Allstate Car Insurance for College Students

College students can save up to 30% on Allstate car insurance for college students if they meet the requirements for Alsltate's smart student discount. Students must be under 25 years old, and either have a B average or higher, go to school 100 miles away, or have completed Allstate's teenSMART program.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Allstate’s smart student discount can help young drivers save

- It is often cheapest for college students to stay on a parent’s policy

- Allstate also offers other discounts college students can take advantage of

Allstate’s smart student discount is a great way for drivers to save on Allstate car insurance for college students. Read on to learn more about how Allstate can offer the best car insurance for young drivers, from rates to discounts.

Want to find the cheapest car insurance for college students today? Enter your ZIP code into our free quote comparison tool.

Average Cost of College Car Insurance

| State | Annual Premium |

|---|---|

| Alabama | $4,298 |

| Alaska | $3,676 |

| Arizona | $4,379 |

| Arkansas | $5,634 |

| California | $6,943 |

| Colorado | $4,762 |

| Connecticut | $7,259 |

| Delaware | $8,125 |

| Florida | $4,987 |

| Georgia | $4,983 |

| Hawaii | $3,987 |

| Idaho | $3,399 |

| Illinois | $5,987 |

| Indiana | $3,986 |

| Iowa | $4,987 |

| Kansas | $3,654 |

| Kentucky | $5,498 |

| Louisiana | $7,465 |

| Maine | $4,001 |

| Maryland | $7,863 |

| Massachusetts | $5,782 |

| Michigan | $9,349 |

| Minnesota | $3,987 |

| Mississippi | $3,671 |

| Missouri | $4,987 |

| Montana | $4,197 |

| Nebraska | $3,876 |

| Nevada | $6,398 |

| New Hampshire | $4,763 |

| New Jersey | $8,653 |

| New Mexico | $5,983 |

| New York | $7,098 |

| North Carolina | $2,973 |

| North Dakota | $4,872 |

| Ohio | $3,987 |

| Oklahoma | $2,983 |

| Oregon | $5,298 |

| Pennsylvania | $8,763 |

| Rhode Island | $7,398 |

| South Carolina | $4,983 |

| South Dakota | $4,982 |

| Tennessee | $4,379 |

| Texas | $5,723 |

| Utah | $4,298 |

| Vermont | $3,982 |

| Virginia | $6,298 |

| Washington | $6,009 |

| Wash. D.C.* | $7,099 |

| West Virginia | $6,129 |

| Wisconsin | $3,989 |

| Wyoming | $2,983 |

Applies to 18 Y/O Male drivers with a two door sedan.

*Washington D.C. is included although not a State.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

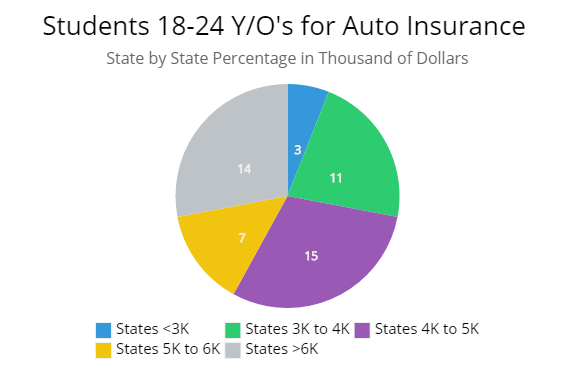

State-by-State Comparison of Auto Insurance Costs for College Students

*Most students pay 4 to 5k with a big majority paying 6K and up as shown by the graph.

Allstate College Student Discounts

Speaking of discounts, your car insurance premium most likely went up when you added your college-bound driver, and those rates will likely stay higher.

There are ways that you can offset this increase, such as taking advantage of the various premium discounts you and your student driver may be eligible for.

If you are not already doing so, look into saving money with these Allstate discounts:

- Multi-car discount – If you insure all of your vehicles with Allstate, you can save money across the board thanks to a car insurance discount for multiple vehicles at Allstate.

- Multi-policy discount – Known as bundling, if you insure your home and cars with Allstate, you get a home and auto insurance bundles discount.

- Safe driver discount – If you and/or your kids have had no tickets or accidents in the past few years, you all can get discounts for being good drivers (read more: best auto insurance companies for good drivers).

- Organizational and club discounts – Allstate offers discounts for being a member of certain organizations and clubs, and there may be fraternities or sororities your son or daughter joins that qualify for these discounts.

- Good grades discounts – If your college student maintains good grades, there can be a discount on premium (up until s/he turns 25). Learn how to get a good student car insurance discount.

When your kids head to college, you’ll have to decide whether to keep them on your family car insurance policy, or require them to find their own car insurance coverage.

In nearly every case, adding or maintaining them on a family policy will ease the burden of cost. No matter what type of car they drive, whether it’s a classic or vintage vehicle, Allstate has various policies available (learn more: How to Get The Right Car Insurance Coverage). You want your student to have more than one option when finding the best car insurance for students, and sometimes it helps you to have them on your auto insurance policy, because you don’t have to worry about them as much.

Should you have a car on campus?

If your child will be staying on the campus of his or her college without a vehicle, then you can actually remove the child from your policy for the months that he or she is away.

Usually, as long as the child does not live at home for longer than a month during the school year, you don’t have to list the child as a driver if they don’t have access to a car that is covered by your policy.Dani Best Licensed Insurance Producer

Some of the other factors you will need to consider before adding your college student to your family’s Allstate car insurance policy include the following questions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How much driving will the student be doing?

Depending on whether your college bound kids are going away to college or commuting to a nearby campus, you may want to either increase the coverage or scale it back accordingly.

If your college student is leaving a car parked at home while s/he lives on campus, you’ll be in a good position to be able to save a few extra dollars a month on the family’s car insurance.

How far away is the campus from home?

If your child’s college is at least 100 miles away from home and no one will be driving his/her car, let your Allstate agent know immediately.

Your child may qualify for what’s called the “resident student” discount, which can help lower your car insurance bill by as much as 30 percent.

On the other hand, if your kids’ daily commute has him/her driving longer distances to get to campus and back, now may be the good time to revisit your coverage limits to make sure that your kids are properly insured.

How safe is the campus?

If your college-bound kids are taking up temporary residence at a campus away from home, enlist the help of your insurance agent and check into the crime and vandalism rates for the campus and its surroundings. No matter your vehicle, Allstate has coverage for a college student.

This will give you and your child a good idea of what to expect as s/he prepares for life in new surroundings.

If your child is going away to college and bringing a car to an environment with a higher crime rate, you may want to include comprehensive coverage at levels suitable to protect against theft or vandalism damage.

Read more: Understanding Comprehensive Car Insurance Coverage

It might also not be a bad time to invest in anti-theft devices for any car headed to campus.

Doing so may not only cut back on the likelihood of things being stolen or damaged, but it might also land you a premium discount.

Learn more: Does Car Insurance Cover Theft of Your Vehicle or Personal Belongings?

If you’re looking into various auto insurance companies trying to find the best auto policy for you and your college student, we have a free comparison tool to compare quotes from different companies and help you with buying auto insurance. Don’t forget to take a look into what types of coverage will be offered, as well as any insurance discounts that are offered. All of that information can lead you to making a confident insurance-based decision in the end.

(Please note: this article is informational in its intent as the author has no affiliation with Allstate or any other insurance company.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the cheapest car insurance for a college student?

State Farm, Geico, and USAA usually have the cheapest rates for college students purchasing their own insurance policy.

What is the best car insurance for college students?

Full coverage policies are usually the best option for college students, as they provide the best protection in accidents.

What GPA is required for Allstate insurance Good Student discount?

Students must have a 3.0 GPA or higher.

Is Allstate or Geico more expensive?

Allstate is usually more expensive, but the only way to know for sure is to get quotes from the two companies for college student auto insurance.

Do college grades affect car insurance?

Having bad grades won’t affect your auto insurance rate, but students with good grades can apply for a discount that will help them get cheap auto insurance for students.

Why do insurers offer good student discounts?

Insurance companies believe that good students make better drivers, as they are more likely to study the rules of the roads and drive safely.

What is the average student discount?

It depends on the auto insurance company, but good student car insurance discounts can save anywhere from 10% to 30% or higher.

What is Drivewise from Allstate?

Drivewise is a good driver program that monitors driving behaviors and awards a discount at the end of the program.

Why is insurance so high for young drivers?

Young drivers, like college students, are charged more because they are high-risk drivers who are more likely to get into an accident due to inexperience.

How can a young driver lower car insurance?

By staying on their parents’ policy, driving safely, and applying for discounts, young drivers can keep rates reasonable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.