Alabama Cheapest Car Insurance & Best Car Insurance Options

Alabama's cheapest car insurance and best car insurance options can be found at Travelers and Nationwide. Travelers has the cheapest minimum coverage in Alabama at an average of $39 per month, while Nationwide has the cheapest full coverage policies at an average of $133 per month in Alabama.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Travelers has the cheapest minimum Alabama coverage

- Nationwide has the cheapest full coverage in Alabama

- AL drivers must carry Alabama’s required minimum coverage

Alabama’s cheapest car insurance and best car insurance options can be found at companies like Travelers and Nationwide. Read on to learn more about the best car insurance in Alabama.

Want to get quotes from the best auto insurance companies in Alabama right away? Simply enter your ZIP code into our free quote tool.

Alabama Cheapest Car Insurance Rates

To help Alabama drivers ensure their vehicle is protected and have adequate liability coverage to protect themselves if a crash occurs, we have put together this useful guide.

Here you will find more information on which companies offer the best rates to save money for Alabama drivers of all types and age groups and which insurance carrier offers the best coverage level at the right price.

- Alabama Cheapest Car Insurance & Best Car Insurance Options

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

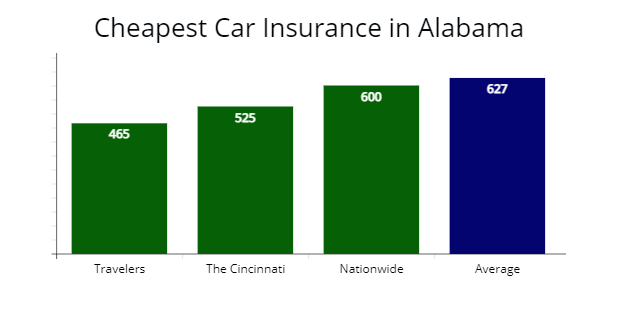

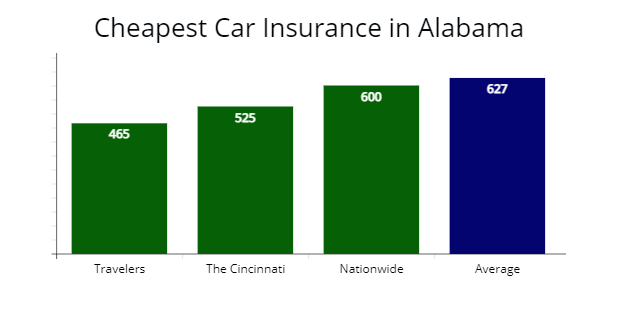

Who has the cheapest car insurance in Alabama?

After comparing several companies car insurance premiums using different age groups and other factors, we found that Travelers Insurance was the most consistent, offering the cheapest car insurance in terms of minimum coverage rates, and includes bodily injury liability and property damage liability coverage.

Learn more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

Other companies that had lower rates include Cincinnati Insurance, State Farm, and Alfa.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Insurer | Annual cost |

|---|---|

| Travelers | $465 |

| Cincinnati Insurance | $525 |

| USAA* | $575 |

| Nationwide | $600 |

| Alfa Insurance | $601 |

| State Farm | $678 |

*USAA is for military members, their spouses, and family members. Your results may vary when you get a quote.

Several factors help you determine how much your insurance costs will be. While one driver in Alabama may get the best deal from Geico, another driver may find a policy that costs even less from Progressive or State Farm.

Your age, driving history, the make and model of your vehicle, and even your credit score can affect your premium’s total cost. That is why it is essential to shop around to find the best deal on Alabama auto insurance.Dani Best Licensed Insurance Producer

Cheapest Auto Insurance Quotes for Full Coverage

In Alabama, Nationwide offers the cheapest average rates for full coverage car insurance with a quote at $1,599. Their average annual rates are 16% less than the state average at $1,900.

Following close behind Nationwide in our sample study are State Farm and Alfa Insurance. Both insurers offer quotes 10% cheaper.

| Insurer | Annual cost |

|---|---|

| Nationwide | $1,599 |

| State Farm | $1,671 |

| Alfa Insurance | $1,705 |

| Travelers | $1,775 |

| Cincinnati Insurance | $1,840 |

| Progressive | $1,981 |

Rates vary by driver profiles. Your rates may vary when you get a quote.

Cheapest Car Insurance in Alabama with a Car Accident

The companies in Alabama with the cheapest car insurance rates for drivers with an accident on their driving history include Alfa Insurance, State Farm, and Nationwide.

Alfa Insurance is at the top of the list, with an average annual premium of $2,143 for drivers in the car accident category. The company only raises rates for most drivers by up to 16%.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Alfa Insurance | $2,143 | $178 |

| State Farm | $2,216 | $184 |

| Nationwide | $2,478 | $206 |

| Travelers | $2,800 | $233 |

| Cincinnati Insurance | $2,965 | $247 |

| Progressive | $3,067 | $255 |

| Liberty Mutual | $3,127 | $260 |

| Alabama average | $2,680 | $223 |

Once you have an accident on your driving record in Alabama, you can expect your rates to go up by 19% on average.

That is why it is good to find an auto insurer that offers lower rates overall so that your rates will not go up by much if you happen to have a crash.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance with a Speeding Ticket in Alabama

According to our research, Alfa is the best company that offers the cheapest insurance rates for drivers with a speeding violation in Alabama.

Alfa offers auto insurance coverage at $1,877 annually or $156 per month.

| Insurance company | Annual cost | Monthly cost |

|---|---|---|

| Alfa | $1,877 | $156 |

| Nationwide | $2,188 | $182 |

| Allstate | $2,620 | $218 |

| Alabama average | $2,360 | $196 |

All types of traffic violations can cause your insurance rates to go up. One of the most common causes of someone going from a “good driver” to a “bad driver” is speeding. In Alabama, drivers can expect their rates to rise by as much as $314 annually after receiving just one speeding violation.

Learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Suppose you have traffic tickets or other similar violations on your driving history. In that case, you will want to shop around and compare your options for the most affordable Alabama car insurance.

Cheapest Car Insurance with a DUI in Alabama

Based on our estimates, the least expensive car insurance company in Alabama for drivers with a DUI on their record is Allstate, with an insurance quote at $2,877 per year. Allstate offers annual rates that are 12% less than the state average at $3,205 per year. Take a look at some more of the best car insurance companies after a DUI below.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Allstate | $2,877 | $239 |

| Alfa | $3,080 | $256 |

| Nationwide | $3,154 | $262 |

| USAA | $3,430 | $285 |

| State Farm | $3,854 | $321 |

| Alabama average | $3,205 | $267 |

No matter what state you are in, you can expect your rates to go up if you receive a DUI. DUIs usually add more to your overall premium rate than any other traffic violation. You can sometimes expect to get a suspended driver’s license and on your driving record for at least three years.

In Alabama, drivers can expect rates to go up by 54% after receiving a DUI or a DWI. That’s why it is a good idea to shop around and find the most affordable auto insurance rates when considering a new policy.

Cheapest Car Insurance with Poor Credit in Alabama

During the AutoInsureSavings.org comparison shopping study to find the top car insurance sites for Alabama car insurance, the most affordable option for coverage, if you have bad credit, is Nationwide, which offers drivers an average savings of $287 per year other providers in the state.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,769 | $147 |

| Alfa Insurance | $2,056 | $171 |

| Allstate | $2,327 | $193 |

| Progressive | $2,450 | $204 |

| Geico | $2,674 | $222 |

| Alabama average | $2,388 | $199 |

Your credit score can have an impact on how much you pay for your car insurance. Many insurance companies will look at your credit report and score to determine if you are a high-risk driver.

According to the Insurance Information Institute (III.org), drivers with lower credit scores tend to file more auto insurance claims than those with good or perfect credit.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers in Alabama

The least expensive option for full coverage auto insurance quotes for young drivers is Allstate and Nationwide, offering quotes at $5,483 and $5,977 annually, 12 and 5% cheaper rates than the state average of $6,190 per year.

Young drivers looking for the best car insurance for new drivers in Alabama for minimum coverage is with State Farm. They offer rates at $1,388 per year or 42% less expensive than average.

| Insurance company | Minimum coverage | Full coverage |

|---|---|---|

| Allstate | $1,688 | $5,483 |

| Nationwide | $1,743 | $5,977 |

| State Farm | $1,388 | $6,089 |

| Alfa Insurance | $2,155 | $6,130 |

| Progressive | $2,654 | $6,874 |

| Alabama average | $2,436 | $6,190 |

Young or teen drivers can expect to pay more for their car insurance premium because most insurance companies consider them high-risk drivers.

Cheapest Car Insurance for Young Drivers with an Accident

AutoInsureSavings insurance agents found Nationwide provides the lowest quotes for young drivers with a recent at-fault accident, with an average cost of $6,294 per year, or 20% cheaper than the statewide average rate.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Nationwide | $5,720 | $476 |

| State Farm | $6,209 | $517 |

| Geico | $6,488 | $540 |

| Allstate | $7,377 | $614 |

| Alfa Insurance | $8,490 | $707 |

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young drivers with a speeding ticket in their driver history can find the cheapest car insurance quotes with Nationwide, who provided us quotes at $5,720 annually or $476 per month.

The average rate increase with a ticket for young drivers in Alabama is 19% (learn more: How much will my auto insurance go up with a speeding ticket?).

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Nationwide | $5,720 | $476 |

| State Farm | $6,209 | $517 |

| Geico | $6,488 | $540 |

| Allstate | $7,377 | $614 |

| Alfa Insurance | $8,490 | $707 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Alabama

As we’ve mentioned throughout this guide, the amount you pay for your auto insurance premium depends on several factors. That is why it is essential to compare several companies’ rates to find the priced right policy.

ValuePenguin has a recent claims satisfaction survey, and USAA has rated the best car insurance company in Alabama by customers.

| Company | % of respondents satisfied recent claim | % of respondents service as "excellent" |

|---|---|---|

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Travelers | 63% | 33% |

| Alfa Insurance | n/a | n/a |

Along with finding the right company that offers the best price, it is also good to look at the discounts offered, the different coverage options available, and the company’s customer service rating.

Based on our research, here are the best auto insurance companies in Alabama for you to consider.

#1 USAA

USAA rates at number two according to J.D. Power. In the AutoInsureSavings.org comparison shopping study, we don’t rank USAA because it is not available to all drivers in Alabama, only active military members, retired military, veterans, and their families.\

Learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits

But if you do qualify for membership with USAA, you will have access to some of the best car insurance options for veterans and the military. They have a customer satisfaction ranking of 909, an AM Best Financial ranking of A++, and a BBB rating of A-.

#2 Erie Insurance

If you are looking for an insurance company you will stay with long-term, Erie Insurance is a good option. They are rated at number three with J.D. Power and offer an Accident Forgiveness Program that forgives drivers of their first accident claim if they have been a customer for at least three years.

Read more: A Review of Erie Auto Insurance & Policy Options

Erie Insurance also offers many great discounts for young drivers and reduced usage. They have a customer satisfaction ranking of 871, an AM Best Financial ranking of A+, and a BBB rating of A+.

#3 Alfa Insurance

Alfa Insurance is a great company that is unfortunately only offered in a small number of states. But if you live in Alabama, you can take advantage of their savings and excellent personalized customer service. They are rated at number four with J.D. Power.

Drivers in Alabama must join the Alabama Farmers Federation before they can purchase insurance through Alfa. The membership’s cost is inexpensive; however, consider all the savings you will receive from their auto insurance. They have a customer satisfaction ranking of 858, an AM Best Financial ranking of A++, and a BBB rating of A+.

#4 Geico

Geico offers some of the best options for car insurance in Alabama. They are rated at number five with J.D. Power. There are many discounts available for drivers in Alabama to choose from, allowing you to save even more on your premium.

Some of the best deals offered by this top-ranked company include 25% off for drivers who are accident-free and as much as 15% savings on new car insurance. They have a customer satisfaction ranking of 857, an AM Best Financial ranking of A++, and a BBB rating of A+.

| Company | NAIC Complaint Index | J.D. Power claims satisfaction score | A.M. Best |

|---|---|---|---|

| Alfa Insurance | 0.16 | n/a | A |

| Nationwide | 0.37 | 876 | A+ |

| Progressive | 0.42 | 856 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

Suppose you are looking for an auto insurance company with superior customer service. In that case, Alfa insurance is a stand-out with a complaint index ratio from the National Association of Insurance Commissioners (NAIC) of only 0.16.

Cheapest Car Insurance Cost by City

The average cost of coverage in Alabama is $1,900 annually or $158 per month for full coverage from our sample 30-year-old driver.

Location is a factor for auto insurers to determine your rate. The price difference from one city to the next is over $500 annually.

Learn more: What Factors Impact the Cost of Car Insurance?

Out of the most populous cities in Alabama, the cheapest car insurance is in Dothan and Phenix City. Drivers can find Mobile and Birmingham’s insurance rates the most expensive in the state.

Cheapest Car Insurance in Birmingham, AL

Drivers can find the cheapest car insurance quotes in Birmingham with Alfa, who provided quotes at $1,729 annually or $144 per month for full coverage.

| Birmingham Company | Average Premium |

|---|---|

| Alfa | $1,729 |

| Nationwide | $1,884 |

| State Farm | $2,063 |

| Birmingham average | $2,199 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Montgomery, AL

Drivers with clean driving records in Montgomery can find the most affordable coverage with Nationwide, with quotes at $1,514 per year and 26% less expensive than the average Montgomery rate. Take a look at the best car insurance in Montgomery below.

| Montgomery Company | Average Premium |

|---|---|

| Nationwide | $1,514 |

| Alfa | $1,586 |

| Allstate | $1,852 |

| Montgomery average | $2,033 |

Cheapest Car Insurance in Huntsville, AL

Huntsville’s cheapest full coverage policy is with Travelers, providing the least expensive insurance at $1,277 per year or 36% cheaper than the average citywide rate.

| Huntsville Company | Average Premium |

|---|---|

| Travelers | $1,277 |

| Alfa | $1,396 |

| Nationwide | $1,451 |

| Huntsville average | $1,991 |

Cheapest Car Insurance in Mobile, AL

Mobile drivers can find the cheapest car insurance with Alfa, providing our agents with a $1,640 quote for full coverage. Alfa’s quote is 26% less expensive than Mobile’s average rate.

| Mobile Company | Average Premium |

|---|---|

| Alfa | $1,640 |

| Nationwide | $1,783 |

| State Farm | $1,926 |

| Mobile average | $2,215 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Hoover, AL

Drivers can get the cheapest car insurance in Hoover with Alfa, who provide our licensed agents with a $1,548 quote or 30% less expensive than the citywide rate.

| Hoover Company | Average Premium |

|---|---|

| Alfa | $1,548 |

| Nationwide | $1,615 |

| Travelers | $1,843 |

| Hoover average | $2,181 |

Cheapest Car Insurance in Auburn, AL

Residents of Auburn can get the cheapest auto insurance with Alfa, who provided us a quote of $1,327 annually or $110 per month, which is 31% lower than Auburn’s average rate.

| Auburn Company | Average Premium |

|---|---|

| Nationwide | $1,327 |

| Alfa | $1,460 |

| Travelers | $1,531 |

| Auburn average | $1,900 |

Cheapest Car Insurance in Decatur, AL

AutoInsureSavings.org licensed agents found the cheapest insurance in Decatur is with State Farm, who provided a quote at $1,476 per year for full coverage, 25% less expensive than average.

| Decatur Company | Average Premium |

|---|---|

| State Farm | $1,476 |

| Alfa | $1,572 |

| Travelers | $1,688 |

| Decatur average | $1,910 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Cost of Coverage in 100 Cities

| City | Average Annual Rate | City | Average Annual Rate |

|---|---|---|---|

| Birmingham | $2,199 | Pell City | $2,020 |

| Montgomery | $2,033 | Jasper | $2,011 |

| Huntsville | $1,991 | Chelsea | $2,038 |

| Mobile | $2,215 | Moody | $1,769 |

| Tuscaloosa | $2,068 | Jacksonville | $1,982 |

| Hoover | $2,181 | Irondale | $1,654 |

| Dothan | $1,879 | Leeds | $2,142 |

| Auburn | $1,900 | Gulf Shores | $2,173 |

| Decatur | $1,910 | Sylacauga | $2,024 |

| Madison | $1,980 | Eufaula | $1,844 |

| Florence | $1,754 | Fairfield | $1,753 |

| Phenix City | $1,659 | Saks | $1,682 |

| Prattville | $1,912 | Clay | $2,021 |

| Gadsden | $1,480 | Russellville | $1,869 |

| Vestavia Hills | $1,998 | Pleasant Grove | $1,811 |

| Alabaster | $1,850 | Rainbow City | $1,769 |

| Opelika | $1,670 | Atmore | $1,984 |

| Enterprise | $1,559 | Meadowbrook | $1,954 |

| Bessemer | $1,739 | Pike Road | $2,046 |

| Athens | $1,905 | Valley | $2,024 |

| Daphne | $1,630 | Boaz | $1,844 |

| Northport | $1,879 | Fultondale | $1,940 |

| Homewood | $1,523 | Bay Minette | $2,054 |

| Pelham | $2,093 | Sheffield | $1,990 |

| Trussville | $1,947 | Forestdale | $1,639 |

| Prichard | $2,024 | Southside | $1,879 |

| Anniston | $1,932 | Andalusia | $1,940 |

| Albertville | $1,844 | Clanton | $2,061 |

| Oxford | $1,879 | Spanish Fort | $1,879 |

| Fairhope | $1,911 | Tuskegee | $1,699 |

| Mountain Brook | $2,024 | Guntersville | $2,024 |

| Troy | $1,699 | Tuscumbia | $1,847 |

| Foley | $1,879 | Arab | $1,940 |

| Helena | $2,082 | Wetumpka | $1,877 |

| Selma | $1,827 | Greenville | $1,687 |

| Tillmans Corner | $1,632 | Brook Highland | $1,940 |

| Center Point | $1,940 | Pinson | $1,953 |

| Cullman | $2,023 | Meridianville | $2,024 |

| Millbrook | $2,024 | Moores Mill | $1,965 |

| Hueytown | $1,940 | Demopolis | $2,024 |

| Talladega | $1,953 | Montevallo | $1,625 |

| Scottsboro | $1,942 | Hamilton | $1,851 |

| Alexander City | $1,713 | Lincoln | $2,064 |

| Hartselle | $1,858 | Oneonta | $2,053 |

| Ozark | $1,821 | Robertsdale | $1,840 |

| Saraland | $1,855 | Opp | $1,683 |

| Fort Payne | $1,800 | Theodore | $1,749 |

| Muscle Shoals | $1,936 | Lanett | $1,835 |

| Gardendale | $1,955 | Grayson Valley | $1,843 |

| Calera | $1,832 | Tarrant | $1,915 |

Minimum Car Insurance Requirements

Alabama drivers are required to maintain minimum liability coverage as per state law.

| Liability | Minimum coverage |

|---|---|

| Bodily injury (BI) | $25,000 per person and $50,000 per accident |

| Property damage (PD) | $25,000 per accident |

Our licensed insurance agents recommend purchasing more coverage limits that are required by state law. For instance, if you engage in higher liability activities such as night driving, you should consider higher bodily injury liability and property damage liability limits. AutoInsureSavings.org licensed agents recommend optional uninsured motorist coverage.

Naturally what you buy depends on how much you drive, what type of vehicle you drive, and a number of other factors that include your driving history. Remember, the cheapest option may not net you the best in terms of coverage. When you’re looking for affordable car insurance, look at what policy limits are set up, if there’s a variety of discounts you can pick from, and what customers are saying about the company you’re looking into.

Don’t forget about our comparison tool, which will help you to compare quotes from various companies. Coverage per person is going to vary, so you may need a policy that’s different from anyone else in your life. Whether that means you’ll need less or additional coverage, you should compare prices to find the best rate.

To learn more about the best car insurance options in Alabama, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings Coverage Methodology

| AutoInsureSavings.org used insurance data provided by Quadrant Information Services. Rates were publicly sourced from insurer filings and are intended for comparative purposes as your premiums could differ. Our sample driver a 30-year-old male drives 12,000 miles each year in a 2018 Honda Accord. |

| Coverage type | Study limits |

|---|---|

| Bodily liability insurance | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Frequently Asked Questions

Who has the cheapest car insurance in Alabama?

If you only want minimum coverage in Alabama, Travelers is your best option. You get all the great benefits and discounts from this industry leader with average rates for minimum coverage at just $465 per year or $39 per month. Other car insurance companies to consider are The Cincinnati, which offers minimum coverage at $525 per year, and Nationwide, with an average annual rate of $600 for the state’s minimum.

How do I save on car insurance in Alabama?

To save the most money on your car insurance, you need to determine which companies offer the lowest rates and most discounts. Once you find several companies to choose from, you can compare them by visiting a quote comparison website to get a personalized quote for the lowest priced auto insurance coverage that meets your needs. Once you are ready to buy a policy, make sure to do your due diligence, then get available discounts.

How much is car insurance in Alabama per month?

For drivers with clean driving records in Alabama, car insurance’s cheapest monthly rates are the following: Travelers at $39, The Cincinnati at $43, USAA at $48, and Nationwide at $50 minimum coverage policy.

How much will my car insurance increase with a speeding violation in Alabama?

In Alabama, drivers can expect their car insurance rates to go up by $314 per year on average after receiving a speeding violation, which comes to an estimated $1,672 annual premium.

How much is full coverage car insurance in Alabama?

The average cost of full coverage for Alabama auto insurance is $1,900 annually. The state minimum average rate is $610, with a difference in savings of $1,290.

Why is Alabama car insurance so expensive?

Alabama car insurance is more expensive due to location factors like the higher crash rate in the state.

What is the best car insurance in Alabama?

Full coverage auto insurance policies are the best car insurance policies in Alabama, as they provide the best financial assistance after an accident.

Is Alabama a no-fault state?

Alabama is an at-fault auto insurance state.

Is it illegal to drive without car insurance in Alabama?

Yes, Alabama drivers must carry at least minimum coverage in Alabama. To find affordable Alabama insurance, make sure to get Alabama car insurance quotes.

Is Alabama a PIP state?

No, PIP car insurance is not required in Alabama.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.