What Every DUI Offender That Needs Car Insurance Should Know

If you're looking for car insurance with a DUI on your record, chances are you want as many options as you can find. We'll cover what to expect when it comes to auto insurance and a DUI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Shopping for car insurance with a DUI shouldn’t be complicated, because there are so many options available. You may have to put in a little more work if you have a DUI on your record. However, in order to find the best car insurance with a DUI you’ll need to be prepared to look at many different insurance companies and policy options.

You may be concerned about your rates increasing with your insurance company following a drunk driving infraction. Still, there are things you can do to find the cheapest car insurance after being convicted of a DUI. We’ll cover some of them below.

Best Cheap Car Insurance After a DUI

You may not find the cheapest insurance with a DUI, but you’ll be able to find a few options that will hopefully fit into your budget. The table below reflects some choices you may find yourself with.

DUI article Cheapest Car Insurance Quick Hits

| Cheapest Car Insurance for a DUI - Quick Hits |

|---|

The cheapest DUI car insurance options are: The cheapest DUI car insurance options are:Cheapest in California: Mercury Insurance Cheapest in New York: Progressive Cheapest in Florida: State Farm Cheapest in Texas: Texas Farm Bureau Cheapest in Ohio: American Family Cheapest in Georgia: State Farm Cheapest in Pennsylvania: Erie Insurance Cheapest in Illinois: Country Financial -- Lowering your rates with a DUI conviction can be complicated but not impossible. The trick is never to let it happen again. -- Insurance rates increase from 50 to 240% with a DUI, depending on your zip code and the insurance company. -- Suppose you aren't obligated to full coverage with a car loan or lease. In that case, the best option is to lower your liability limits and drop collision and comprehensive coverage to save money. |

Read on to learn about vital things you need to get car insurance for DUI offenders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

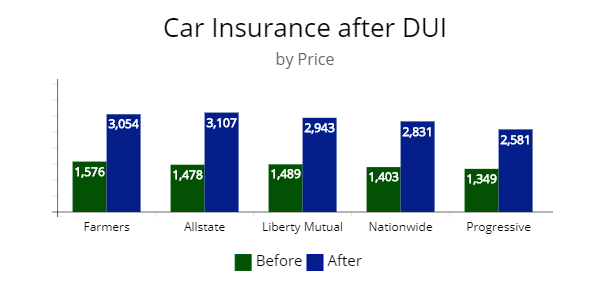

What does a DUI on your record mean for insurance providers?

A DUI mark on your DMV driving record can lead to an astronomical price increase in your car insurance costs, plus a loss of driving privileges.

Insurance Before and After a DUI

| Insurer | Monthly Cost Before DUI | Monthly Cost After DUI |

|---|---|---|

| The General Insurance | $93 | $151 |

| Allstate | $92 | $159 |

| Direct Auto | $84 | $167 |

| Esurance | $77 | $172 |

| Geico | $82 | $180 |

If you get a driving under the influence charge, your car insurance provider may decide not to renew your policy.

In that case, you will need to find a new car insurance company. As a recent DUI offender, you will likely be considered a high-risk driver with possible driver’s license suspension or required ignition interlock device, leading to higher premiums.

Premium increase with DUI

| Company | Standard Premium | Premium with DUI | % increase |

|---|---|---|---|

| Progressive | $1,526 | $2,111 | 28% |

| State Farm | $1,472 | $2,099 | 30% |

| Liberty Mutual | $1,630 | $2,583 | 37% |

| Farmers | $1,538 | $2,638 | 42% |

| USAA | $1,044 | $1,832 | 44% |

| Allstate | $1,783 | $3,174 | 44% |

| Geico | $1,290 | $2,483 | 49% |

| The General Insurance | $1,480 | $2,899 | 51% |

| Nationwide | $1,481 | $2,975 | 51% |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Do you need an SR-22 for proof of insurance after a DUI?

Yes, an SR-22 is required in many states following a DUI or DWI conviction. In Florida and Virginia, it’s an FR-44 form.

If the judge mandates you to have an SR-22, your auto insurance carrier will issue it to the DMV. The SR-22 is proof that you have met the state’s minimum financial responsibility requirements to drive a motor vehicle by having car insurance coverage in place.

You must maintain auto insurance coverage for the entire time required to have the SR-22, usually three to five years. The SR-22 form costs $30 to $50.

How much does car insurance increase after a DUI?

Depending on the state, you can expect to pay average rates of 50 to 240% more than your pre-DUI rates for first-time offenders with an auto insurance company.

Rate increases vary from carrier to carrier and state to state.

AutoInsureSavings.org licensed agents completed a study and found car insurance after a driving under the influence violation increased by $1,363 per year for full coverage and $588 annually for a minimum coverage insurance policy for a 30-year-old driver.

Car insurance quotes depend on various factors such as your past driving history, marital status, credit score, zip code, type of coverage, and the insurance company you choose.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Most Expensive States to Get a DUI Conviction

North Carolina, Michigan, and Hawaii are the most expensive states to get drunk driving infractions.

In North Carolina, a driver with a DUI conviction in their driving history will pay $3,200 more per year. A driver in Michigan will pay $3,117 more per year, and a driver in Hawaii will pay $2,922 more per year for car insurance.

Out of those three states, the biggest percentage car insurance increase for a DUI conviction is Hawaii, with an 80% increase in rates.

In other states, you will see a big price increase in auto insurance quotes after DUI offenses are California, Kentucky, New Jersey, and Rhode Island.

DUI Rates by State

| State | Full coverage policy with clean driving history | Full coverage with one DUI | Annual difference |

|---|---|---|---|

| North Carolina | $1,187 | $4,387 | $3,200 |

| Michigan | $2,522 | $5,639 | $3,117 |

| Hawaii | $1,209 | $4,131 | $2,922 |

| California | $1,700 | $3,847 | $2,147 |

| Rhode Island | $1,690 | $3,211 | $1,521 |

| New Jersey | $1,838 | $3,186 | $1,348 |

| Kentucky | $2,280 | $3,625 | $1,345 |

| Connecticut | $1,722 | $2,986 | $1,264 |

| Louisiana | $3,203 | $4,425 | $1,222 |

| Arizona | $1,476 | $2,599 | $1,123 |

| Georgia | $1,699 | $2,832 | $1,133 |

| Vermont | $1,011 | $2,111 | $1,100 |

| Florida | $2,411 | $3,486 | $1,075 |

| Wisconsin | $1,088 | $2,076 | $988 |

| Massachusetts | $1,342 | $2,280 | $938 |

| South Dakota | $1,327 | $2,257 | $930 |

| Nevada | $1,912 | $2,836 | $924 |

| Wyoming | $1,206 | $2,127 | $921 |

| Minnesota | $1,316 | $2,236 | $920 |

| Alabama | $1,472 | $2,370 | $898 |

| District of Columbia | $1,574 | $2,467 | $893 |

| West Virginia | $1,361 | $2,248 | $887 |

| Delaware | $1,572 | $2,453 | $881 |

| New Hampshire | $1,126 | $1,983 | $857 |

| Arkansas | $1,531 | $2,387 | $856 |

| Kansas | $1,407 | $2,239 | $835 |

| Montana | $1,326 | $2,158 | $832 |

| North Dakota | $1,241 | $2,064 | $823 |

| Washington | $1,326 | $2,146 | $820 |

| Colorado | $1,625 | $2,427 | $802 |

| South Carolina | $1,511 | $2,299 | $788 |

| Oklahoma | $1,627 | $2,407 | $780 |

| Maryland | $1,611 | $2,368 | $757 |

| New York | $2,127 | $2,874 | $747 |

| Tennessee | $1,254 | $2,028 | $774 |

| Illinois | $1,237 | $1,984 | $750 |

| Texas | $1,503 | $2,237 | $734 |

| Mississippi | $1,471 | $2,197 | $726 |

| Alaska | $1,239 | $1,965 | $726 |

| Idaho | $1,037 | $1,760 | $726 |

| Iowa | $1,021 | $1,743 | $722 |

| New Mexico | $1,329 | $2,045 | $716 |

| Ohio | $1,028 | $1,732 | $704 |

| Missouri | $1,435 | $2,054 | $619 |

| Virginia | $1,028 | $1,643 | $615 |

| Indiana | $1,028 | $1,639 | $611 |

| Maine | $986 | $1,587 | $601 |

| Utah | $1,327 | $1,914 | $587 |

| Pennsylvania | $1,320 | $1,900 | $580 |

| Nebraska | $1,265 | $1,784 | $519 |

| Oregon | $1,377 | $1,802 | $425 |

States With The Cheapest Increase in DUI Insurance

States with the lowest rate hike for DUI car insurance are Oregon, Nebraska, and Pennsylvania.

In Oregon, you will see your auto insurance rates increase by $425 annually, Nebraska rates increase by $519 per year, and in Pennsylvania, insurance quotes increase by $580.

Out of those three states, the lowest percentage rate increase is Oregon at 24%.

Other states where driving under the influence conviction has a low percentage rate increase are Indiana, Maine, and Utah. All three average a $600 increase in annual car insurance rates or about 28%.

Driving while impaired by alcohol or drugs is a severe problem in the US. The National Highway Traffic Safety Administration reported an average of one alcohol-impaired-related fatality in the US every 50 minutes in 2016.

The CDC estimates alcohol-related car accidents cost more than $40 billion annually. These statistics show why car insurance increases following a DUI conviction.

Where can you find the cheapest insurance with a DUI?

While your rates will likely increase following a driving while impaired charge, there are ways to find cheaper car insurance rates.

Comparing your options online will help you find the most affordable car insurance rates in your area.

You may be able to reduce your coverage limits if you typically carry full coverage.

Full coverage includes comprehensive and collision coverage and is required if you lease your vehicle or have a car loan.

Increasing your deductible, say from $500 to $1,000, can also result in significant premium savings.

Changing your liability limits and your deductible shifts more of the financial responsibility of an accident to you, so be sure you understand the coverage limits you are selecting.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What are the cheapest insurance rates after a DUI in California?

Drivers who have been convicted of a DUI in California can see the rates increase from 60 to 240% per year.

California’s best insurance company for DUI offenders is Mercury, which offered our agents a $2,790 quote for a 30-year-old with full coverage. Mercury’s rate is 28% cheaper than California’s average rates.

Cheapest DUI Rates in California

| California company | Annual Cost | Monthly Cost |

|---|---|---|

| Mercury | $2,790 | $232 |

| Geico | $2,943 | $245 |

| State Farm | $3,231 | $269 |

| California average | $3,847 | $320 |

In California, auto insurers aren’t allowed to use your credit score to determine your auto insurance rate. If you have a low credit score, your rates won’t increase in California.

Auto insurers cannot increase your coverage rates during the insurance policy in California. They can only raise rates at renewal.

If you get a drunken driving traffic violation in California, you shouldn’t see an increase in your auto insurance until the renewal of your policy.

Where can you find the best insurance for a DUI in New York?

Progressive insurance company is your best insurance option in New York for DUI offenders. They offered us a quote at $2,286 per year, which is 21% lower than the $2,874 New York’s state average rates.

Cheapest DUI Rates in New York

| New York company | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $2,286 | $190 |

| State Farm | $2,474 | $206 |

| New York Central Mutual | $2,630 | $219 |

| New York average | $2,874 | $239 |

What about the best car insurance for a DUI in Florida?

Our licensed insurance agents found State Farm ($2,570 per year) provides the lowest rates for people with a DUI in Florida. Their rate is 27% cheaper than the state average $3,486 Florida rate for drinking and driving offenders.

Cheapest DUI Rates in Florida

| Florida company | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $2,570 | $214 |

| Progressive | $2,832 | $236 |

| Geico | $3,033 | $252 |

| Florida average | $3,486 | $290 |

Driving while impaired offenses in Florida requires drivers to have the car insurance company file an FR-44 on their behalf to prove they have the required coverage limits.

FR-44 policies must be paid in full in Florida, making it essential to comparison shop after a DUI conviction to get the best coverage rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What are the rates in Texas like for insurance after a DUI?

Texas’s average rate is $2,237 per year, and the most affordable option for drivers with a recent violation is Texas Farm Bureau with a $1,754 quote per year for a 30-year-old driver.

Cheapest DUI Rates in Texas

| Texas company | Annual Cost | Monthly Cost |

|---|---|---|

| Texas Farm Bureau | $1,754 | $146 |

| Geico | $1,841 | $153 |

| Progressive | $1,955 | $162 |

| Texas average | $2,237 | $186 |

Ohio Auto Insurance Rates for a DUI

Ohio drivers can find the most affordable DUI coverage with American Family, who provided our agents a $1,373 quote for our sample 30-year-old driver.

American Family’s rate is 21% cheaper than the Ohio mean rate of $1,732 for driving while impaired offenders.

Cheapest DUI Rates in Ohio

| Ohio company | Annual Cost | Monthly Cost |

|---|---|---|

| American Family | $1,373 | $114 |

| State Farm | $1,490 | $124 |

| USAA | $1,515 | $116 |

| Ohio average | $1,732 | $144 |

Georgia Rates for Insurance After a DUI

State Farm provides the least expensive quotes for DUI offenders in Georgia, with $1,688 annual rates for a 30-year-old driver, or $1,144 lower than the state average $2,832 rate.

Georgia DUI’s stay on your driving record for a decade, another reason to make sure to comparison shop for cheaper auto insurance quotes.

Cheapest DUI Rates in Georgia

| Georgia company | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,688 | $140 |

| Allstate | $1,930 | $160 |

| Country Financial | $2,238 | $186 |

| Georgia average | $2,832 | $236 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pennsylvania Auto Insurance Rates for a DUI

Pennsylvania residents with a recent DUI conviction should compare quotes with Erie Insurance. Erie provided our agents a $1,601 rate per year or 16% cheaper than the $1,900 average Pennsylvania rate.

Cheapest DUI Rates in Pennsylvania

| Pennsylvania company | Annual Cost | Monthly Cost |

|---|---|---|

| Erie | $1,601 | $133 |

| State Farm | $1,678 | $139 |

| Allstate | $1,955 | $162 |

| Pennsylvania average | $1,900 | $236 |

What are the cheapest auto insurance rates after a DUI in Illinois?

If you get caught drinking and driving in Illinois, your insurance rates will go up 38% on average to $1,984.

With Country Financial, you get car insurance in Illinois at $1,590 per year or only a 20% increase in your insurance premium.

Cheapest DUI Rates in Illinois

| Illinois company | Annual Cost | Monthly Cost |

|---|---|---|

| Country Financial | $1,590 | $132 |

| Progressive | $1,727 | $143 |

| Geico | $1,905 | $158 |

| Illinois average | $1,984 | $165 |

What are the cheapest full coverage insurance rates after DUI offenses?

You may not want to lower your coverage to save money on premium costs with your car insurance company in some cases.

If your vehicle is leased or has a lien holder, you may be obligated to carry specific auto insurance limits with a DWI conviction.

If you are in this position and need to maintain full coverage following a conviction, you could consider lowering your liability coverage while raising your deductible limits on collision and comprehensive insurance.

You will take on more risk, so make sure to consult with your auto insurance company or licensed agent before lowering coverage limits.

And it is even more important to compare rates and continue shopping around for better rates at your renewals after a DUI/DWI charge.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What will be the cheapest minimum coverage car insurance after a DUI?

If you have some flexibility on your coverage limits, you may be able to lower your coverage with your car insurance company to state minimum limits to save money each month on premiums.

Knowing a drunken driving charge will increase your rates, it may be more economical to drop coverage as low as you can afford to go.

During AutoInsureSavings.org analysis, for a driver with one DUI, the minimum required car insurance costs $97 a month, or about $45 more than someone with a clean driving history would pay.

What would be the most affordable minimum coverage insurance for a DUI by state?

In Washington D.C., AutoInsureSavings.org licensed agents found Progressive is the cheapest auto insurance option for DUI offenders requiring minimum coverage.

Progressive provided us a quote at $1,824 per year or 31% lower than Washington D.C.’s average rate of $2,389.

DUI Cheapest Minimum Coverage by Insurer

| State | Lowest DUI Premium | State | Lowest DUI Premium |

|---|---|---|---|

| Alaska | State Farm | Montana | Liberty Mutual |

| Alabama | Progressive | North Carolina | North Carolina Farm Bureau |

| Arkansas | Southern Farm Bureau Casualty | North Dakota | Farmers |

| Arizona | State Farm | Nebraska | Farmers Mutual of Nebraska |

| California | Mercury | New Hampshire | Concord Group |

| Colorado | Allstate | New Jersey | New Jersey Manufacturers |

| Connecticut | State Farm | New Mexico | Progressive |

| Delaware | State Farm | Nevada | State Farm |

| Florida | Allstate | New York | Progressive |

| Georgia | Progressive | Ohio | American Family |

| Hawaii | State Farm | Oklahoma | Farmers |

| Iowa | Geico | Oregon | Allstate |

| Idaho | State Farm | Pennsylvania | Erie |

| Illinois | Country Financial | Rhode Island | Travelers |

| Indiana | Progressive | South Carolina | State Farm |

| Kansas | American Family | South Dakota | State Farm |

| Kentucky | Kentucky Farm Bureau | Tennessee | Geico |

| Louisiana | Southern Farm Bureau | Texas | Texas Farm Bureau |

| Massachusetts | Geico | Utah | Bear River |

| Maryland | Erie | Virginia | Progressive |

| Maine | State Farm | Vermont | State Farm |

| Michigan | Progressive | Washington | State Farm |

| Minnesota | Progressive | Wisconsin | Progressive |

| Missouri | American Family | West Virginia | State Farm |

| Mississippi | Alfa | Wyoming | State Farm |

Who has the cheapest car insurance after a DUI by state?

The auto insurance company you have before driving under the influence, may not be the cheapest one afterward.

In our licensed agent’s analysis, the cheapest car insurance company for drivers with a clean driving record could end up being the most expensive insurance after a DUI traffic violation. Below are statistics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Importance Of Comparison Shopping After a DUI

— Allstate is one of the cheapest insurers in Michigan for clean record drivers but one of the most expensive auto insurance companies for drivers with a DUI.

— In New Jersey, Travelers Insurance is a better option for those without drunk driving infractions but one of the most expensive auto insurers for drivers with a DUI in New Jersey.

— In Virginia, Nationwide Insurance is a cheaper insurance option for most drivers with good driving history. Still, it is one of the most expensive insurance companies for DUI offenders in Virginia.

— Liberty Mutual offers the best insurance coverage in Washington State for good drivers. Still, it becomes one of the most expensive insurance companies for drivers with a DUI conviction in Washington.

— If you are a military member or a family member of service personnel in Arizona, you get the cheapest rates with USAA. However, if you get a DWI traffic violation, you will have the most expensive insurance rates in Arizona with USAA.

Who are the cheapest car Insurance companies for a DUI?

Some car insurance companies specialize in high-risk drivers, so choosing one of those companies may be the cheapest option following a driving under the influence charge.

For example, Progressive advertises their coverage for drivers following DWI charges only increases by 13% for the first offense. Their rates may be a good starting point to compare car insurance carriers and coverages.

What are the most affordable insurance rates by company if you have a DUI?

Insurance Companies quotes for DUI

| Company | Average rate for full coverage with a DUI | Average rate for minimum coverage with a DUI |

|---|---|---|

| American Family | $1,432 | $688 |

| Erie | $1,465 | $580 |

| New Jersey Manufacturers (NJM) | $1,576 | $712 |

| Country Financial | $1,688 | $616 |

| USAA* | $1,732 | $687 |

| Safeco | $2,003 | $716 |

| The Hartford | $2,143 | $783 |

| Travelers | $2,276 | $986 |

| Progressive | $2,280 | $801 |

| State Farm | $2,365 | $975 |

| National General | $2,437 | $876 |

| Geico | $2,511 | $1,031 |

| Mercury | $2,682 | $1,044 |

| Auto-Owners | $2,921 | $1,053 |

| Farmers | $2,954 | $1,316 |

| Nationwide | $3,050 | $1,376 |

| Auto Club of Southern California | $3,067 | $1,400 |

| Allstate | $3,236 | $1,443 |

| Kemper | $3,311 | $1,328 |

| Amica | $3,583 | $1,275 |

| MetLife | $3,900 | $1,549 |

| Liberty Mutual | $3,951 | $1,972 |

| CSAA | $4,126 | $1,461 |

| 21st Century | $4,328 | $1,876 |

| The Hanover | $4,417 | $2,041 |

| Automobile Club Group | $4,943 | $2,454 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How can I lower my car insurance after a DUI?

One important trick to remember after getting a DUI is that you should shop around – you do not need to accept the first car insurance rate you find.

Your current insurance company may drop you, but if not, their rate may not be the most competitive for your new situation. By comparing rates and coverages, you will find the most competitive carrier for your needs.

Going online and using an online calculator or quote tool is a quick and efficient way to shop for the cheapest car insurance after DUI offenses. Remember to shop around at renewal time, as well – you may be eligible for a better rate after six or twelve months of good driving.

How can I lower my car insurance after a DUI?

Shopping around is one way to lower car insurance rates after a DUI. Another way to lower your rates is to reduce your coverages. If you carry high limits, you may reduce your coverage limits or increase your deductible to lower your monthly auto insurance premium.

Be sure to ask for any discounts that apply to you. Many carriers offer discounts for things like bundling your auto and home insurance policies, selecting paperless invoices and automatic payments, and sharing telematics data.

Because many carriers use your credit score as a rating factor, be sure to maintain good credit following your offense. DUI charges are expensive, so thinking ahead about ensuring your credit score stays high as you pay for the charge is a smart strategy.

Do not incur any additional tickets, charges, or driver’s license suspensions. Be a safe, courteous driver and avoid further infractions on your license.

Incurring additional moving violations or loss of driving privileges following a DUI charge could result in higher premiums or your policy termination with your insurance company and possibly jail time.

Frequently Asked Questions

What is DUI insurance?

Some car insurance carriers will write coverage for drivers who have DUI convictions, and others will not. Sometimes the policies written by carriers for drivers with the charges are called ‘DUI policies’ even though they are standard auto insurance policies written for high-risk drivers. The car insurance policy itself will be the same as others written by that carrier.

How does a DUI affect your insurance rates?

A DUI charge will increase your auto insurance rates and affect your premium for several years following the initial charge. Each carrier differs, and rates vary from driver to driver and state to state. Because there are so many rating factors that affect your premium, it is good to shop around and compare rates following a DUI.

In fact, a DUI often brings about a bigger premium increase than any single road violation more than an at-fault accident, racing, or reckless driving.

What is the difference between a DUI and DWI?

A DWI charge is a Driving While Intoxicated – or Driving While Impaired – charge, while DUI means Driving Under the Influence of prescription drugs or alcohol. In some states, the terms are used interchangeably. In others, different blood alcohol levels determine the severity of the charge.

Some states also consider DWAI charges – Driving While Ability Impaired – for drivers who do not meet BAC limits for higher charges but who are still impaired while behind the wheel. A BAC of .08 or higher is a DWI charge in many states, and a BAC of .05 and above is a DWAI charge.

You may be required to have SR-22 insurance coverage to show proof of financial responsibility if your license was suspended because of a DUI or DWI.

How long does a DUI stay on your driving record?

A DUI can affect your car insurance rates for five to seven years. It will stay on your driving record for three to five years in some states. In California, a DUI stays on your driving record for 10 years.

How can I get the cheapest DUI insurance?

Some carriers specialize in high-risk drivers and therefore can offer more competitive rates. The General and Safe Auto are two examples.

It is worth your time to shop around to find the best carrier for your situation following a DUI offense. Remember to compare rates often – at least at each renewal – so you can be confident you continue to have the best rate following a DUI.

Methodology:

| AutoInsureSavings.org licensed insurance agents used average DUI rates for ten zip codes from Quadrant Information Services in each state from 5 carriers with full coverage and a $500 deductible. We applied standard discounts such as paperless billing, multi-policy, and home insurance. For minimum coverage, we adjusted the numbers above to reflect state laws. Our sample 30-year-old driver drives a 2018 Honda Accord with 12,000 annual miles. |

|---|

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.