alpena | $2,826 | Elk Rapids | $3,041 |

| Flat Rock | $2,840 | Livingston | $2,798 |

| Bridgeport | $2,814 | Holton | $2,863 |

| Tittabawassee | $2,647 | Sebewaing | $2,921 |

| Benton Harbor | $2,886 | Bridgman | $2,826 |

| St. Joseph | $2,698 | Columbia | $2,946 |

| Marysville | $2,736 | Park | $2,689 |

| Sparta | $2,771 | Newton | $2,717 |

| Howell | $3,026 | Home | $3,016 |

| Bedford | $2,921 | Lincoln | $2,698 |

| Hampton | $2,863 | Fulton | $2,987 |

| Ecorse | $2,798 | Milton | $2,736 |

| Sumpter | $2,826 | Maple Grove | $2,886 |

| Berlin charter | $2,771 | Climax | $2,814 |

| Dalton | $2,698 | Tobacco | $2,840 |

| Long Lake | $2,736 | Hudson | $3,041 |

| Saline | $2,689 | Sullivan | $2,647 |

| Bruce | $2,717 | Sandusky | $2,826 |

| Kimball | $2,987 | Edenville | $3,049 |

| Grosse Pointe Farms | $3,041 | Jefferson | $2,698 |

| York | $3,047 | Adams | $3,026 |

| Plymouth | $2,948 | Waverly | $2,736 |

| Charlotte | $2,840 | Polkton | $2,798 |

| Oronoko | $2,698 | Athens | $2,921 |

| Alma | $2,647 | West Branch | $2,863 |

| Blair | $2,826 | Olive | $2,771 |

| Schoolcraft | $2,814 | Orchard Lake Village | $2,689 |

| Clay | $2,886 | Venice | $2,717 |

| Pennfield | $3,016 | Westphalia | $2,987 |

| Alpena | $2,736 | Bingham | $2,698 |

| Lapeer | $3,041 | Ingham | $2,814 |

| Courtland | $2,798 | Leslie | $3,026 |

| Northfield | $2,689 | Clearwater | $2,736 |

| Mason | $2,863 | Ovid | $2,826 |

| Putnam | $2,987 | Walton | $2,886 |

| Madison | $2,698 | Kenockee | $2,798 |

| Greenville | $2,921 | Reed city | $2,647 |

| Richfield | $2,736 | Sands | $2,840 |

| Jamestown | $2,717 | Croswell | $3,029 |

| Tecumseh | $2,771 | Duplain | $2,698 |

| Handy | $2,826 | Cherry Grove | $2,987 |

| Albion | $2,814 | Pleasant Ridge | $2,689 |

| St. Joseph | $2,886 | Three Oaks | $2,736 |

| Lansing | $2,647 | Woodland | $2,944 |

| Center Line | $2,863 | Clio | $2,826 |

| Tallmadge | $2,698 | Markey | $2,921 |

| Richland | $2,798 | Royal Oak | $2,840 |

| Buena Vista | $2,736 | Jonesville | $2,717 |

| Thornapple | $2,689 | Sturgis | $2,698 |

| Menominee | $3,033 | Cambria | $3,016 |

| Hillsdale | $2,987 | Prairie Ronde | $2,771 |

| Ludington | $2,798 | Albert | $2,736 |

| Spring Arbor | $2,840 | Adams | $3,041 |

| Flushing | $2,886 | Blue Lake | $2,647 |

| Mayfield | $2,698 | Inland | $3,036 |

| Grand Blanc | $2,689 | Marengo | $2,814 |

| St. Johns | $2,717 | Pere Marquette | $3,047 |

| Houghton | $2,826 | Midland | $2,863 |

| Grand Ledge | $2,921 | Porter | $2,698 |

| Atlas | $2,863 | Keeler | $2,987 |

| Dorr | $2,944 | Charlevoix | $3,026 |

| Ash | $3,041 | Pinconning | $2,798 |

| Raisin | $2,736 | Ironwood | $3,047 |

| Three Rivers | $2,771 | New Buffalo | $2,886 |

| Brighton | $2,698 | Aetna | $2,840 |

| Laketon | $2,987 | Morenci | $2,689 |

| River Rouge | $2,647 | Sanilac | $2,717 |

| Kinross | $3,016 | Saline | $2,863 |

| Columbia | $3,041 | Campbell | $2,698 |

| Iron Mountain | $2,814 | East Jordan | $2,826 |

| Hudsonville | $2,798 | Antrim | $2,921 |

| Hastings | $3,041 | Swan Creek | $2,944 |

| Clayton charter | $3,047 | Pipestone | $3,016 |

| St. Louis | $2,689 | Pine River | $2,771 |

| Augusta | $3,041 | St. Ignace | $2,717 |

| Walled Lake | $2,826 | Nottawa | $2,736 |

| Howell | $2,698 | Grout | $2,798 |

| Dundee | $2,921 | Everett | $2,840 |

| Marshall | $3,026 | Hazelton | $2,987 |

| Windsor | $2,736 | Cheshire | $2,814 |

| St. Clair | $2,863 | Selma | $2,647 |

| Paw Paw | $2,689 | Munising | $2,698 |

| Almont | $2,886 | Sherwood | $3,100 |

| Oscoda | $2,987 | Bangor | $2,736 |

| Napoleon | $2,717 | Watson | $3,047 |

| Solon | $2,798 | Pine township | $3,041 |

| Webster | $2,698 | Bronson | $3,080 |

| Thetford | $2,944 | Inverness | $2,826 |

| Lowell | $2,771 | Newfield | $2,840 |

| Addison | $2,814 | Perry | $3,050 |

| Argentine | $3,016 | Clyde | $3,026 |

| Gaines | $3,069 | Carlton | $2,689 |

| Ontwa | $2,647 | Denver | $2,698 |

| Blendon | $2,987 | Springport | $2,863 |

| Dexter | $2,826 | Seville | $2,921 |

| Lodi | $2,736 | Pokagon | $2,717 |

| Ishpeming | $2,698 | Galesburg | $2,886 |

| Robinson | $3,029 | Assyria | $2,798 |

| Rose | $3,041 | Camden | $2,771 |

| Pavilion | $3,041 | Spaulding | $3,047 |

| Huntington Woods | $2,689 | Belvidere | $2,698 |

| Calumet | $2,863 | Brady | $2,814 |

| Bear Creek | $2,921 | Sherman | $3,026 |

| Oakfield | $2,717 | Sunfield | $2,840 |

| Rockford | $2,840 | Chester | $2,944 |

| Adrian | $2,798 | Springvale | $2,987 |

| Green Lake | $2,886 | Auburn | $2,826 |

| Forsyth | $2,698 | Winfield | $2,647 |

| Salem | $2,927 | Hart | $2,689 |

| Milan | $2,863 | Watertown | $2,736 |

| Howard | $2,798 | Lincoln | $3,025 |

| Manistee | $2,771 | Ontonagon | $3,041 |

| Gun Plain | $2,826 | Bruce | $2,698 |

| Northville | $2,987 | Almer | $2,717 |

| Grass Lake | $2,944 | Douglass | $3,110 |

| Bagley | $2,736 | Hillsdale | $2,921 |

| Montrose | $2,698 | Pulaski | $2,826 |

| Chocolay | $2,840 | Ely | $3,041 |

| Richmond | $2,886 | Homestead | $3,027 |

| Laketown | $2,647 | Yale | $2,736 |

| Raisinville | $2,921 | Hillman | $2,863 |

| Otsego | $3,026 | Au Sable | $2,698 |

| Peninsula | $2,689 | Newaygo | $2,771 |

| New Boston | $3,041 | Fairplain | $3,100 |

| Oregon | $2,698 | South Arm | $3,075 |

| Dowagiac | $2,717 | Ovid | $2,798 |

| Grayling | $2,814 | Billings | $3,041 |

| Birch Run | $2,826 | Higgins | $2,736 |

| Carrollton | $3,041 | Tecumseh | $2,863 |

| Petoskey | $2,736 | Sanborn | $2,886 |

| Belding | $2,840 | Marlette | $2,944 |

| Breitung | $2,987 | Leslie | $2,826 |

| Deerfield | $2,771 | Burnside | $2,647 |

| Leighton | $3,041 | Sharon | $2,689 |

| Fruitland | $3,026 | Arlington | $2,698 |

| Cambridge | $2,736 | Leelanau | $2,717 |

| Groveland | $2,863 | Clarence | $2,921 |

| Zeeland | $2,826 | Elmira | $2,886 |

| Swartz Creek | $2,698 | Broomfield | $2,736 |

| Armada | $2,798 | Wilson | $2,814 |

| Clyde | $3,041 | Baltimore | $3,016 |

| Denton | $3,070 | Deep River | $2,944 |

| Larkin | $2,689 | Fremont | $3,043 |

| Reynolds | $3,076 | Grayling | $2,736 |

| Chelsea | $2,717 | Fife Lake | $2,771 |

| St. Clair | $2,698 | Austin | $2,647 |

| Watertown | $2,863 | Central Lake | $2,840 |

| Frankenmuth | $2,736 | Tuscola | $2,826 |

| Eaton Rapids | $3,041 | Harrison | $3,033 |

| Elba | $2,921 | Mills | $2,886 |

| Grosse Pointe | $2,814 | Vermontville | $2,826 |

| Springfield | $2,698 | Kalamo | $2,689 |

| Olive | $3,026 | Palmyra | $2,798 |

| Williamstown | $2,771 | Isabella | $2,921 |

| Ira | $2,944 | Maple Valley | $2,698 |

| Almena | $2,826 | Ronald | $2,717 |

| Paradise | $2,647 | Parchment | $2,989 |

| Nelson | $2,840 | Otisco | $2,736 |

| Tyrone | $3,032 | Dayton | $2,863 |

| Lapeer | $2,990 | Harbor Beach | $3,041 |

| Berrien | $2,698 | Sodus | $2,826 |

| Allegan | $3,047 | Bridgeton | $2,921 |

| Utica | $2,689 | Colfax | $2,814 |

| Kingsford | $2,798 | Garfield | $2,771 |

| Coloma | $2,944 | Riley | $2,698 |

| Ironwood | $2,717 | Brockway | $3,047 |

| Davison | $2,863 | Sheridan | $3,026 |

| Ross | $2,886 | Whitehall | $3,041 |

| Salem | $2,736 | South Branch | $2,647 |

| Kochville | $2,814 | Bunker Hill | $2,840 |

| Ida | $2,698 | Brant | $3,047 |

| Kalkaska | $3,049 | Essex | $2,771 |

| Williams | $2,921 | Briley | $2,689 |

| Royalton | $2,826 | Hayes | $2,993 |

| Dryden | Kearney | $3,016 | |

| Wells | $2,863 | Tawas | $2,698 |

| Gladstone | $2,992 | Fennville | $2,826 |

| Big Rapids | $3,041 | Hamilton | $2,717 |

| Attica | $2,814 | Albee | $3,047 |

| Owosso | $2,647 | Ossineke | $2,886 |

| Henrietta | $2,698 | Dayton | $2,736 |

| Manchester | $3,026 | Bangor | $2,798 |

| La Salle | $2,689 | Penn | $3,041 |

| Cheboygan | $2,987 | Frankenmuth | $3,091 |

| Kawkawlin | $3,041 | Weesaw | $3,048 |

| Acme | $2,771 | Mount Haley | $3,026 |

| Jerome | $2,840 | Wheatfield | $2,921 |

| DeWitt | $2,717 | Keene | $2,944 |

| Rives | $2,736 | Blumfield | $2,698 |

| Chippewa | $2,798 | Reading | $3,082 |

| Vergennes | $2,826 | Goodland | $2,814 |

| Dexter | $2,698 | Chassell | $2,647 |

| Hayes | $2,998 | Burlington | $3,047 |

| Allegan | $2,886 | Sylvan Lake | $2,689 |

| Port Sheldon | $2,798 | Bessemer | $2,863 |

| Hancock | $2,921 | Cedar Creek | $3,041 |

| Negaunee | $3,016 | Winsor | $2,798 |

| Ann Arbor | $3,041 | Warren | $2,717 |

| Somerset | $3,026 | Garfield | $2,771 |

| Gibraltar | $2,647 | Bear Lake | $2,944 |

| Marathon | $2,826 | Beaverton | $2,698 |

| Hadley | $2,771 | Calvin | $2,736 |

| Elmwood | $2,840 | Evart | $2,863 |

| Forest | $3,071 | Standish | $2,987 |

| Brady | $2,689 | Scipio | $3,070 |

| Crockery | $2,698 | Wilson | $3,041 |

| Vernon | $2,798 | Chester | $2,921 |

| Whiteford | $2,814 | Lincoln | $2,826 |

| Chesaning | $2,717 | Deerfield | $2,736 |

| Coopersville | $3,041 | Leland | $2,886 |

| South Haven | $2,987 | Sumner | $2,798 |

| Mancelona | $2,736 | Charlevoix | $2,689 |

| Erie | $2,863 | Tawas | $2,647 |

| Aurelius | $2,826 | Bay Mills | $2,771 |

| Morton | $2,944 | Solon | $2,698 |

| Caledonia charter | $3,041 | Caseville | $3,026 |

| Taymouth | $2,921 | Torch Lake | $2,717 |

| Roscommon | $2,698 | Wright | $2,840 |

| Buchanan | $2,771 | Arcada | $2,814 |

| Yankee Springs | $2,736 | Colfax | $3,065 |

| Metamora | $2,689 | Locke | $2,886 |

| Lee | $2,647 | Clark | $2,826 |

| Deerfield | $2,798 | Dover | $3,016 |

| Spencer | $2,929 | Crystal Falls | $2,944 |

| Quincy | $2,863 | New Buffalo | $2,736 |

| Perry | $2,717 | Richmond | $2,987 |

| Wayland | $2,840 | Presque Isle | $2,698 |

| Constantine | $2,771 | Roxand | $3,041 |

| Eaton Rapids | $2,944 | Convis | $3,026 |

| Mills | $2,826 | Ovid | $2,736 |

| Millington | $2,698 | Hersey | $2,921 |

| Lathrup Village | $3,041 | Comins | $2,798 |

| Eaton | $2,987 | Bingham | $2,689 |

| Marine | $2,814 | Wells | $2,863 |

| Mussey | $3,066 | Fairfield | $2,647 |

| Lowell | $2,736 | Marlette | $2,698 |

| Lee | $2,944 | Marion | $2,886 |

| Manistee | $2,863 | Fremont | $3,047 |

| Fremont | $3,026 | Girard | $2,717 |

| Caro | $2,921 | Webber | $2,771 |

| Casco | $2,798 | Eveline | $3,062 |

| Algonac | $2,698 | Fredonia | $2,840 |

| Rutland | $2,647 | Zilwaukee | $2,826 |

| Shelby | $3,047 | Spalding | $3,041 |

| Columbus | $3,041 | Grant | $2,814 |

| Ray | $2,689 | Martiny | $2,736 |

| Eureka | $3,016 | Montrose | $2,921 |

| Bloomfield Hills | $2,863 | Sheridan | $2,987 |

| Homer | $2,771 | Hart City | $3,047 |

| Otsego | $3,047 | West Traverse | $3,026 |

| Stockbridge | $2,886 | Bark River | $2,944 |

| Sandstone | $2,698 | Greendale | $2,863 |

| Williamston | $2,717 | Algansee | $2,647 |

| Richland | $2,826 | Marion | $3,022 |

| South Haven | $2,840 | Baldwin | $2,798 |

| Burtchville | $2,736 | Rome | $2,698 |

| Portland and Alamo | $2,921 | Olivet | $2,987 |

| Marquette charter | $2,863 | Golden | $2,689 |

| Vassar | $2,814 | Corwith | $2,717 |

| Grattan | $2,647 | Fairgrove | $2,771 |

| Linden | $2,987 | Deerfield | $2,736 |

| Oneida | $2,698 | Middlebury | $2,840 |

| Belleville | $3,028 | Pentwater | $3,041 |

| Milton | $2,826 | West Branch | $2,647 |

| Ionia | $2,736 | Mayfield | $3,041 |

| Lima | $2,886 | Franklin | $2,698 |

| Nottawa | $2,689 | Beaver Creek | $2,826 |

| Blissfield | $3,026 | Banks | $3,082 |

| Iosco | $2,798 | Jonesfield | $2,944 |

| Exeter | $2,771 | Maple Ridge | $2,736 |

| Odessa | $2,717 | Coloma | $3,055 |

| North Muskegon | $2,698 | Hanover | $2,921 |

| Roosevelt Park | $2,647 | Ridgeway | $3,019 |

| White Pigeon | $2,840 | Marion | $2,689 |

| Porter | $2,944 | Springville | $2,814 |

| Lockport | $2,987 | Greenwood | $2,698 |

| Plainwell | $3,026 | Churchill | $2,826 |

| Richmond | $3,041 | Bushnell | $2,863 |

| Boyne City | $2,736 | Moscow | $2,886 |

| East China | $3,047 | Fork | $2,771 |

| Plainfield | $2,921 | Flowerfield | $2,717 |

| Leroy | $2,689 | Evart | $2,798 |

| Woodhull | $2,698 | Milan | $2,814 |

| Hanover | $2,863 | Moorland | $2,647 |

| Vevay | $2,826 | Le Roy | $2,987 |

| L'Anse | $3,041 | Boardman | $2,840 |

| Cedar Springs | $3,024 | Watervliet | $3,047 |

| Almira | $3,056 | Richland | $3,026 |

| Gaylord | $2,886 | Sciota | $2,689 |

| Worth | $2,798 | Wakefield | $2,987 |

| Bloomer | $2,717 | Norway | $2,944 |

| Richfield | $2,771 | Pittsford | $2,736 |

| Leroy | $3,047 | Juniata | $2,921 |

| Baraga | $2,647 | Brookfield | $3,041 |

| Decatur | $2,814 | Mottville | $2,698 |

| Conway | $3,041 | Freedom | $3,026 |

| North Branch | $2,944 | Masonville | $3,138 |

| Hagar | $3,047 | Washington | $2,717 |

| Castleton | $2,921 | Tekonsha | $2,863 |

| Imlay | $2,689 | Crystal Falls | $3,041 |

| Heath | $2,736 | Lincoln | $2,826 |

| Surrey | $2,987 | Coldsprings | $2,647 |

| Clinton | $2,863 | Allouez | $2,798 |

| Haring | $2,698 | Montague | $2,886 |

| Geneva | $2,771 | Newberg | $2,814 |

| Ishpeming | $2,840 | Pickford | $2,698 |

| Lyons | $2,826 | Kasson | $2,736 |

| Victor | $2,689 | Kinderhook | $3,016 |

| Standish | $2,717 | Galien | $3,041 |

| Vernon | $2,798 | Buel | $2,987 |

| Oscoda | $3,021 | Maple Valley | $2,826 |

| Victory | $2,647 | Centerville | $2,921 |

| Eckford | $3,026 | Riverton | $2,771 |

| Batavia | $2,886 | Burlington | $2,698 |

| Rose Lake | $3,016 | Allen | $2,689 |

| Grant | $2,736 | California | $2,944 |

| Harrisville | $2,988 | Pleasant Plains | $2,798 |

| Dafter | $2,930 | Springfield | $2,863 |

| Orange | $2,814 | Koylton | $2,840 |

| Maple River | $2,771 | Macon | $2,717 |

| Norman | $2,698 | Rolland | $2,647 |

| Edwards | $2,876 | Rich | $2,698 |

| Oliver | $2,689 | Chase | $2,790 |

Minimum Auto Insurance Requirements in Michigan

According to Michigan.gov, all drivers in Michigan must comply with state auto insurance laws and have the minimum bodily injury liability coverage, property damage liability, personal injury protection (PIP), and property protection insurance (PPI) in their car insurance policies for vehicle registration and to drive legally on the roads.

Below are the Michigan no-fault state requirements with minimum liability limits:

| Required liability coverage, PIP, and PPI coverage | State minimum limits |

|---|---|

| Personal injury protection | $250,000 or opt-out |

| Property protection insurance (PPI) | $1 million per accident |

| Residual bodily injury liability | $20,000 per person and $40,000 per accident |

| Residual property damage liability | $10,000 per accident |

Michigan drivers have the option to buy personal injury protection coverage up to $250,000 in medical costs. Drivers with Medicare Part A or B can opt-out of personal injury protection (PIP) entirely. If enrolled in Medicaid, you have the option to buy $50,000 worth of PIP coverage.

AutoInsureSavings.org insurance agents recommend higher liability car insurance for drivers in Michigan with collision and comprehensive coverage or full coverage.

We urge drivers to buy uninsured motorist coverage in Michigan, since the uninsured motorist rate is 25%, according to the Insurance Information Institute (III.org).

Learn more: What is uninsured motorist coverage?

You will be responsible for the extra costs in an at-fault auto accident in Michigan if the cost of bodily injury and property damage exceeds the liability insurance requirements.

Michigan drivers should always have their insurance ID card in the insured vehicle.

To learn more about affordable car insurance in Michigan, enter your zip code or get expert advice at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used car insurance rates for Michigan drivers with accident histories and other traffic violations for various age groups for rate analyses. Current Michigan law does not allow credit scores or marital status to determine auto insurance rates. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Frequently Asked Questions

Who has the cheapest car insurance in Michigan?

Frankenmuth offers the state minimum cheapest auto insurance rate at $964 per year for 30-year-old drivers. The average annual car insurance premiums for minimum coverage in Michigan are $2,053 per year, and Frankenmuth’s premium costs 54% less per year. Other good options for affordable car insurance are Progressive at $980 per year and Auto-Owners Insurance at $1,043 per year.

How much is car insurance in Michigan per month?

The average car insurance costs $262 per month for full coverage in Michigan and $171 per month for state minimum coverage for a 30-year-old driver with a clean driving record.

How much is full coverage car insurance in Michigan?

The average cost of full coverage car insurance in Michigan is $3,147 per year or $262 per month, with $100,000 per accident in liability coverage. Progressive’s average rate for full coverage is $1,741 per year or $145 per month or 45% less per year, while Frankenmuth’s $2,038 rate is 36% below Michigan state average rates.

How can drivers save on Michigan car insurance?

The best way to save on your insurance premium in Michigan is to find out from your car insurance provider if you are eligible for the company’s money-saving driver discounts. Many insurance providers in Michigan will lower your overall insurance prices if you have more than one car insurance policy with them, such as life or home insurance policies.

Another way to save on car insurance premiums is to practice safe driving habits and maintain clean driving records. Many auto insurance companies offer good driving discounts for drivers in Michigan that have clean driving records. One example is Auto-Owners, which offers good drivers a safe driver discount of up to 20% through the “TrueRide” telematics car insurance program. Not only will you keep and your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

Why is Michigan car insurance so expensive?

Michigan auto insurance is expensive because Michigan is a no-fault state, meaning every driver is responsible for their own accident costs regardless of who caused the accident.

Is Michigan a no-fault state?

Yes, Michigan is a no-fault state, so we recommend that drivers carry the best car insurance in Michigan to protect themselves after an accident.

Can you go without car insurance in Michigan?

No, all Michigan drivers must carry auto insurance. We recommend getting quotes to find the best cheap car insurance in Michigan.

What are the bare minimum car insurance requirements in Michigan?

All drivers must carry bodily liability and property liability insurance to drive in Michigan.

What city has the cheapest car insurance in Michigan?

The best auto insurance rates in Michigan can be found in cities like Commerce, Plymouth, and Monroe.

Why did my car insurance go up in Michigan?

If your rates went up, it could be due to changes in your driving record, location, or simply universal rate increases at your company. You should get multiple quotes to ensure you have the best cheap car insurance in Michigan.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Dec 18, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.