Liberty Mutual’s New & Better Car Replacement What Are The Differences & Limitations; Should You Add One?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

While it’s nice for Liberty Mutual to remind us that we’re all only human when it comes to auto insurance challenges.

One of the suggestions for protection they offer isn’t as easy as it may sound.

Vehicle replacement coverage is a pretty standard optional coverage for most auto insurance companies.

Liberty Mutual ups the ante in the game by offering a couple of variations on it. This includes new-car replacement coverage! While details may vary, new-car replacement coverage essentially is what it sounds like. If you carry this additional coverage, your insurance company will replace your totaled vehicle with a brand new car after a collision. Let’s look at what this extra coverage looks like with Liberty Mutual insurance.

Companies Offering New Car Replacement

Before we go into the details below I have created a table list for major carriers offering replacement options.

Liberty was the pioneer in offering this type of coverage. However, there are other insurers offering a similar type of coverage. We have included other insurers too since other insurers, such as Progressive, have similar optional coverage.

There is an easy to use “search” feature for the table to find the company you may be looking for.

| Company | New Car Replacement | Name of Policy | Eligibility requirements | A.M. BEST* | S&P* | Claims Satisfaction** |

|---|---|---|---|---|---|---|

| Travelers | Yes | Premier New Car Replacement® | Vehicle must be in its first five model years. Does not cover a stolen car or one damaged by fire or flooding. Also includes gap coverage and lower deductible for glass claims. | A++ | AA+ | 4 |

| The Hartford | No | A+ | A+ | 3 | ||

| Progressive | No | Total Loss Concierge | A+ | AA | 4 | |

| Liberty Mutual | Yes | Similar option called Better Car Replacement® | Eligible cars are less than 1 year old and have fewer than 15,000 miles Better car replacement: Reimburses for same model one year newer, with 15,000 fewer miles on it than totaled car. Available for car of any age | A | A- | 3 |

| Mercury | No | A+ | A+ | 3 | ||

| Allstate | Yes | Your Choice Auto® | Vehicle must be 2 model years old or newer. | A+ | AA- | 3 |

| Farmers | Yes | New Car Pledge® | Vehicle must be 2 model years old or newer and have fewer than 24,000 miles. | A | A+ | 3 |

| USAA | No | A++ | AA+ | 5 | ||

| State Farm | No | A++ | AA | 4 | ||

| Nationwide | Yes | Combines GAP coverage with coverage for new car replacement | With Allied, a Nationwide company; applies to cars up to 3 model years old, then is replaced by gap insurance. | A+ | A+ | 4 |

| Allied | Yes | Good-As-New® | With Allied, a Nationwide company; applies to cars up to 3 model years old, then is replaced by gap insurance. | A+ | BBB+ | 3 |

| Ameriprise | Yes | Purchased by itself or added to a GAP policy | New car replacement covers the first year that you own your new car, and then it converts to GAP insurance if you’ve chosen to package both types of insurance together. | A- | A- | 4 |

| Geico | No | A++ | A++ | 4 | ||

| Metlife | No | A++ | A+ | 4 |

*Financial Strength of each carrier as of 2018 & customer claims satisfaction reviews based on JD Power & Associates.

Here’s a summary of what they offer and some things to consider before adding it to your Liberty Mutual insurance policy.

New Car or Better Car? Two Replacement Options

It can be confusing, but if you are a Liberty Mutual customer, you have at least two distinct options for adding vehicle replacement as a coverage layer to your policy.

New Car Replacement

New car replacement and its trademarked Better Car Replacement plan.

Limitations of New Car Replacement

-

- Automobiles less than one year old

- Not previously owned

- That have less than 15,000 miles

Leased autos and motorcycles are excluded.

(New car replacement coverage is not available to Liberty Mutual customers in North Carolina or Wyoming.)

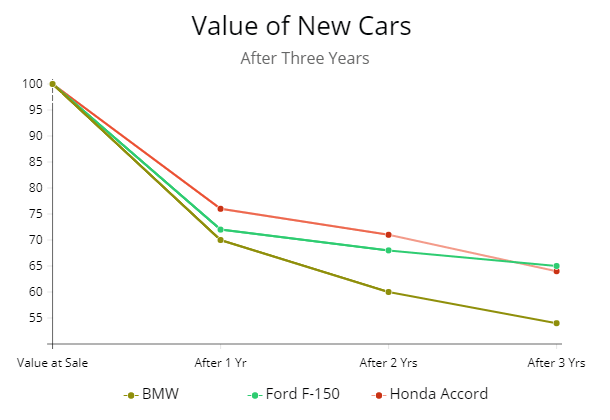

Note: Before the advent of replacement coverage GAP insurance was, and still is, mostly used for covering the full value of a totaled vehicle. For example, if the loan amount of the vehicle is $20,000 at 3 years, but only has a $10,000 value, GAP would cover the $10,000 difference. Be sure to consult with your broker to find the coverage best for your needs.

Better Car Replacement

With the Better Car Replacement option, Liberty Mutual steps it up a bit.

If you total your vehicle in a claimable incident, Liberty Mutual will pay out enough to help you get a replacement that is one model year newer than the automobile you totaled.

As long as it has at least 15,000 fewer miles than your current vehicle.

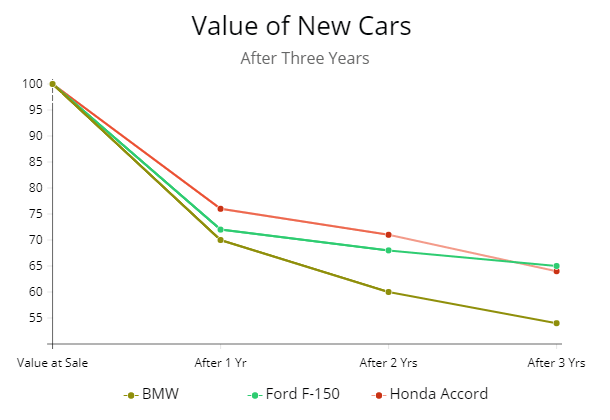

Note: The biggest years for depreciation are from 1 to 3 years. The value of a Mercedes from the point of sale to 5 years is 50% less than MSRP. For example, if your Mercedes cost $50,000 then it would be approximately valued at $25,000 5 years later.

Boldness of Better Car Replacement

As the company likes to tout on its website, if you have a 2007 vehicle with 35,000 miles on it and are involved in a total-loss accident with Better Car Replacement in place, Liberty Mutual will give you the money for a 2008 model with 20,000 miles on it.

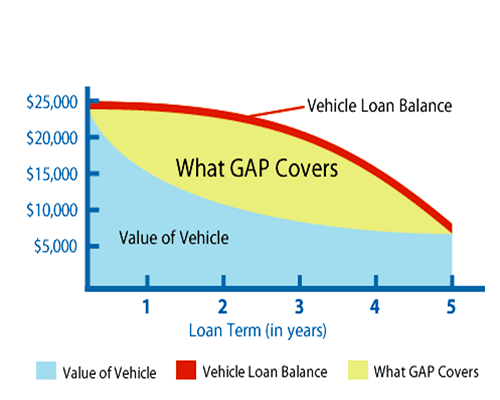

Note: The best overall vehicle insurance firms by category and what is offered. For example, State Farm is the best in customer service, but does not offer GAP or replacement coverage. Amica is the best overall and offers GAP and replacement coverage.

Be Aware of the Details & more Details

The Better Car Replacement option does come with a few details you should be aware of. For example:

- Your vehicle must be declared a total loss by Liberty Mutual

- The original claim must come under an already existing policy option such as collision or comprehensive

- You still have to pay the deductible that applies for the original option under which the claim is initially made

- This option is not available for leased vehicles or motorcycles

- This option is not available on all plans or in all states

- The replacement vehicle would have to be in the same class and basic model type as your original car that was declared a total loss

This last detail is an important one to remember when considering whether to add this option.

You can’t, for example, have the option on a 2007 Honda Civic with 25,000 miles on it, total that automobile and expect to be able to get a check to buy a 2008 Honda SUV or Odyssey mini-van with 10,000 miles or less on it.

You would be required to make a rough apples-to-apples upgrade.

True Cost of Owning of Vehicle

When thinking of the best coverage to buy you want to think of value of the long term cost of having it.

Below I have created a table to show you an example of the true cost of owning a vehicle.

| Year 1 | Year 2 | Year 3 | 3yr Total | |

|---|---|---|---|---|

| Depreciation | $1,099 | $993 | $862 | $2,954 |

| Taxes & Fees | $498 | $55 | $55 | $608 |

| Financing | $345 | $281 | $216 | $842 |

| Fuel | $2,685 | $2793 | $2,845 | $8,323 |

| Insurance | $1,103 | $862 | $873 | $2,838 |

| Maintenance | $721 | $562 | $711 | $1,994 |

| Repairs | $635 | $763 | $894 | $2,292 |

| Actual Cost to Own | $7,086 | $6,309 | $6,456 | $19,851 |

Is it Worth It? Which Option is the Best Value?

If you are a Liberty Mutual customer and you’re insuring a new car, adding the new car replacement option may prove a better value overall then taking on the Better Car Replacement option.

If you happen to be financing the purchase of a vehicle, the option may save you from also having to add separate gap coverage (which may be required by your lender.)

Older Model Vehicle Owners Should Consider

If you have an older automobile and you’re considering adding the Better Car Replacement option, there are other factors you will need to consider.

Figuring out Comprehensive & Collision Coverage?

First of all, is the vehicle you’re insuring worth adding an option like collision or comprehensive.

A precursor to adding Better Car Replacement?

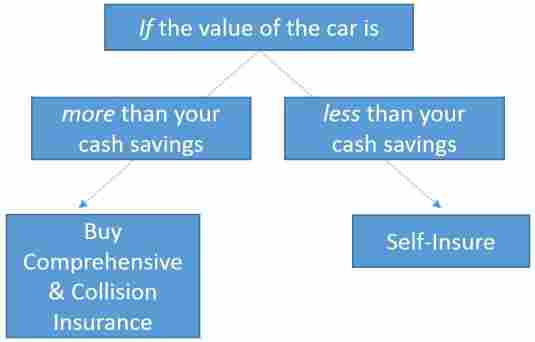

Note: I’ve decided to add this graphic to determine if you need comprehensive and collision coverage. Why? If you don’t need either coverage if wouldn’t be cost-effective to get Better Car Replacement coverage either.

A quick way to figure if such an option is cost-effective is to add up the total of the additional premium you will be paying for the option over the expected life of the automobile.

Plus whatever the deductible is for the option.

If the grand total of these amounts exceeds the cash or current market value of the automobile you’re insuring, it probably isn’t a cost-effective move.

For example, if comprehensive & collision are $100 per month multiply by the expected life of the vehicle. $100 x 84 months (or 7 years) = $8,400 + $500 deductible = $8,900. If your vehicle value is less than $8,900 then you probably should forego the coverage.

If you’ve determined that adding collision or comprehensive to your coverage is a smart, value-added move, you’ll then have to figure in the added cost of the Better Car Replacement option.

Getting a firm grip on this number may be a challenge.

I plugged in numerous coverage options for a wide range of automobile years and models using Liberty Mutual’s online quoting tools and found the added cost for Better Car Replacement running anywhere from 5 percent in added premium to as much as 40 percent in added premium.

This also took into account the discounts that were available in the states we shopped with Liberty Mutual.

Final Thoughts

As with many highly-touted options, Liberty Mutual’s Better Car Replacement isn’t as easy or as straightforward as the ads portray, but it could prove to be a valuable option in your overall policy protection strategy.

It might be best to speak directly to an agent to get your questions asked, or you can always start by using the online quoting tools they provide.

In any case, be sure you know all the details before you add an option like this and find out later that (being only human) you made the wrong decision.

Sources

https://www.consumerfinance.gov/ask-cfpb/what-is-guaranteed-auto-protection-gap-insurance-en-797/

http://www.iihs.org/iihs/topics/insurance-loss-information

http://www.naic.org/documents/

(Note: this article in intended for informational purposes only and should in no way be considered a solicitation or a promotion. The author is not affiliated with Liberty Mutual or any other auto premium provider.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.