Illinois Cheapest Car Insurance & Best Car Insurance Coverage

The Illinois cheapest car insurance policies can be found at Unique, followed by Progressive and State Farm. Each of these Illinois car insurance companies has average auto insurance rates for good drivers that are at least 10% cheaper than the average cost of auto insurance in Illinois.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Unique has the cheapest IL car insurance coverage

- Progressive and State Farm are also affordable options

- All IL drivers need to carry at least minimum coverage

Illinois’ cheapest car insurance is at Unique, Progressive, and State Farm. Each of these best auto insurance companies can provide quotes from 10 to over 20% lower than the average cost. This article will cover the minimum requirements in Illinois, cost-saving strategies, and the least expensive car insurance companies by age.

To get the cheapest car insurance in Illinois today, use our free quote comparison tool.

Cheapest Car Insurance in Illinois

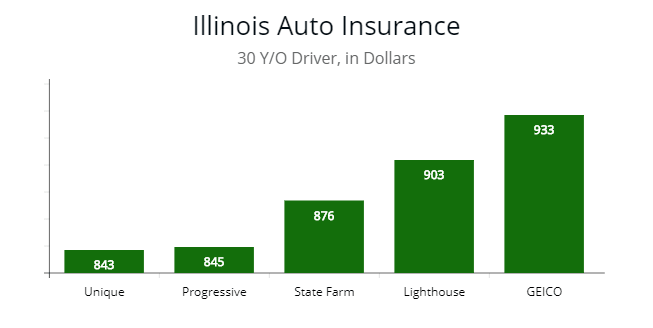

Note: The lowest insurance premiums for a 25-year-old driver in Illinois are Unique, Progressive, and State Farm. I queried each at $1,156, $1,166, and $1,178 per year. All 5 insurers illustrated are more than 20% below the “mean” rate in Illinois.

Note: The lowest insurance premiums for a 25-year-old driver in Illinois are Unique, Progressive, and State Farm. I queried each at $1,156, $1,166, and $1,178 per year. All 5 insurers illustrated are more than 20% below the “mean” rate in Illinois.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Minimum Requirements in Illinois

| Coverage | Illinois Minimum Liability Coverage | Recommended Coverage |

|---|---|---|

| Bodily Injury Protection | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage | $25,000 | $25,000 |

| Uninsured Motorist Coverage | $25,000 / $50,000 | $25,000 / $50,000 |

| Comprehensive Coverage | Optional | $500 - $1,000 deductible |

| Collision Coverage | Optional | $500 - $1,000 deductible |

Bodily Injury Liability

If an individual is known to be at fault in an accident, bodily injury liability covers the hospital costs of the other people involved in the accident.

If minimum liability auto insurance coverage is purchased, an insurer will pay up to $20,000 per head up to a total of $40,000 for all passengers per accident.

Property Damage Liability

Property damage liability covers damages to automobiles and buildings, guard rails, or other public property.

With minimum insurance coverage, an insurer will pay out up to $15,000 to cover property damage costs. Of the cheapest car insurance companies, your annual premiums will like vary.

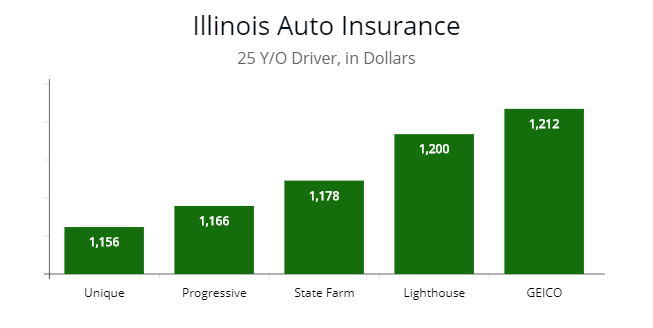

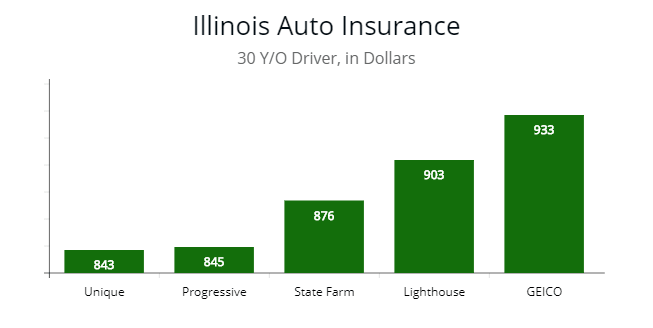

Note: The lowest price insurers for a 30-year old are Unique and Progressive. I queried each at $843 and $845 per year. For a driver with good driving history, any of the 5 illustrated would be competitive choices.

Note: The lowest price insurers for a 30-year old are Unique and Progressive. I queried each at $843 and $845 per year. For a driver with good driving history, any of the 5 illustrated would be competitive choices.

As with most states, Illinois has mandatory car insurance minimums set at 20/40/15, and each number is in thousands represented respectfully by the figures above.

To drive legally in the state, you have to have a valid driver’s license, proof of coverage, and you have to keep the insurance card on you or in your vehicle at all times.

In tort states like Illinois, each time an automobile accident happens, law enforcement and each auto insurance corporation will decide which driver caused the crash.

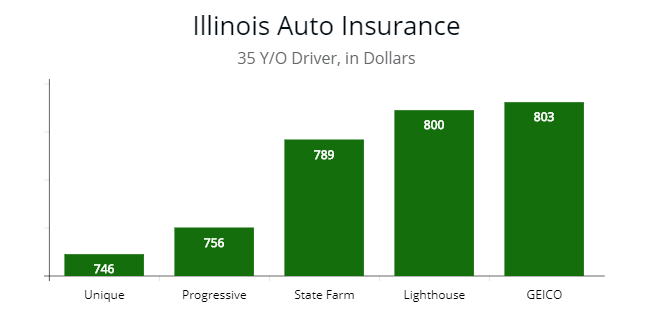

Note: For a 35-year-old driver in Illinois, all 5 insurers illustrated are competitive choices. Each clustered around the $750 to $800 range. A family of 4 would find cheaper quotes by comparing Unique and Progressive.

Note: For a 35-year-old driver in Illinois, all 5 insurers illustrated are competitive choices. Each clustered around the $750 to $800 range. A family of 4 would find cheaper quotes by comparing Unique and Progressive.

In the opinion of the state’s laws, the individual accountable for causing the accident will be paying the doctor’s bills for those needing medical treatment.

Any repair bills to the automobile will have to be paid too, according to insurance requirements.

Cheapest Car Insurance by Rate & Age in Illinois

The table below outlines the cheapest insurers in Illinois for drivers from 25 to 55 years of age.

Unique, Progressive, and State Farm can offer quotes 21% to 34% lower than the median rate for similar age drivers and profiles.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Another carrier in the top 3 overall, but was numerous times when querying for local zip codes, is Lighthouse.

Lighthouse can offer quotes from 16% to 32% lower, depending on your age and profile.

Geico and Rockford Mutual can offer quotes from 10% to over 20% lower than average.

Two other carriers you would want to put on your bucket list to get quotes are Nationwide and Farmers.

On review, both carriers were able to go head-to-head with Unique, Progressive, or Lighthouse depending on your age, vehicle type, and profile.

Each aged driver had one driving violation, good credit, and was single. If you have a clean driving record, you may be quoted a more affordable rate.

| Illinois Company | Annual Rate 25 Y/O Driver | 30 Y/O Driver | 35 Y/O Driver | 40 Y/O Driver | 45 Y/O Driver | 55 Y/O Driver |

|---|---|---|---|---|---|---|

| Unique | $1,156 | $843 | $746 | $623 | $599 | $551 |

| Progressive | $1,166 | $845 | $756 | $645 | $610 | $511 |

| State Farm | $1,178 | $876 | $789 | $678 | $623 | $523 |

| Lighthouse | $1,200 | $903 | $800 | $688 | $609 | $554 |

| Geico | $1,212 | $933 | $803 | $690 | $647 | $556 |

| Rockford Mutual | $1,267 | $979 | $843 | $734 | $608 | $558 |

| MetLife | $1,288 | $1,004 | $843 | $721 | $700 | $675 |

| Amica | $1,299 | $1,049 | $854 | $743 | $708 | $558 |

| Nationwide | $1,376 | $1,111 | $879 | $789 | $711 | $590 |

| The Cincinnati | $1,487 | $1,123 | $909 | $800 | $721 | $595 |

| 21st Century | $1,499 | $1,176 | $913 | $801 | $705 | $600 |

| Allstate | $1,512 | $1,188 | $943 | $785 | $706 | $643 |

| Esurance | $1,587 | $1,190 | $956 | $789 | $709 | $658 |

| SECURA | $1,634 | $1,243 | $990 | $805 | $743 | $634 |

| Pekin | $1,655 | $1,256 | $1,000 | $865 | $765 | $689 |

| Auto Owners | $1,689 | $1,276 | $1,009 | $876 | $777 | $699 |

| Farmers | $1,699 | $1,289 | $1,046 | $832 | $778 | $694 |

| State Auto | $1,745 | $1,293 | $1,090 | $843 | $793 | $711 |

| Liberty Mutual | $1,832 | $1,300 | $1,147 | $909 | $799 | $699 |

| Hastings Mutual | $1,865 | $1,366 | $1,176 | $987 | $800 | $699 |

| Ameriprise | $1,865 | $1,409 | $1,198 | $999 | $800 | $701 |

| The General | $1,887 | $1,476 | $1,276 | $1,032 | $825 | $733 |

| Mercury | $1,900 | $1,488 | $1,300 | $1,098 | $876 | $738 |

| American Freedom | $2,087 | $1,632 | $1,289 | $1,154 | $878 | $745 |

| Kemper Specialty | $2.132 | $1,689 | $1,345 | $1,187 | $903 | $784 |

| Grange | $2,432 | $1,902 | $1,344 | $1,165 | $898 | $744 |

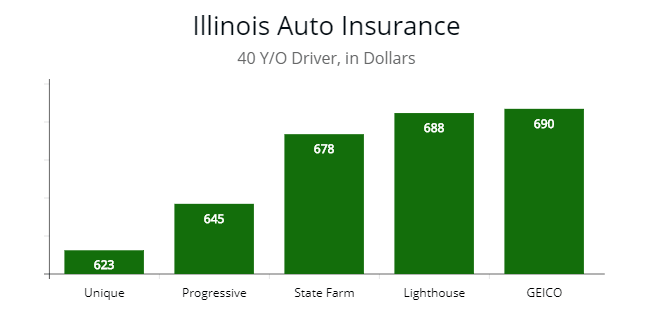

Note: Once again, the cheapest rates for a 40-year old are from Unique and Progressive. Both at $623 and $645 respectfully per year. Which is over 28% lower than the average rate. State Farm and Lighthouse offer competitive prices with quotes at $678 and $688 respectfully per year.

Note: Once again, the cheapest rates for a 40-year old are from Unique and Progressive. Both at $623 and $645 respectfully per year. Which is over 28% lower than the average rate. State Farm and Lighthouse offer competitive prices with quotes at $678 and $688 respectfully per year.

Best Illinois Carriers by Consumer Rating, Rate Change, & Complaints

Below I have outlined over 20 carriers with the number of written premiums, rate change, complaints, and consumer rating.

The carrier with the highest amount of written premiums in Illinois is State Farm.

Of course, they have more complaints, which are to be expected.

However, the complaint ratio is low.

The percentage rate change ranges from 2.4% to 4%, depending on the company.

This is normal.

If you get a traffic violation, your monthly or yearly rate change could increase dramatically (learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates).

Lighthouse, Unique, and Rockford Mutual are not on the list since there isn’t any reliable data.

They are registered with the state to do business as an insurer.

Consumer ratings are averaged data from reputable online sources.

Large national companies such as State Farm, Progressive, and Farmers usually have a better consumer rating than local or regional companies such as Hastings or Rockford Mutual.

This is normal too.

Local companies can, at times, offer tailored, more personable service over national carriers.

Any other data is compiled from the Insurance Information Institute (III.org), JD Power & Associates, and AM Best.

| Illinois Company | Written Premiums | Rate Change < 18 Months | # of Complaints | Consumer Rating out of 5 Stars |

|---|---|---|---|---|

| Progressive | $285,110 | +2.3% | 65 | 4.4 |

| State Farm | $1,868,698 | +2.3% | 102 | 4.4 |

| Geico | $324,891 | +2.4% | 54 | 4.4 |

| Erie | $19,952 | +3.5% | 12 | 4.2 |

| MetLife | $111,952 | +2.7% | 23 | 4.0 |

| Country Financial | $437,026 | +2.9% | 30 | 4.0 |

| Nationwide | $103,221 | +3.0% | 11 | 4.1 |

| 21st Century | $88,328 | +3.0% | 2 | 3.9 |

| Allstate | $675,083 | +2.9% | 41 | 4.2 |

| Esurance | $101,112 | +2.8% | 12 | 4.2 |

| USAA | $125,551 | +2.4% | 17 | 4.5 |

| Auto-Owners | $98,321 | +3.0% | 9 | 4.0 |

| Farmers | $305,455 | +3.1% | 8 | 4.1 |

| State Auto | $95,553 | +3.2% | 8 | 3.9 |

| Liberty Mutual | $188,714 | +3.2% | 11 | 4.0 |

| Hastings Mutual | $83,432 | +3.4% | 2 | 3.8 |

| The General | $55,321 | +3.8% | 19 | 3.6 |

| Mercury | $72,765 | +3.6% | 5 | 3.9 |

| American Family | $271,604 | +3.5% | 6 | 4.0 |

| Kemper Specialty | $76,111 | +3.2% | 8 | 3.7 |

| Grange | $67,764 | +3.3% | 4 | 3.7 |

Comprehensive, Collision Coverage, GAP, & UM Protection

Since Illinois has major cities such as Chicago, Rockford, Peoria, and Cicero, it would be a good idea to carry comprehensive car insurance coverage.

This is also called “non-collision” coverage and will protect your vehicle from damage caused by natural disasters, which could happen in Illinois since heavy rains, winds, and snow during the winter season.

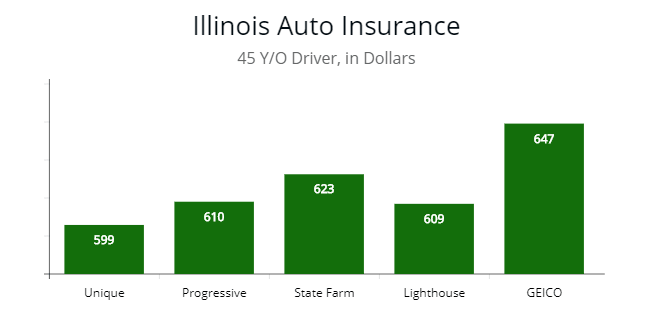

The cheapest car insurance for a 45-year-old driver can be found with Unique, Lighthouse, and Progressive. Each is more than 29% lower than the “mean” rate. State Farm and Geico are competitive too.

The cheapest car insurance for a 45-year-old driver can be found with Unique, Lighthouse, and Progressive. Each is more than 29% lower than the “mean” rate. State Farm and Geico are competitive too.

Other coverage to consider when comparing insurance quotes is collision car insurance coverage, uninsured motorist protection (underinsured motorist coverage), and GAP insurance if you have financed your vehicle. In this case, your minimum coverage limits and your coverage per accident should be considered as well.

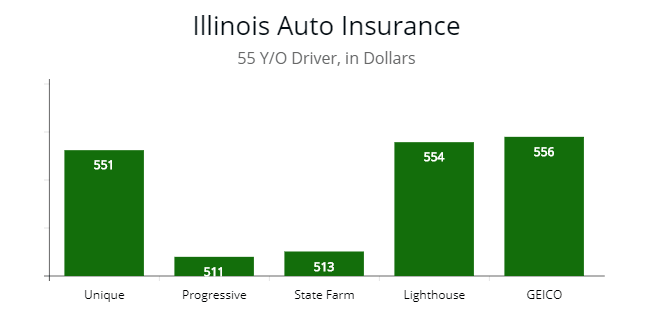

The best choices for a 55-year-old driver in Illinois are State Farm and Progressive. Each near the $500 mark for a driver with good driving history. Lighthouse, Unique, and Geico clustered at the $550 mark, which makes them competitive too.

The best choices for a 55-year-old driver in Illinois are State Farm and Progressive. Each near the $500 mark for a driver with good driving history. Lighthouse, Unique, and Geico clustered at the $550 mark, which makes them competitive too.

Learn more: How to Get The Right Car Insurance Coverage

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Illinois Car Insurance Rates by City

Below is a list of 36 less populated cities in Illinois with the average premium.

Location is a primary factor when insurers determine your premium.

One of the reasons you will have significantly different premium costs from one city or zip code to another.

Learn more: Understanding How Car Insurance Premiums Are Calculated

If you find that your quoted premium is higher than those listed below, you may either be a young driver or your driving record is not clean.

Read more: The Best Car Insurance for New Drivers

If you would like a detailed comparison of quotes by more populous cities in Illinois, please read further below.

| City | Avg Rate | City | Avg Rate | City | Avg Rate |

|---|---|---|---|---|---|

| Alton | $1,321 | Fairview | $1,503 | Seneca | $1,487 |

| Belvidere | $1,340 | Freeport | $1,237 | Sparta | $1,487 |

| Calumet City | $1,189 | Geneva | $1,301 | Shelbyville | $1,582 |

| Carbondale | $1,208 | Granite City | $1,189 | Quincy | $1,428 |

| Centralia | $1,672 | Kankakee | $1,487 | Swansea | $1,587 |

| Charleston | $1,311 | Lincoln | $1,305 | Tampico | $1,518 |

| Colchester | $1,567 | Lindenhurst | $1,419 | Troy | $1,867 |

| Colfax | $1,587 | Medora | $1,387 | Waukegan | $1,732 |

| Danville | $1,388 | Morris | $1,532 | Westchester | $1,399 |

| East Peoria | $1,300 | Mundelein | $1,503 | Wheaton | $1,711 |

| Fairfield | $1,188 | Olney | $1,411 | Yorkville | $1,253 |

Chicago, IL

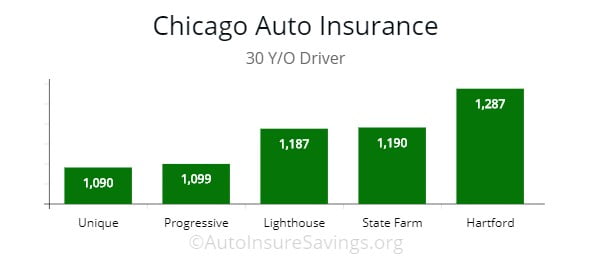

The average car insurance rate in Chicago, Illinois, is about $1,900 per year.

The average car insurance rate in Chicago, Illinois, is about $1,900 per year.

As illustrated, I was able to find rates for drivers below the $1,100 with two insurers, Unique and Progressive.

I queried each at $1,090 and $1,099 per year for a 30-year-old driver.

Which is 45% lower than the average premium cost for similar age drivers.

For a 45-year-old driver, the lowest premiums are found with Unique and Progressive.

I queried each at $723 and $743 per year for full coverage.

Which is 46% lower than the average premium for similar profile drivers.

All of the insurers illustrated in the table are more than 34% below the city “average” rate.

For any driver, it would be smart to compare all the insurance firms listed in the table.

| Chicago Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Unique | $1,090 | $723 |

| Progressive | $1,099 | $743 |

| Lighthouse | $1,187 | $788 |

| State Farm | $1,190 | $865 |

| Geico | $1,256 | $879 |

| Hartford | $1,287 | $912 |

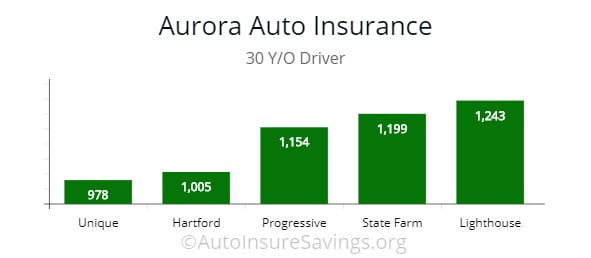

Aurora, IL

Finding cheap car insurance is easy in Aurora if you know where to look.

Finding cheap car insurance is easy in Aurora if you know where to look.

The lowest rates are found with Unique at $978, then Hartford at $1,005, followed by Progressive at $1,154.

Each insurer is 24% below the median rate of $1,430 per year for a 30-year-old driver.

A 45-year-old driver can find rates well below the $800 with Unique and The Hartford.

I queried each at $731 and $730 respectfully per year for full coverage.

Which is over 41% lower than the “mean” quote for similar age drivers in Aurora.

For a competitive comparison and the best coverage for low cost, it would be wise to get quotes from all companies.

| Aurora Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Unique | $978 | $731 |

| Hartford | $1,005 | $730 |

| Progressive | $1,154 | $843 |

| State Farm | $1,199 | $821 |

| Lighthouse | $1,243 | $896 |

| Geico | $1,288 | $904 |

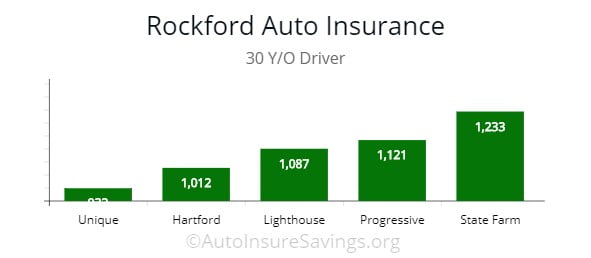

Rockford, IL

You can find affordable auto insurance in Rockford with Unique, Lighthouse, and Geico.

You can find affordable auto insurance in Rockford with Unique, Lighthouse, and Geico.

Unique by far being the lowest at $932 for a 30-year-old driver.

Since Rockford’s average rate is nearly $1,300 per year, a premium with Unique would save you more than 34% annually.

A 45-year-old driver would do well by comparing Lighthouse, Hartford, and Unique.

Each of them clustered between $689 to $789 per year.

Which is 39% lower than the median quote for similar age drivers in Rockford. It would be wise for a family of e to get quotes from Lighthouse and Hartford plus the top insurers such as Geico and State Farm.

| Rockford Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Unique | $932 | $689 |

| Hartford | $1,012 | $743 |

| Lighthouse | $1,087 | $789 |

| Geico | $1,099 | $843 |

| Progressive | $1,121 | $857 |

| State Farm | $1,233 | $939 |

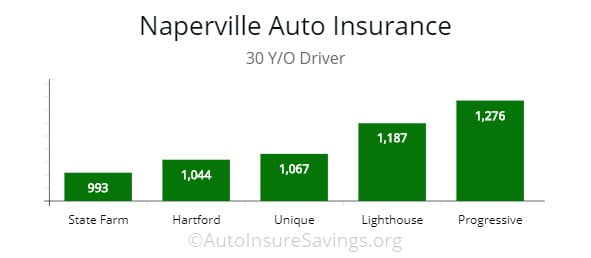

Naperville, IL

The cheapest auto insurance rates can be found with State Farm, The Hartford, and Unique at $1,003, $1,032, $1,089 respectfully for a 30-year old.

The cheapest auto insurance rates can be found with State Farm, The Hartford, and Unique at $1,003, $1,032, $1,089 respectfully for a 30-year old.

Which is nearly 38% lower than the median quote for similar age drivers in Naperville.

A 45-year-old driver can find low rates with State Farm, The Harford, and Unique.

I queried each at $876, $843, and $902 respectfully per year for full coverage.

Which is 32% to 34% lower than the median quote for similar profile drivers in Naperville.

The average rate in the city of Naperville is $1,290 per year.

With each of the insurers, I queried you would find savings of at least 14%.

| Naperville Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| State Farm | $993 | $876 |

| Hartford | $1,044 | $843 |

| Unique | $1,067 | $902 |

| Geico | $1,143 | $906 |

| Lighthouse | $1,187 | $987 |

| Progressive | $1,276 | $1,021 |

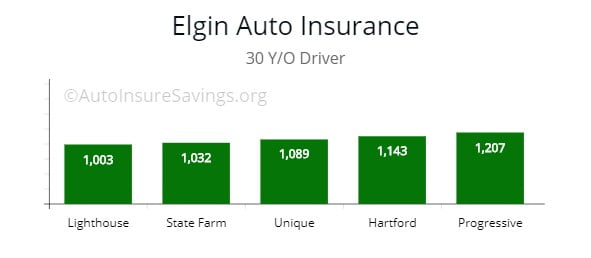

Elgin, IL

The lowest premiums for a 30-year-old driver in Elgin are found with State Farm, Lighthouse, and Unique.

The lowest premiums for a 30-year-old driver in Elgin are found with State Farm, Lighthouse, and Unique.

I queried each at $1,003, $1,032, and $1,089 per year.

Which is 23% lower than the average rate of $1,478 in the city of Elgin.

A 45-year-old driver can find the same low rates as the Lighthouse, State Farm, and Unique.

I queried each at $888, $899, and $956 per year for full coverage.

Which is 26% to 29% lower than the “mean” quote for similar age drivers in Elgin.

| Elgin Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Lighthouse | $1,003 | $888 |

| State Farm | $1,032 | $899 |

| Unique | $1,089 | $956 |

| Hartford | $1,143 | $987 |

| Geico | $1,165 | $1,001 |

| Progressive | $1,207 | $1,022 |

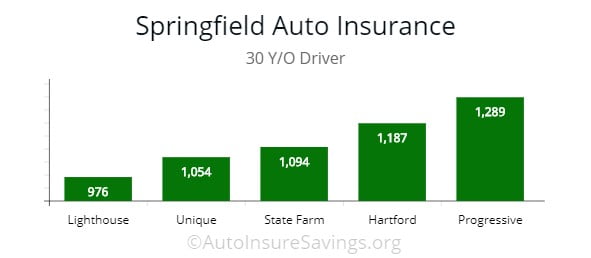

Springfield, IL

The average auto insurance rate in Springfield is over $1,400 per year.

The average auto insurance rate in Springfield is over $1,400 per year.

With Lighthouse, Springfield, and State Farm, you can find more than 30% in savings for a 30-year-old driver.

The Hartford, Geico, and Progressive shouldn’t be counted out either since their rates for drivers are 22% lower than Springfield’s average rate.

A 45-year-old driver would find substantial savings by comparing all five the insurers illustrated.

A driver with a clean driving history would find rates from $846 to $1,089.

This is 16% lower than the median rate for drivers of similar age.

| Springfield Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Lighthouse | $976 | $846 |

| Unique | $1,054 | $896 |

| State Farm | $1,094 | $943 |

| Hartford | $1,187 | $1,004 |

| Geico | $1,276 | $1,056 |

| Progressive | $1,289 | $1,089 |

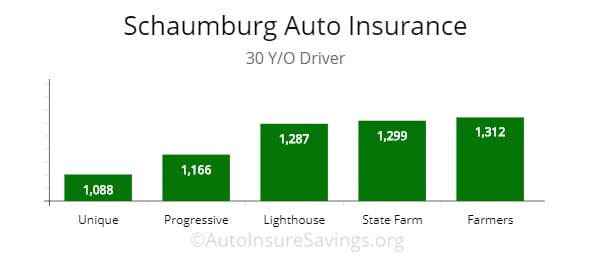

Schaumburg, IL

To find the least expensive premium in Schaumburg, start with Unique, Progressive, and Lighthouse.

To find the least expensive premium in Schaumburg, start with Unique, Progressive, and Lighthouse.

Unique was queried at $1,088 while Progressive at $1,166 and Lighthouse at $1,287.

Each insurer is over 18% lower than the median rate for a 30-year-old driver.

A 45-year-old driver can find the cheapest quotes with Unique, Progressive, and Lighthouse.

Each queried at $717, $755, and $790 per year for full coverage.

Which is 19% lower than the median quote for drivers of similar age and profile in Schaumburg.

State Farm and Farmers offer cheap car insurance with prices at $875 and $898, respectfully.

| Schaumburg Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Unique | $1,088 | $717 |

| Progressive | $1,166 | $755 |

| Lighthouse | $1,287 | $790 |

| State Farm | $1,299 | $875 |

| Farmers | $1,312 | $898 |

| Nationwide | $1,355 | $927 |

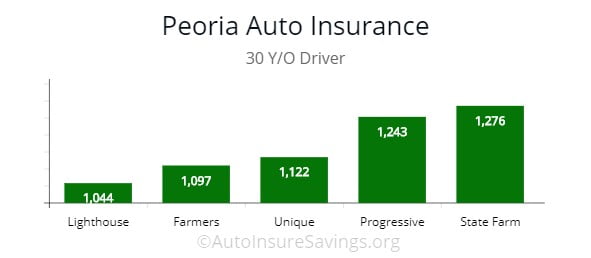

Peoria, IL

Drivers in Peoria can find inexpensive minimum coverage by getting quotes from Lighthouse, Farmers, and Unique.

Drivers in Peoria can find inexpensive minimum coverage by getting quotes from Lighthouse, Farmers, and Unique.

Each queried at $1,044, $1,097, $1,122 respectfully for a 30-year-old driver.

Which is 14% lower than the “mean” quote for drivers of similar age and profile.

Progressive and State Farm offer competitive quotes at $1,243 and $1,276 respectfully for full coverage.

A 45-year old can find affordable rates with Lighthouse, Farmers, and Unique.

Each queried at $799, $824, $876 per year for full coverage.

Which is 14% lower than the median rate for drivers in Peoria of similar age.

A 45-year old should put Progressive and State Farm on their list to get quotes.

Both carriers offer competitive rates at $897 and $932, respectfully.

| Peoria Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Lighthouse | $1,044 | $799 |

| Farmers | $1,097 | $824 |

| Unique | $1,122 | $876 |

| Progressive | $1,243 | $897 |

| State Farm | $1,276 | $932 |

| Nationwide | $1,312 | $976 |

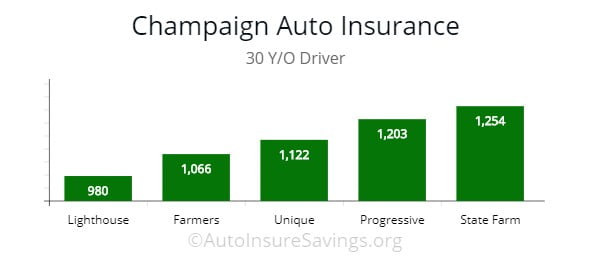

Champaign, IL

Residents of Champaign can find cheap auto insurance quotes with Lighthouse, Farmers, and Unique.

Residents of Champaign can find cheap auto insurance quotes with Lighthouse, Farmers, and Unique.

Each queried at $980, $1,066, and $1,122 per year for a 30-year-old driver.

Which is 24% lower than the median rate for drivers of similar age and profile.

You may want to put Progressive and State Farm on your bucket list to get quotes.

Both carriers are significantly lower than the median quote.

Each queried at $1,203 and $1,254 respectfully.

A 45-year old can find the least expensive quotes with Lighthouse, Farmers, and Unique.

By far, Lighthouse was able to provide the lowest quote at $716, which is 25% lower than the median quote for similar age drivers.

Farmers and Unique offered quotes at $785 and $800 respectfully.

Which is 20% lower than the “mean” rate for similar age drivers.

| Champaign Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Lighthouse | $980 | $716 |

| Farmers | $1,066 | $785 |

| Unique | $1,122 | $800 |

| Progressive | $1,203 | $824 |

| State Farm | $1,254 | $887 |

| Nationwide | $1,306 | $914 |

Joliet, IL

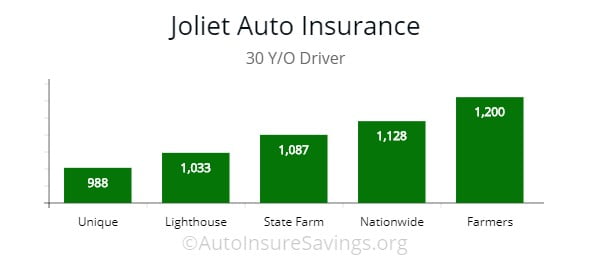

Drivers in Joliet which aren’t getting the lowest quotes are probably looking in the wrong spot.

Drivers in Joliet which aren’t getting the lowest quotes are probably looking in the wrong spot.

Start by getting quotes from Unique, Lighthouse, and State Farm.

Each queried at $988, $1,033, and $1,087 per year for a 30-year-old driver.

Which is 19% lower than the median rate for drivers in Joliet.

Two honorable mentions are Nationwide and Farmers.

Each offers low quotes at $1,128 and $1,200 per year for full coverage.

A 45-year old can find affordable quotes with Unique, Lighthouse, and State Farm.

I queried each at $702, $714, and $776 per year for full coverage.

Which is 21% lower than the median rate for drivers of similar age and profile.

Nationwide and Farmers are competitive for a 45-year old with cheap car insurance quotes at $824 and $876, respectfully.

| Joliet Company | 30 Y/O Driver | 45 Y/O Driver |

|---|---|---|

| Unique | $988 | $702 |

| Lighthouse | $1,033 | $714 |

| State Farm | $1,087 | $776 |

| Nationwide | $1,128 | $824 |

| Farmers | $1,200 | $876 |

| Progressive | $1,245 | $908 |

Insurance Resources & DMV Information

| Department of Insurance | Department of Transportation | Department of Motor Vehicles |

|---|---|---|

| 320 W Washington St, Springfield, IL 62701 (217) 782-4515 | 2300 S Dirksen Pkwy, Springfield, IL 62764 (217) 782-7820 | 2701 S Dirksen Pkwy, Springfield, IL 62723 (217) 782-6212 |

| Website | Website | Website |

Frequently Asked Questions

What is the best car insurance in Illinois?

Full coverage is the best car insurance coverage for Illinois drivers.

Who has the best auto insurance for drivers in Illinois?

Depending on your location in Illinois, your best options are Allstate, Progressive, and The Hartford.

For local companies, get quotes from Rockford Mutual, Lighthouse, and Pekin.

How much is auto insurance per month in Illinois?

A 30-year-old driver is going to pay approximately $550 for a 6-month policy.

The same driver is going to pay $988 for full coverage.

When should I drop full coverage?

If you pay for repairs out of pocket or if you believe repairs aren’t worth the cost.

A rule of thumb is your 12-month premium payment is 10% of the vehicle’s value.

If your car is financed, you will have to maintain full coverage on the vehicle.

Who has the cheapest car insurance in Illinois?

Unique has the top cheap car insurance in Illinois.

What is the minimum car insurance in Illinois?

Illinois drivers need to carry liability insurance in the amount of 25/50/20.

Can you drive without insurance in Illinois?

No, you can’t drive in Illinois without carrying the state’s minimum auto insurance.

Is Illinois a no-fault state?

Illinois is an at-fault state.

Is Illinois a PIP state?

Illinois is not a PIP state.

Does insurance follow the car or driver in Illinois?

Auto insurance generally follows the vehicle, not the driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.