Can Someone Else Insure My Car? And Who Is Allowed To Insure It?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Car insurance can be complicated, there are many factors to consider when purchasing a vehicle and everyone knows cars need to be insured.

So you may be wondering if somebody else can insure your vehicle for you or if you can insure someone else’s car for them.

Can You Insure a Car That’s Not In Your Name?

| Can Someone Else Insure Your Car? - Key Takeaways |

|---|

- Yes, you can insure a car you don't own. Insurance companies want you to have "insurable interest" in the car, but policy terms and state laws vary. - Yes, you can insure a car you don't own. Insurance companies want you to have "insurable interest" in the car, but policy terms and state laws vary. - Insurable interest means you have a financial interest to insure the vehicle and its value. - Most car insurance companies, such as Liberty Mutual, Geico, and State Farm want proof of ownership to insure a vehicle. Progressive allows you to insure someone else's car with restrictions. - There are four ways you can insure someone else's car: -- Transfer the registration -- Add yourself as a driver to the owner's existing insurance policy. -- Add the vehicle owner to the policy as additional interest. -- Buy a non-owners policy. - High-risk drivers can have another person insure their vehicle for insurance premium savings if they transfer the car registration. |

Read on to learn more about times when you may be able to insure an automobile you do not own with an insurance company and reach out to AutoInsureSavings.org licensed insurance agents for more information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Can Someone Else Insure My Car?

Yes, someone else can insure your car. However, auto insurance companies generally have a requirement called “insurable interest.”

Insurable interest means you have an interest in the insured vehicle’s value, typically a financial relationship. Still, it could also be a contractual or legal relationship to the insured property, such as your car.

Auto insurance companies want to make sure their policyholders have an insurable interest in the vehicle they insure because it implies the policyholder will take better care of the property.

If they have no financial stake in it, people may be less likely to maintain the property they insure. This is an additional consideration for insurance companies.

Car insurance is financial protection in case you cause an accident with your car, or in case your car is damaged or stolen.

Insuring a Car for Young or Teen Drivers

Car insurance for teenage drivers can cost a fortune.

Teenagers do not have the driving experience or credit history to gauge how safe or risky it would be for an insurance provider to provide them with affordable auto insurance.

If your young driver needs to be added to your insurance policy, you may be able to add them as an additional driver to your existing policy. Because they reside with you, they can be added as drivers of your vehicle on your insurance policy.

| Type Policy | Annual Cost |

|---|---|

| Parent's insurance policy | $1,361 |

| Insurance policy with teenager | $2,830 |

| Teen policy (alone) | $5,138 |

Insurance providers prefer family members to add a teen driver to an existing insurance policy. If the younger driver has their motor vehicle, their parents or family member can get a multi-policy discount to save money.

If your teen doesn’t have a vehicle, you can get additional insurance savings by assigning the household’s cheapest car to the teenager.

Insurance Cost for Teens and Young Drivers

| State | Teenager with individual policy | Add Teen to Existing Policy |

|---|---|---|

| Alabama | $6,957 | $2,319 |

| Alaska | $5,389 | $2,156 |

| Arizona | $7,321 | $2,769 |

| Arkansas | $6,318 | $2,466 |

| California | $7,419 | $3,031 |

| Colorado | $7,608 | $3,138 |

| Connecticut | $9,843 | $3,427 |

| Delaware | $7,773 | $3,275 |

| Florida | $8,232 | $3,436 |

| Georgia | $7,518 | $3,411 |

| Hawaii | $7,230 | $3,658 |

| Idaho | $4,299 | $2,119 |

| Illinois | $7,436 | $2,931 |

| Indiana | $5,718 | $2,036 |

| Iowa | $4,112 | $1,944 |

| Kansas | $5,844 | $2,373 |

| Kentucky | $9,528 | $3,328 |

| Louisiana | $10,220 | $4,150 |

| Maine | $4,238 | $2,033 |

| Maryland | $6,280 | $2,747 |

| Massachusetts | $6,073 | $2,952 |

| Michigan | $11,659 | $4,957 |

| Minnesota | $5,099 | $2,333 |

| Mississippi | $6,851 | $2,748 |

| Missouri | $6,452 | $2,376 |

| Montana | $3,481 | $1,898 |

| Nebraska | $5,277 | $2,264 |

| Nevada | $8,589 | $3,270 |

| New Hampshire | $6,418 | $2,438 |

| New Jersey | $6,494 | $2,518 |

| New Mexico | $7,325 | $2,673 |

| New York | $8,998 | $3,264 |

| North Carolina | $3,471 | $2,040 |

| North Dakota | $5,511 | $2,246 |

| Ohio | $5,056 | $1,847 |

| Oklahoma | $7,482 | $2,329 |

| Oregon | $7,569 | $2,662 |

| Penn | $5,651 | $2,199 |

| Rhode Island | $9,341 | $3,178 |

| South Carolina | $6,188 | $2,630 |

| South Dakota | $6,021 | $2,475 |

| Tennessee | $7,573 | $2,784 |

| Texas | $6,649 | $2,276 |

| Utah | $6,323 | $2,106 |

| Vermont | $4,472 | $1,872 |

| Virginia | $4,300 | $1,942 |

| Washington | $5,763 | $2,053 |

| West Virginia | $5,702 | $2,298 |

| Wisconsin | $6,043 | $2,832 |

| Wyoming | $4,549 | $1,858 |

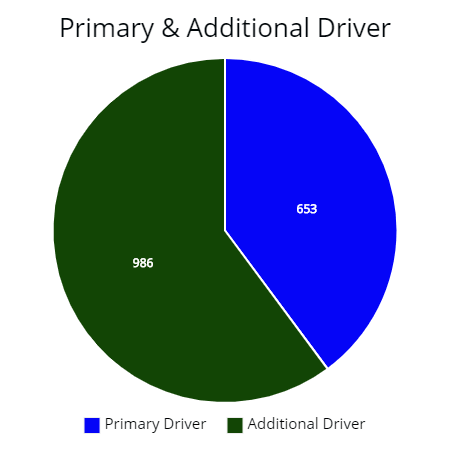

A Primary Driver Can Insure Your Car

If you are not your vehicle’s primary driver, the primary driver could insure your car and add you as an additional interest.

This can be a good solution and provide primary coverage options for drivers who do not live together, like if your child moves away for college and has your vehicle with them.

You would be listed as the additional interest and retain your financial interest in the car, but your child is the primary insured and primary driver.

Can Someone Else Insure Your Car As a High-Risk Driver?

If you are a high-risk driver with a poor driving record, you may be wondering if somebody else can insure your vehicle to save money on your auto insurance premium.

If you intend to transfer the registration to the other person or for them to drive your car instead of you, they would be able to insure it.

However, if you are listed as a driver, you will be rated on the auto insurance policy and pay an additional premium to be listed on the policy.

| Insurance Company | Without DUI | With DUI |

|---|---|---|

| USAA | $1,176 | $2,260 |

| Geico | $1,116 | $2,671 |

| State Farm | $1,243 | $2,487 |

| Allstate | $1,329 | $2,936 |

| National Average | $1,311 | $3,421 |

* Higher-risk drivers or those with a DUI may try to get someone else to insure their vehicle to avoid increased insurance rates. AutoInsureSavings.org licensed agents do not recommend insuring vehicles for high-risk drivers unless another primary driver has an insurable interest in the driver’s vehicle registration transfer.

Can You Insure a Car You Do Not Own?

You can insure a vehicle you do not own. Different car insurance carriers may have different restrictions and conditions. A non-owner insurance policy provides liability coverage for bodily injury and property damage.

Shopping around to compare your non-owner car insurance options, and determine what to buy, can help you make the best decision if you need to insure a car you do not own.

Can Someone Else Insure Your Car With Progressive?

Progressive is an insurance company that allows you to insure a car you do not own; however, they require it to be parked overnight at your residence. Progressive also sells non-owners policies.

Can Someone Else Insure Your Car With State Farm?

No, State Farm requires proof of ownership to insure a vehicle, but State Farm offers non-owners policies. Their rates for non-owners policies are $350 to $500 per year, depending on your age, credit history, marital status, and other risk factors.

How to Insure a Car You Do Not Own

If you wish to insure a car you do not own, there are a few ways you can do that:

Transfer the Registration

Since a car insurance company wants you to have an insurable interest in the vehicle to insure a car, one way to do that is to transfer the registration to yourself.

You can also add yourself to the title. If you are listed on the registration, you can prove your interest and insure the car.

Add Yourself as a Driver to the Owner’s Existing Policy

If you live with the owner of the car you wish to insure, you can add yourself as a driver to their existing car insurance policy.

Many insurers will not add you if you do not reside together due to rating issues with different garaging. But if you live with the person who owns the vehicle, this could be a good option.

However, adding yourself as a driver means increased insurance premiums to account for the increased risk you bring to the carrier.

Adding the Owner to the Policy as Additional Interest

You can choose to add the vehicle’s owner to your insurance policy as an additional interest. This shows the vehicle owner still has a financial interest in the car even though someone else insures it.

This can be a simple solution if you do not live with the person who owns the car and needs to insure your policy’s vehicle.

Buying a Non-Owner car insurance Policy

Non-owner’s policies are intended for people who occasionally drive other people’s cars and do not have auto insurance coverage themselves.

The non-owner policy is a liability-only policy designed to be in addition to the primary auto policy for the vehicle – this means it does not provide collision or comprehensive coverage as it is not rated for any particular vehicle.

Instead, it provides liability coverage that kicks in after the underlying policy has been exhausted.

Why You Shouldn’t Insure a Car You Do Not Own

Insuring a car you do not own can be a red flag to an insurance company of potential insurance fraud. They wonder why someone would pay to insure a vehicle they don’t have any financial interest in.

If you do not own the car, you cannot maintain it or be sure it is cared for – making it a poor idea to insure a car you don’t own.

Potential Insurance Fraud Issues

According to Carinsurance.com, insuring a car you do not own can be potentially fraudulent. Without a financial responsibility for the car, you would be unjustly enriched if there was an insurance payout to you.

According to Allstate Insurance, one of the tenets of insurance is that people cannot benefit from it – it is meant to indemnify or make you whole again after a loss, not to profit.

Frequently Asked Questions

What is Insurable Interest With Car Insurance?

Insurable interest means a legal or financial relationship to the insured property. In the case of insurance, this means the person insuring the vehicle owns or leases the vehicle or has another financial, contractual, or legal responsibility for it. For an auto insurance company, making sure the person insuring the vehicle as an insurable interest means that person will take care of the vehicle since they stand to lose financially if they do not. If a person did not have an insurable interest, there is no incentive to maintain the vehicle.

Do You Need Car Insurance to Drive Someone Else’s Car?

No. Most states require auto insurance. If you borrow a friend’s car, their insurance will likely cover the vehicle if you get into an accident, as long as you have permission to use the car. However, if you have your policy or a non-owners policy, that may provide another coverage source.

Can You Purchase Auto Insurance for Someone Else?

Yes. Insurance companies have their own rules, and you will likely have to prove an insurable interest in the vehicle to purchase insurance for someone else. In other words, if you finance a car someone else can insure it. The car owner and policyholder do not necessarily have to match.

Can Two People Insure the Same Vehicle?

Two people can insure the same car if they both have an insurable interest in it. If two people insure the same vehicle, insurance carriers will need to determine who is primary or how to pay the claim, creating challenges.

How to Learn More

To learn more about insuring your vehicle, contact our auto insurance experts today at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Sources

— IRMI.com. “Insurable Interest Definition.”

— Progressive Insurance. “FAQ’s Insuring Vehicles Not In Your Name.”

— State Farm Insurance. “Coverage Options, Non-Owner Insurance.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.