Iowa Cheapest Car Insurance & Best Coverage Options

IMT and Nationwide have the Iowa cheapest car insurance policies, with rates below the Iowa state average. At IMT, for example, a minimum car insurance policy averages only $22/mo. Most Iowa drivers, however, should spend more to purchase a full coverage insurance policy for complete protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- IMT Insurance ($258 per year) has the cheapest rate for state-minimum coverage

- Nationwide Insurance ($1,079 per year) has the cheapest full coverage insurance

- Full coverage provides the best protection to Iowa drivers

Iowa cheapest car insurance policies can be found at IMT and Nationwide. There are also several other best auto insurance companies that offer affordable rates in Iowa, so read on to learn about the best way to find cheap Iowa car insurance policies.

To find cheap auto insurance in Iowa today, enter your ZIP code into our free quote tool to easily compare rates from multiple Iowa companies.

Affordable Iowa Car Insurance Rates

Drivers in Iowa have several options to choose from when looking for affordable and reliable car insurance companies.

| Cheapest Car Insurance in Iowa - Quick Hits |

|---|

The cheapest Iowa car insurance options are: The cheapest Iowa car insurance options are:Cheapest for minimum coverage: IMT Insurance Cheapest for full coverage: Nationwide Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Nationwide Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Farm Bureau Financial For young drivers with a speeding violation: Farm Bureau Financial For young drivers with an at-fault accident: State Farm |

This excellent Iowa auto insurance guide will help you find the best car insurance and save money for drivers in various categories and age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Iowa for Minimum Coverage

Our licensed insurance agents found IMT Insurance offers the most affordable rates for minimum coverage car insurance in Iowa with a $258 yearly quote or $22 monthly rate during our comparison shopping analysis.

The average Iowa state minimum rate is $523 per year, and IMT Insurance’s quote is $265 cheaper or 51% less expensive than average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| IMT Insurance | $258 | $22 |

| State Farm | $290 | $24 |

| Nationwide | $348 | $29 |

| Farm Bureau | $412 | $34 |

| American Family | $464 | $38 |

| Progressive | $504 | $42 |

| Liberty Mutual | $514 | $42 |

| Grinnell Mutual | $524 | $43 |

| Allstate | $540 | $45 |

| Geico | $589 | $49 |

| Auto-Owners Insurance | $612 | $51 |

While you can enjoy lower auto insurance rates in Iowa by taking out a minimum coverage policy, you may not have all the coverage you need to cover the cost of repairs if your motor vehicle is involved in a severe crash.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Therefore, it is good to compare the rates with multiple car insurance providers with full coverage policies in Iowa.

Cheapest Full Coverage Car Insurance in Iowa

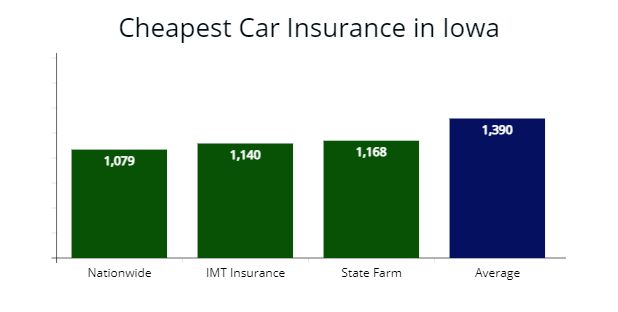

Our agents found Nationwide offers the cheapest auto insurance option with a quote at $1,079 per year or $90 per month for affordable full coverage rates.

Nationwide’s rate is 23% less expensive than Iowa’s average rate of $1,390 annually or $311 in insurance savings per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,079 | $90 |

| IMT Insurance | $1,140 | $95 |

| State Farm | $1,168 | $97 |

| American Family | $1,254 | $104 |

| Farm Bureau | $1,374 | $114 |

| Progressive | $1,471 | $122 |

| Liberty Mutual | $1,536 | $128 |

| Geico | $1,630 | $135 |

| Grinnell Mutual | $1,710 | $142 |

| Allstate | $1,758 | $146 |

| Auto-Owners Insurance | $1,823 | $152 |

The average cost for full coverage car insurance for Iowa drivers is $1,390 annually or $115 per month. The difference between the average price of minimum coverage and a policy with comprehensive and collision insurance in Iowa is $867.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Although it is more expensive than a basic policy, the amount you can save over time with a policy with higher liability limits with collision and comprehensive coverage can help make up the difference since you won’t pay for incidences of inclement weather or vandalism out of pocket.

Learn more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

Cheapest Car Insurance with a Speeding Ticket in Iowa

Iowa drivers with one speeding ticket in their driving history can save 19% with Nationwide Insurance, which has average annual premium costs of $1,512 per year.

We found Nationwide’s rate is $348 cheaper than Iowa’s mean speeding violation rate of $1,860 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,512 | $126 |

| IMT Insurance | $1,727 | $143 |

| State Farm | $1,783 | $148 |

| Iowa average | $1,860 | $155 |

In Iowa, drivers pay an average of $1,860 annually for their car insurance or a 33% rate increase if they have a speeding ticket on their driving record.

Therefore, it is good to choose a car insurance company that offers the lowest rates for drivers with a speeding violation, even if you do not currently have one on your driving record.

Cheapest Car Insurance with an Auto Accident in Iowa

Drivers in Iowa with one at-fault car accident on their driving records can get cheaper auto insurance with State Farm, which provided our agents a $1,912 yearly rate or 16% less expensive than Iowa’s average accident rate for full coverage.

Our agents suggest comparing insurance quotes with Nationwide to find the best rate since their quotes are 10% cheaper for an at-fault accident.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,912 | $159 |

| Nationwide | $2,056 | $171 |

| Grinnell Mutual | $2,121 | $176 |

| Iowa average | $2,257 | $188 |

We found the average cost of coverage can increase by 44% in Iowa with an at-fault accident during AutoInsureSavings.org analysis.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The average premium difference for a driver with a clean driving history than a driver with one accident is $867 per year.

Cheapest Car Insurance With a DUI in Iowa

Progressive offers the cheapest coverage rates for Iowa drivers with a $2,032 annual premium or $169 per month for a DUI during our rate analysis.

Progressive’s rate is 26% or $698 less expensive than Iowa’s average car insurance premium for drivers with a DUI in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,032 | $169 |

| Allstate | $2,285 | $190 |

| State Farm | $2,514 | $209 |

| Iowa average | $2,730 | $227 |

Drivers who receive a DUI citation in Iowa can expect their insurance to go up by as much as 50% annually, along with a temporary driver’s license revocation or a required ignition interlock device (IID) installed in their motor vehicle.

According to the Iowa Insurance Division (iid.iowa.gov), drivers who take a defensive driving course could lower insurance costs by 25% after a DUI violation.

Cheapest Car Insurance for Drivers With Poor Credit in Iowa

Iowa drivers with poor credit can find the cheapest insurance with Geico, with an annual $1,643 rate for full coverage. Geico’s rate is 33% less expensive than the statewide average of $2,417.

Additional car insurance companies with better than average rates for drivers with poor credit are American Family and IMT Insurance.

Both auto insurers offer monthly rates at $143 and $162, respectfully or 20% lower than average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,643 | $136 |

| American Family | $1,719 | $143 |

| IMT Insurance | $1,954 | $162 |

| Average cost in Iowa | $2,417 | $201 |

The average cost of auto insurance for drivers in Iowa with poor credit is $2,417 per year. Car insurance companies will often look at your credit report’s details to determine what your rate should be.

That is because drivers who have bad or poor credit tend to file more claims based on statistics. Keep a close eye on your credit report and make sure there are no mistakes is a great way to lower your car insurance rates.

Cheapest Car Insurance for Young Drivers in Iowa

During AutoInsureSavings.org comparison analysis, young Iowa drivers or college students can find the cheapest minimum liability auto insurance with Farm Bureau Financial with an $816 minimum coverage rate.

Young driver’s next best option is State Farm, for state minimum, which provided our agents at $987 or $82 monthly rate for liability insurance.

Young or teen drivers looking for the most affordable full coverage auto policy should go with Farm Bureau Financial, which provided us a $3,233 quote or 30% lower than Iowa’s average of $4,612.

Additional auto insurers offering lower than average full coverage rates for young Iowa drivers are Nationwide and IMT Insurance, with quotes at $3,876 and $4,032 or 13% cheaper.

| Insurer | Minimum coverage | Full coverage |

|---|---|---|

| Farm Bureau Financial | $816 | $3,233 |

| Nationwide | $1,030 | $3,876 |

| IMT Insurance | $1,234 | $4,032 |

| Grinnell Mutual | $1,267 | $4,154 |

| State Farm | $987 | $4,236 |

| Geico | $1,327 | $4,438 |

| American Family | $1,438 | $5,631 |

| Allstate | $1,500 | $5,755 |

| Progressive | $1,558 | $5,951 |

Young or adolescent drivers have higher car insurance rates in Iowa due to their lack of experience and a higher risk of being involved in a car accident, according to Insurance Information Institute (III.org).

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

With a speeding violation in their driver history, younger drivers in Iowa should look to Farm Bureau Financial Insurance for the best coverage rates.

Farm Bureau’s annual rate of $3,412 or $284 per month is $1,621 cheaper than the average $5,043 rate for full coverage.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farm Bureau Financial | $3,412 | $284 |

| IMT Insurance | $4,176 | $321 |

| State Farm | $4,319 | $359 |

| Iowa average | $5,043 | $420 |

For drivers under the age of 21 or college students away at school, our agents recommend they go on an adult family member or their parent’s auto policy since you can find the best coverage rates with an experienced driver as the primary policyholder.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Good student discounts offer up to 30% savings if you have a B average in school.

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

The cheapest auto insurance coverage for younger drivers with one at-fault accident in Iowa is State Farm, which provided our agents a $370 monthly rate for full coverage or $15 less than Grinnell Mutual’s $385 per month rate.

The next cheapest option is IMT Insurance, with a $377 monthly rate or 12% less expensive than Iowa’s average at-fault accident rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,441 | $370 |

| IMT Insurance | $4,530 | $377 |

| Grinnell Mutual | $4,627 | $385 |

| Iowa's average cost | $5,515 | $424 |

Best Auto Insurance Companies in Iowa

AutoInsureSavings.org licensed agent’s research found that IMT Insurance, Farm Bureau Financial, Nationwide, and State Farm offered some of the lowest auto insurance rates with excellent customer service and sound financial strength ratings for various Iowa drivers.

If you want to find the best insurance company with customer service and claims handling, Auto-Owners is the better option, according to ValuePenguin’s recent survey.

| Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| American Family (AmFam) | 86% | 50% |

| Nationwide | 78% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| IMT Insurance (Wadena) | n/a | n/a |

| Grinnell Mutual | n/a | n/a |

| Farm Bureau Financial | n/a | n/a |

We used the National Association of Insurance Commissioners (NAIC) complaint index to find the best auto insurer in an alternative approach.

The insurance companies with the lowest complaint index ratio are IMT Insurance (0.0), Grinnell Mutual (0.31), and Nationwide (0.41).

IMT and Grinnell Mutual insurance companies have no J.D. Power’s claims satisfaction survey. Still, they have an “A” financial strength ratings with A.M. Best, while Nationwide has an “A+” financial strength ratings and an 876 J.D. Power claims satisfaction score.

| Company | NAIC Complaint index | J.D. Power Claims Satisfaction score | A.M. Best Financial Strength Rating |

|---|---|---|---|

| IMT Insurance | 0.00 | n/a | A |

| Grinnell Mutual | 0.31 | n/a | A |

| Nationwide | 0.41 | 876 | A+ |

| Farm Bureau Financial | 0.43 | n/a | A |

| American Family | 0.45 | 862 | A |

| Progressive | 0.59 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Auto-Owners Insurance | 0.69 | 890 | A++ |

| Geico | 1.02 | 871 | A++ |

*NAIC complaint ratio index, the lower the number, the better. IMT Insurance has zero (0) complaints based on market share, while Grinnell Mutual is 0.31.

Average Car Insurance Cost by City in Iowa

AutoInsureSavings.org licensed agents surveyed multiple insurance companies across most cities in Iowa and found the average cost of Iowa car insurance is $1,390 per year.

Your zip code in Iowa is a significant factor that can influence your car insurance rates, along with your credit score, driver profile, marital status, type of motor vehicle, and coverage levels.

Cheapest Auto Insurance in Des Moines, IA

AutoInsureSavings.org licensed agents found Nationwide is the cheapest insurance company for drivers in Des Moines. They provided us a $1,080 annual rate for full coverage, 24% less expensive than Des Moines’s yearly average rate of $1,417.

| Des Moines Company | Average Premium |

|---|---|

| Nationwide | $1,080 |

| IMT Insurance | $1,145 |

| American Family | $1,249 |

| Des Moines average | $1,417 |

Cheapest Auto Insurance in Cedar Rapids, IA

Cedar Rapids drivers can find the most affordable full coverage insurance policy with IMT, which provided our agents a $1,118 annual rate per year of $93 per month. IMT’s insurance quote is 22% cheaper than average rates for similar driver profiles in Cedar Rapids.

| Cedar Rapids Company | Average Premium |

|---|---|

| IMT Insurance | $1,118 |

| State Farm | $1,190 |

| Nationwide | $1,263 |

| Cedar Rapids average | $1,421 |

Cheapest Auto Insurance in Davenport, IA

Davenport drivers can find cheap auto coverage with State Farm, which provided us a $1,089 yearly rate for our sample 30-year-old driver with full coverage. State Farm’s quote is 26% cheaper than Davenport’s $1,458 average rates.

| Davenport Company | Average Premium |

|---|---|

| State Farm | $1,089 |

| American Family | $1,120 |

| Nationwide | $1,271 |

| Davenport average | $1,458 |

Cheapest Auto Insurance in Sioux City, IA

Sioux City residents looking for the best auto insurance policies should get quotes from IMT, which provided our insurance agents a $980 yearly rate or $81 per month for a 30-year-old driver with a full coverage policy. IMT’s car insurance quote is $445 less expensive than Sioux City’s average annual rate of $1,425 per year.

| Sioux City Company | Average Premium |

|---|---|

| IMT | $980 |

| Nationwide | $1,043 |

| State Farm | $1,236 |

| Sioux City average | $1,425 |

Cheapest Auto Insurance in Iowa City, IA

Our research found the cheapest auto insurance in Iowa City is with Nationwide, with an $87 monthly rate or $1,047 per year, for a 30-year-old with full coverage. Nationwide’s rate is 28% less expensive than the citywide $1,445 rate for similar driver profiles.

| Iowa City Company | Average Premium |

|---|---|

| Nationwide | $1,047 |

| State Farm | $1,185 |

| Auto-Owners | $1,449 |

| Iowa City average | $1,445 |

Cheapest Auto Insurance in Ames, IA

Ames drivers can find the cheapest auto insurance with Nationwide, which provided our agents a $1,165 average rate per year for our 30-year-old driver. Nationwide’s quote is 27% less expensive than Ames’s average rates.

| Ames Company | Average Premium |

|---|---|

| Nationwide | $1,165 |

| State Farm | $1,363 |

| Geico | $1,481 |

| Average in Ames | $1,578 |

Average Car Insurance Cost for All Cities in Iowa

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Des Moines | $1,417 | Rockwell City | $1,425 |

| Cedar Rapids | $1,421 | West Branch | $1,445 |

| Davenport | $1,458 | Columbus Junction | $1,540 |

| Sioux City | $1,425 | Ely | $1,421 |

| Iowa City | $1,445 | Sumner | $1,458 |

| Waterloo | $1,544 | Bellevue | $1,546 |

| Ames | $1,578 | New London | $1,562 |

| West Des Moines | $1,458 | Cascade | $1,425 |

| Council Bluffs | $1,570 | Prairie City | $1,569 |

| Ankeny | $1,421 | Hull | $1,561 |

| Dubuque | $1,542 | Lake Mills | $1,602 |

| Urbandale | $1,425 | Mount Ayr | $1,445 |

| Cedar Falls | $1,603 | Alta | $1,421 |

| Marion | $1,561 | Wapello | $1,458 |

| Bettendorf | $1,614 | Sac City | $1,417 |

| Mason City | $1,421 | Ida Grove | $1,542 |

| Marshalltown | $1,445 | Atkins | $1,611 |

| Clinton | $1,417 | Epworth | $1,425 |

| Burlington | $1,458 | Parkersburg | $1,606 |

| Ottumwa | $1,610 | Peosta | $1,417 |

| Fort Dodge | $1,425 | Britt | $1,460 |

| Muscatine | $1,619 | Durant | $1,421 |

| Johnston | $1,460 | Ogden | $1,606 |

| Coralville | $1,542 | Leon | $1,445 |

| Waukee | $1,620 | Sigourney | $1,460 |

| North Liberty | $1,421 | Manson | $1,425 |

| Altoona | $1,445 | Pleasantville | $1,542 |

| Clive | $1,612 | Colfax | $1,561 |

| Indianola | $1,425 | Remsen | $1,600 |

| Newton | $1,460 | Ackley | $1,421 |

| Grimes | $1,579 | Moville | $1,612 |

| Boone | $1,602 | Mediapolis | $1,445 |

| Oskaloosa | $1,417 | Lake City | $1,460 |

| Spencer | $1,542 | Granger | $1,606 |

| Norwalk | $1,445 | Monroe | $1,523 |

| Storm Lake | $1,460 | Greenfield | $1,417 |

| Fort Madison | $1,561 | Denver | $1,425 |

| Keokuk | $1,614 | Brooklyn | $1,616 |

| Fairfield | $1,421 | Hartley | $1,602 |

| Pella | $1,425 | Guttenberg | $1,421 |

| Waverly | $1,417 | Guthrie Center | $1,460 |

| Le Mars | $1,527 | Walcott | $1,445 |

| Carroll | $1,606 | State Center | $1,523 |

| Pleasant Hill | $1,421 | Monona | $1,417 |

| Grinnell | $1,445 | Corydon | $1,561 |

| Mount Pleasant | $1,460 | Reinbeck | $1,425 |

| Denison | $1,602 | Kingsley | $1,602 |

| Creston | $1,522 | Farley | $1,421 |

| Webster City | $1,417 | Akron | $1,460 |

| Decorah | $1,606 | Slater | $1,602 |

| Perry | $1,421 | Sanborn | $1,445 |

| Clear Lake | $1,425 | Corning | $1,516 |

| Sioux Center | $1,464 | Pocahontas | $1,417 |

| Charles City | $1,561 | Stuart | $1,602 |

| Hiawatha | $1,445 | Blue Grass | $1,425 |

| Washington | $1,602 | Logan | $1,421 |

| Knoxville | $1,516 | Oakland | $1,464 |

| Nevada | $1,602 | Manning | $1,611 |

| Atlantic | $1,608 | Traer | $1,445 |

| Eldridge | $1,421 | Nora Springs | $1,516 |

| Bondurant | $1,425 | Urbana | $1,602 |

| Orange City | $1,417 | Dallas Center | $1,606 |

| Independence | $1,445 | Bedford | $1,425 |

| Maquoketa | $1,464 | Nashua | $1,421 |

| Oelwein | $1,417 | Woodbine | $1,503 |

| Estherville | $1,425 | Strawberry Point | $1,439 |

| Asbury | $1,503 | Shell Rock | $1,464 |

| Anamosa | $1,421 | Lenox | $1,561 |

| Centerville | $1,439 | Avoca | $1,600 |

| Algona | $1,567 | Roland | $1,570 |

| Clarinda | $1,417 | Manly | $1,480 |

| Red Oak | $1,425 | Dysart | $1,503 |

| Glenwood | $1,464 | Walford | $1,421 |

| Winterset | $1,417 | Elkader | $1,439 |

| DeWitt | $1,499 | Earlham | $1,425 |

| Sheldon | $1,421 | Clarksville | $1,565 |

| Iowa Falls | $1,549 | Montezuma | $1,464 |

| Osceola | $1,439 | Alton | $1,417 |

| Vinton | $1,417 | Wellman | $1,561 |

| Spirit Lake | $1,568 | Lone Tree | $1,421 |

| Manchester | $1,425 | Tripoli | $1,602 |

| Windsor Heights | $1,469 | Dike | $1,499 |

| Cherokee | $1,421 | Holstein | $1,429 |

| Shenandoah | $1,588 | Central City | $1,469 |

| Harlan | $1,429 | Coon Rapids | $1,439 |

| Sergeant Bluff | $1,573 | Tabor | $1,421 |

| Evansdale | $1,469 | Fairbank | $1,417 |

| Polk City | $1,598 | Woodward | $1,469 |

| Adel | $1,439 | Villisca | $1,599 |

| Humboldt | $1,417 | Van Meter | $1,429 |

| Mount Vernon | $1,602 | Marcus | $1,466 |

| Camanche | $1,421 | Lake Park | $1,439 |

| Hampton | $1,469 | Panora | $1,580 |

| Carlisle | $1,429 | Laurens | $1,607 |

| Chariton | $1,561 | Eddyville | $1,499 |

| Jefferson | $1,439 | Sloan | $1,421 |

| Dyersville | $1,553 | Hamburg | $1,429 |

| Saylorville | $1,606 | Griswold | $1,469 |

| Le Claire | $1,429 | Sheffield | $1,439 |

| Forest City | $1,521 | George | $1,561 |

| Monticello | $1,421 | Jewell Junction | $1,602 |

| Rock Valley | $1,439 | Anita | $1,499 |

| Carter Lake | $1,469 | Buffalo | $1,429 |

| Huxley | $1,499 | Melcher-Dallas | $1,561 |

| Cresco | $1,417 | University Heights | $1,606 |

| West Liberty | $1,429 | St. Ansgar | $1,439 |

| Emmetsburg | $1,499 | New Sharon | $1,417 |

| Albia | $1,602 | Glidden | $1,469 |

| Waukon | $1,561 | Mechanicsville | $1,499 |

| Osage | $1,479 | Fredericksburg | $1,421 |

| Robins | $1,439 | Riverside | $1,549 |

| Eagle Grove | $1,421 | Mapleton | $1,429 |

| New Hampton | $1,469 | Fayette | $1,561 |

| Story City | $1,417 | Allison | $1,479 |

| Tiffin | $1,429 | Lawton | $1,439 |

| Tipton | $1,561 | Princeton | $1,417 |

| Williamsburg | $1,606 | Winfield | $1,421 |

| Garner | $1,562 | Springville | $1,531 |

| Milford | $1,421 | North English | $1,602 |

| West Burlington | $1,476 | Conrad | $1,429 |

| Wilton | $1,439 | Lake View | $1,606 |

| Hawarden | $1,429 | Sidney | $1,469 |

| Park View | $1,560 | Wayland | $1,421 |

| Jesup | $1,623 | Dunlap | $1,622 |

| Onawa | $1,417 | Palo | $1,476 |

| Tama | $1,469 | Donnellson | $1,439 |

| Clarion | $1,611 | Fruitland | $1,417 |

| La Porte City | $1,439 | Newhall | $1,561 |

| Fairfax | $1,476 | Larchwood | $1,429 |

| Grundy Center | $1,421 | Greene | $1,469 |

| Bloomfield | $1,511 | De Soto | $1,476 |

| Eldora | $1,435 | Treynor | $1,439 |

| Missouri Valley | $1,469 | Malvern | $1,421 |

| Solon | $1,602 | Gilbert | $1,435 |

| Sibley | $1,417 | Elk Run Heights | $1,500 |

| Madrid | $1,476 | Calmar | $1,469 |

| Lamoni | $1,561 | Baxter | $1,602 |

| Postville | $1,439 | Beaverdale | $1,417 |

| Rock Rapids | $1,421 | Preston | $1,498 |

| West Union | $1,469 | Long Grove | $1,439 |

| Center Point | $1,536 | Eldon | $1,469 |

| Kalona | $1,491 | Le Grand | $1,548 |

| Lisbon | $1,417 | Danville | $1,421 |

| Marengo | $1,435 | Gladbrook | $1,590 |

| Belle Plaine | $1,469 | Janesville | $1,480 |

| Belmond | $1,439 | Inwood | $1,417 |

| Hudson | $1,421 | Clarence | $1,435 |

| Mitchellville | $1,417 | Aplington | $1,476 |

| Toledo | $1,479 | Shellsburg | $1,439 |

| Northwood | $1,435 | Keota | $1,421 |

Minimum Auto Insurance Requirements in Iowa

Iowa drivers must have minimum car insurance requirements to be legal and compliant with state laws. When buying car insurance, our agents recommend a full coverage policy to include uninsured motorist coverage.

| Liability coverage | Minimum coverage requirements |

|---|---|

| Bodily injury liability | $20,000 per person / $40,000 per accident |

| Property damage liability | $15,000 per accident |

Drivers in Iowa have an alternative to car insurance requirements by showing other proof of financial responsibility.

In an auto accident or you lose driving privileges in Iowa, state law requires drivers to have a car insurance policy with at least minimum liability limits, insurance bond, or security bond.

— An insurance bond requires motorists to deposit $55,000 to Iowa’s Department of Transportation.

— If you file a deposit certificate with the state’s treasurer, you will receive a security insurance card, which indicates you have $55,000 on deposit with an Iowa bank.

Both the insurance bond and security insurance bond are proof of financial responsibility. You will be required to show this to the Department of Motor Vehicles (DMV), Department of Transportation (DOT), or a police officer.

Frequently Asked Questions

Who has the Cheapest Car Insurance Coverage in Iowa?

IMT Insurance offers the most affordable rates for those wanting minimum coverage in Iowa. The average cost of insurance from IMT is $258 annually. That is 51% less than the state’s average of $523. Other low-priced coverage options include State Farm, Nationwide, and Farm Bureau Financial.

If you want to find the lowest rates for full coverage insurance, Nationwide ($1,079 per year) offers car insurance premiums that are slightly lower than IMT ($1,140 per year).

How Much is Car Insurance in Iowa per Month?

The average cost of car insurance in Iowa per month is $43 for those who want minimum coverage. Companies that offer rates less than that per month include IMT Insurance: $22, State Farm: $22, and Nationwide: $29 per month.

How Much Is Full Coverage Car Insurance in Iowa?

The average cost of full coverage Iowa car insurance is $1,390 annually or $115 per month. The following companies offer the best rates that are lower than the state’s average. Nationwide: $1,079, IMT Insurance: $1,140, and State Farm: $1,168 per year.

How Much Will my Car Insurance Rise With a Speeding Ticket in Iowa?

The annual cost of car insurance will go up by $492 per year or 33%. A speeding ticket will remain on your record for three years in Iowa. Over that time, a driver will have spent $1,492 more on their car insurance because of their traffic ticket. Keep in mind that your speed also plays a factor in how much your rates will increase.

How do I Save on Car Insurance in Iowa?

There are several ways you can save money on your auto insurance in Iowa. It is best to compare auto insurance quotes from several top companies to find the most affordable rates. Taking the time to learn more about each company’s discounts can also help you lower your overall costs. Being a safe driver, keeping an eye on your credit report, and taking out multiple policies such as life and a home insurance policy where available can help you save money on your Iowa auto insurance.

To learn more about the most affordable car insurance options in Iowa, use our quote comparison tool or contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy with a clean driving record for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Iowa rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.