Oregon Cheapest Car Insurance & Best Coverage Options

Progressive has the best Oregon cheapest car insurance and best coverage options, as a minimum coverage policy averages $45 per month at Progressive. Oregon drivers who want more protection with full coverage, however, will find the cheapest rates at State Farm for an average of $101 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Progressive has the cheapest minimum auto insurance in Oregon

- State Farm has the cheapest full coverage auto insurance in Oregon

- Most drivers will be best off with a full coverage insurance policy

Want the best Oregon cheapest car insurance and best coverage options? You will find the cheapest minimum coverage at Progressive and the cheapest full coverage at State Farm. Read on to learn more about the best auto insurance companies in Oregon, as well as ways to save on your Oregon auto insurance.

To get started on finding the best car insurance in Oregon, enter your ZIP code into our free quote comparison tool.

Best Cheap Car Insurance in Oregon

Carrying insurance in the state of Oregon is mandated by state law. However, who provides your coverage and anything above the liability insurance requirements are a matter of choice.

| Cheapest Car Insurance in Oregon - Key Takeaways |

|---|

The cheapest Oregon car insurance options are: The cheapest Oregon car insurance options are:Cheapest for minimum coverage: Progressive Cheapest for full coverage: State Farm Cheapest after an at-fault accident: Country Financial Cheapest after a speeding ticket: American Family Cheapest after a DUI: Progressive Cheapest for poor credit history: State Farm Cheapest for young drivers: Geico For younger drivers with a speeding violation: Nationwide For younger drivers with an at-fault accident: Nationwide |

Keep reading to answer your insurance questions. Learn how to save money with Oregon car insurance companies in various age groups, and how to find the best auto insurance coverage for the most affordable cost through comparison shopping.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Oregon for Minimum Coverage

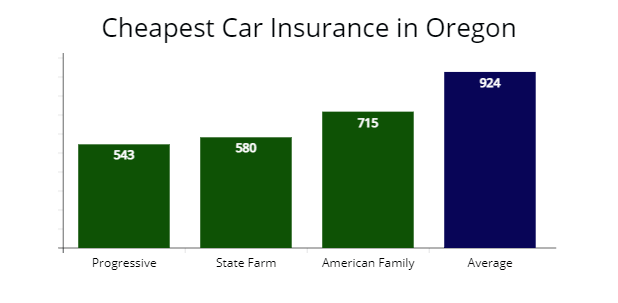

Our agents found that Progressive offers the cheapest minimum coverage car insurance for Oregon drivers with a good driving record at $543 per year, which is 24% less expensive than the average cost for minimum liability from other car insurance companies in Oregon at $924 per year (read more: Progressive Car Insurance Review for Families, Policy Options & Ratings).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Enter your zip code above to compare the cheapest options for an auto insurance quote from the best auto insurers to help you save money.

| Auto Insurer | Average Annual Rate |

|---|---|

| Progressive | $543 |

| State Farm | $580 |

| USAA | $624 |

| American Family | $715 |

| Country Financial | $753 |

| Wawanesa | $795 |

| Geico | $876 |

| Allstate | $978 |

| Farmers | $1,031 |

| Nationwide | $1,154 |

*USAA is for qualified military members, their spouses, and direct family members. Auto insurance rates vary depending on driver profiles.

We found the most expensive insurance providers for minimum coverage during our rate analysis are Farmers and Nationwide, with an average quote of $1,031 and $1,154 per year.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The cheapest car insurance in the state of Oregon is based on several factors. First, you must determine if you want full coverage or the state minimum coverage. Then, you must factor in your vehicle information, age, and driving history.

Minimum coverage is a liability-only insurance policy with bodily injury and property damage liability insurance and uninsured motorist bodily injury, including personal injury protection (learn more: Understanding Liability Auto Insurance).

Cheapest Insurance for Full Coverage in Oregon

State Farm offers cheap insurance rates in Oregon at $1,217 per year or $101 per month for full coverage, 35% cheaper than Oregon state average rates.

The next best is Progressive, which offers full coverage insurance rates at $1,465 per year or 21% cheaper than average rates.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,217 | $101 |

| Progressive | $1,465 | $122 |

| American Family | $1,576 | $131 |

| Oregon average | $1,847 | $153 |

*Your rates may vary when you get a quote.

Oregon’s average premium for full coverage insurance is $1,847 per year or $153 per month.

Most drivers will benefit from full coverage policies that include comprehensive and collision coverage, which reimburse property damage to your vehicle from car accidents, vandalism, or thefts.Dani Best Licensed Insurance Producer

AutoInsureSavings.org licensed insurance agents to recommend drivers in Oregon with newer model vehicles to buy a full coverage auto insurance policy.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Cheapest Auto Insurance in Oregon With Speeding Tickets

Our licensed agents found American Family Insurance company offers the cheapest rates for Oregon drivers with speeding tickets at $1,678 per year or a $139 monthly rate. American Family’s rate is 27% less expensive than Oregon’s average rates of $2,268 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| American Family | $1,678 | $139 |

| Progressive | $1,723 | $143 |

| State Farm | $1,850 | $154 |

| Oregon average | $2,268 | $189 |

Wondering how much will my auto insurance go up with a speeding ticket? The average car insurance premium for an Oregon driver with a speeding violation is $2,258, or $421 more for auto insurance than a clean record driver.

A minor speeding violation stays on Oregon driving records for two years. During those two years, the cost of car insurance can increase by 19%, according to the Oregon Driver & Motor Vehicle Services.

Cheapest Insurance in Oregon For Drivers with an Accident

Country Financial offers the best rate for drivers with a recent at-fault accident in Oregon, with auto insurance premiums at $1,934 per year. That is $1,051 per year less than the average amount drivers pay ($2,985) for auto insurance coverage in Oregon.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Country Financial | $1,934 | $161 |

| State Farm | $2,051 | $170 |

| Wawanesa | $2,374 | $197 |

| Oregon average | $2,985 | $248 |

The least expensive insurance coverage exists for people with clean driving records. Oregon auto insurance carriers will cover people with an accident. Oregon’s average rates for a person with a car accident on their driving record would be $2,985 per year, over $1,138 more than the average premium for full coverage.

Cheapest Auto Insurance in Oregon for Drivers with a DUI

Progressive offers the cheapest auto insurance rates for drivers in Oregon with a DUI in their driving history at $1,862 per year. The average rate for drivers with a DUI in Oregon is $2,860, and Progressive offers savings of $998 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $1,862 | $155 |

| State Farm | $2,127 | $177 |

| Oregon Mutual | $2,561 | $213 |

| Oregon average | $2,860 | $238 |

According to the Oregon Health Authority, DUI offenders in Oregon will have driving privileges suspended for one year, a required ignition interlock device (IID) installed in their motor vehicle for one year, with the required defensive driving course, and 80 hours of community service. A drunk driving violation in Oregon can raise your car insurance premiums by 36% per year for 24 months.

Learn more: The Best Car Insurance Companies After a DUI

Cheapest Car Insurance in Oregon for Drivers With Poor Credit

State Farm offers the least expensive insurance premiums for Oregon drivers with a poor credit score. State Farm provides a savings of over $772 per year or 31% less expensive, with an insurance premium of $1,798 per year for full coverage.

Progressive is the second cheapest car insurance option for a poor credit score at $1,954 per year or 24% cheaper than average Oregon poor credit rates.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,798 | $149 |

| Progressive | $1,954 | $162 |

| Nationwide | $2,231 | $185 |

| Oregon average | $2,570 | $214 |

We found drivers with a bad credit score pay 29% more for coverage in Oregon than those with good credit scores during our rate analysis. Make sure to pay your credit cards, student loans, and bills on time to find the best rates with Oregon car insurance. And keep an eye on your credit report.

Cheapest Car Insurance in Oregon for Young Drivers

Younger drivers shopping for car insurance can find the best car insurance for new drivers in Oregon with Geico, who provided our agents with a $3,165 per year quote for full coverage. Geico’s rate is 43% cheaper than Oregon’s average young driver rate of $5,521 per year.

Teen drivers can find the cheapest insurance for minimum coverage in Oregon with Country Financial, which provided us with a $1,714 per year rate for an 18-year-old driver.

| Insurer | Full Coverage | Minimum Coverage |

|---|---|---|

| Geico | $3,165 | $1,890 |

| USAA | $3,378 | $1,587 |

| Country Financial | $3,481 | $1,714 |

| State Farm | $3,765 | $1,765 |

| Farmers | $4,438 | $2,087 |

| Nationwide | $5,176 | $2,548 |

| Progressive | $6,328 | $1,976 |

| American Family | $6,646 | $3,148 |

| Liberty Mutual | $7,894 | $3,033 |

| Oregon average | $5,521 | $2,353 |

*USAA is for qualified military members, their spouses, and direct family members. Coverage rates may vary depending on driver profiles.

A teen driver who recently received their driver’s license or has been driving for less than five years is a high-risk driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

They tend to get more traffic tickets and have more accidents. The cost to insure an Oregon driver under 21 is significantly higher than insuring a driver over 30 with a clean driving record, making it important to shop around for the best car insurance for teens.

Cheapest Insurance for Young Drivers with Speeding Tickets

Young or teen drivers in Oregon should compare auto insurance quotes with Nationwide Insurance company with a speeding ticket in their driving history. Nationwide provided our agents a quote at $5,176 per year or $431 per month.

Nationwide’s coverage rates are 17% less expensive than average rates for young Oregon drivers.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Nationwide | $5,176 | $431 |

| Geico | $5,241 | $436 |

| Country Financial | $5,573 | $464 |

| Oregon average | $6,137 | $511 |

Learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Cheapest Car Insurance for Young Drivers in Oregon with an Accident

According to our licensed agent’s rate analysis, younger drivers with an at-fault accident can find the cheapest car insurance quotes with Nationwide, with an average cost of $5,176 per year or $431 per month.

Nationwide’s insurance rate is 39% less expensive than Oregon’s $8,431 average rates for younger drivers with an at-fault accident.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Nationwide | $5,176 | $431 |

| Country Financial | $5,208 | $434 |

| Geico | $5,987 | $498 |

| Oregon average | $8,431 | $702 |

Read more: 5 Tips to Get Cheap Car Insurance After an Accident

Best Auto Insurance Companies in Oregon

If we use the NAIC complaint index, J.D. Powers claims satisfaction study, and the average price for state minimum and full coverage, American Family (AmFam) and Country Financial are the best car insurance companies in Oregon.

Sometimes getting the most affordable insurance company for the average driver isn’t the best for quality customer service for Oregon drivers. Depending on your assets and situation, you may need to compare insurance companies with higher than average customer service and satisfaction standards.

| Auto Insurer | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| American Family | 86% | 50% |

| Liberty Mutual | 82% | 40% |

| USAA | 78% | 62% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

| Geico | 64% | 42% |

According to ValuePenguin, AmFam received the highest customer satisfaction ratings for Oregon car insurance. AmFam also received the highest satisfaction ratings from its customers for both claims satisfaction and an NAIC complaint index of 0.55, well below the national average of 1.00.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If we take the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power claims satisfaction score, and A.M. Best financial strength ratings, the results are similar.

| Company | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating |

|---|---|---|---|

| PEMCO | 0.04 | n/a | B++ |

| Country Financial | 0.19 | 863 | A+ |

| Farmers | 0.51 | 872 | A |

| American Family | 0.55 | 861 | A++ |

| Progressive | 0.59 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Liberty Mutual | 0.92 | 870 | A |

| Geico | 1.02 | 871 | A++ |

Country Financial (0.19), Farmers Insurance (0.51), and AmFam (0.55) are the best car insurance companies with excellent financial strength, have a complaint ratio below the national average of 1.00 which means all three car insurance companies have fewer complaints relative to their market share.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in Oregon

An insurance company will use your zip code and many factors to determine your Oregon car insurance costs, as well as your credit score, marital status, type of motor vehicle, and past driving history. If you live in Oregon’s more urban areas, there is a higher chance of auto theft or being in an auto accident. Insurance companies will increase rates to account for such risk, which can pose an issue for what you will pay for in the overall cost of auto insurance.

Cheapest Car Insurance in Portland, OR

Drivers in Portland can find cheap car insurance in Portland with Country Financial with a $1,532 per year rate for our 30-year-old sample driver. A $1,532 quote from Country Financial is 30% cheaper than Portland, Oregon’s average car insurance rates.

| Portland Company | Average Premium |

|---|---|

| Country Financial | $1,532 |

| State Farm | $1,651 |

| Progressive | $1,680 |

| Portland average | $2,186 |

Cheapest Car Insurance in Salem, OR

State Farm offers cheap insurance for drivers in Salem who provided our licensed agents a quote at $1,388 per year or a $115 monthly rate. State Farm’s rate is 31% less expensive than average rates in Salem, Oregon.

| Salem Company | Average Premium |

|---|---|

| State Farm | $1,388 |

| Progressive | $1,475 |

| Travelers | $1,734 |

| Salem average | $2,007 |

Cheapest Car Insurance in Eugene, OR

Eugene drivers can find cheap insurance with Progressive, who offered us a quote at $1,416 per year or a $117 monthly rate with $500 deductibles for comprehensive and collision insurance. Progressive’s insurance quote is 32% cheaper than Eugene’s average rates at $2,075 per year.

| Eugene Company | Average Premium |

|---|---|

| Progressive | $1,414 |

| Country Financial | $1,529 |

| Travelers | $1,811 |

| Eugene average | $2,075 |

Cheapest Car Insurance in Gresham, OR

Progressive Insurance offers cheaper car insurance for drivers in Gresham with a good driving record with quotes at $1,436 per year and 30% less expensive than average rates in Gresham.

| Gresham Company | Average Premium |

|---|---|

| Progressive | $1,436 |

| Country Financial | $1,538 |

| State Farm | $1,571 |

| Gresham average | $2,042 |

Cheapest Auto Insurance in Hillsboro, OR

AutoInsureSavings.org licensed agents found that Hillsboro’s cheapest insurance rate is with State Farm, who provided us a quote at $1,327 per year for full coverage or 33% lower than average rates for drivers in Hillsboro, Oregon.

| Hillsboro Company | Average Premium |

|---|---|

| State Farm | $1,327 |

| American Family | $1,400 |

| Country Financial | $1,526 |

| Hillsboro average | $1,964 |

Cheapest Auto Insurance in Beaverton, OR

Country Financial offers cheaper car insurance for drivers in Beaverton, Oregon, with a quote at $1,314 per year or a $109 monthly rate for a full coverage car insurance policy, which is 30% less expensive than the average rates in Beaverton.

| Beaverton Company | Average Premium |

|---|---|

| Country Financial | $1,314 |

| American Family | $1,375 |

| Geico | $1,651 |

| Beaverton average | $1,855 |

Average Cost of Insurance for All Cities in Oregon

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Portland | $2,186 | Metzger | $1,409 |

| Salem | $2,007 | Harrisburg | $1,438 |

| Eugene | $2,075 | Toledo | $1,460 |

| Gresham | $2,042 | Mount Angel | $1,496 |

| Hillsboro | $1,964 | Hubbard | $1,511 |

| Beaverton | $1,855 | Boardman | $1,422 |

| Bend | $1,810 | Myrtle Creek | $1,513 |

| Medford | $1,570 | Estacada | $1,527 |

| Springfield | $1,619 | Oakridge | $1,580 |

| Corvallis | $1,600 | Jefferson | $1,458 |

| Aloha | $1,559 | Dundee | $1,579 |

| Albany | $1,536 | Warm Springs | $1,513 |

| Tigard | $1,538 | Three Rivers | $1,422 |

| Lake Oswego | $1,675 | Nyssa | $1,629 |

| Keizer | $1,579 | Bandon | $1,409 |

| Grants Pass | $1,618 | Shady Cove | $1,604 |

| Oregon City | $1,689 | Redwood | $1,493 |

| McMinnville | $1,409 | North Plains | $1,536 |

| Redmond | $1,422 | Jacksonville | $1,438 |

| Tualatin | $1,493 | Eagle Crest | $1,579 |

| West Linn | $1,619 | Sublimity | $1,598 |

| Bethany | $1,604 | Burns | $1,536 |

| Woodburn | $1,624 | Stanfield | $1,547 |

| Forest Grove | $1,458 | Gervais | $1,409 |

| Wilsonville | $1,513 | Dayton | $1,422 |

| Newberg | $1,438 | Sisters | $1,579 |

| Roseburg | $1,710 | Lakeview | $1,614 |

| Hayesville | $1,409 | Myrtle Point | $1,680 |

| Klamath Falls | $1,683 | Bunker Hill | $1,653 |

| Ashland | $1,536 | Turner | $1,438 |

| Milwaukie | $1,579 | Cave Junction | $1,493 |

| Happy Valley | $1,702 | Willamina | $1,731 |

| Sherwood | $1,680 | Gold Beach | $1,710 |

| Altamont | $1,733 | Rogue River | $1,513 |

| Central Point | $1,422 | Odell | $1,458 |

| Oak Grove | $1,744 | La Pine | $1,409 |

| Canby | $1,723 | Mulino | $1,741 |

| Cedar Mill | $1,493 | John Day | $1,536 |

| Hermiston | $1,659 | Union | $1,604 |

| Lebanon | $1,680 | Carlton | $1,579 |

| Pendleton | $1,513 | Rainier | $1,493 |

| Troutdale | $1,409 | Vale | $1,730 |

| Four Corners | $1,438 | Lincoln Beach | $1,614 |

| Coos Bay | $1,710 | Waldport | $1,733 |

| Dallas | $1,536 | Irrigon | $1,680 |

| The Dalles | $1,729 | Enterprise | $1,409 |

| Oatfield | $1,493 | Millersburg | $1,422 |

| St. Helens | $1,458 | Harbor | $1,736 |

| La Grande | $1,409 | Chenoweth | $1,513 |

| Cornelius | $1,741 | Warren | $1,738 |

| Oak Hills | $1,604 | Durham | $1,493 |

| Gladstone | $1,579 | Merlin | $1,438 |

| Damascus | $1,740 | Culver | $1,733 |

| Sandy | $1,614 | Columbia City | $1,409 |

| Ontario | $1,493 | Barview | $1,737 |

| Newport | $1,742 | Brownsville | $1,536 |

| Monmouth | $1,438 | Vernonia | $1,458 |

| Silverton | $1,493 | Mill City | $1,733 |

| Cottage Grove | $1,710 | Canyonville | $1,579 |

| Prineville | $1,409 | Banks | $1,422 |

| Bull Mountain | $1,680 | Depoe Bay | $1,493 |

| Rockcreek | $1,493 | Lakeside | $1,438 |

| White City | $1,513 | Stafford | $1,409 |

| Independence | $1,536 | Bay City | $1,776 |

| Astoria | $1,733 | Terrebonne | $1,680 |

| Baker City | $1,727 | Amity | $1,614 |

| North Bend | $1,409 | Clatskanie | $1,748 |

| Sweet Home | $1,579 | Gearhart | $1,515 |

| Fairview | $1,422 | Grand Ronde | $1,493 |

| Molalla | $1,458 | New Hope | $1,749 |

| Eagle Point | $1,438 | Cannon Beach | $1,409 |

| Florence | $1,409 | Elgin | $1,710 |

| Cedar Hills | $1,680 | Gold Hill | $1,727 |

| West Haven-Sylvan | $1,604 | Tangent | $1,740 |

| Lincoln City | $1,438 | Hines | $1,579 |

| Stayton | $1,493 | Williams | $1,749 |

| Sutherlin | $1,710 | Glide | $1,536 |

| Jennings Lodge | $1,614 | Yamhill | $1,438 |

| Green | $1,517 | Pilot Rock | $1,680 |

| Hood River | $1,493 | Falls City | $1,409 |

| Scappoose | $1,727 | Sunriver | $1,458 |

| Umatilla | $1,422 | Cascade Locks | $1,747 |

| Milton-Freewater | $1,409 | Yoncalla | $1,733 |

| Garden Home-Whitford | $1,712 | Riddle | $1,493 |

| West Slope | $1,438 | Athena | $1,749 |

| Madras | $1,536 | Dunes City | $1,614 |

| Seaside | $1,581 | Lowell | $1,409 |

| Talent | $1,727 | Rose Lodge | $1,579 |

| Brookings | $1,458 | Rockaway Beach | $1,516 |

| Raleigh Hills | $1,493 | Siletz | $1,426 |

| Sheridan | $1,579 | Donald | $1,438 |

| Junction City | $1,680 | Adair Village | $1,458 |

| Deschutes River Woods | $1,614 | Heppner | $1,721 |

| Warrenton | $1,409 | Pacific City | $1,493 |

| Winston | $1,604 | Lyons | $1,680 |

| Creswell | $1,513 | Aurora | $1,614 |

| Tillamook | $1,438 | Powers | $1,680 |

| Roseburg North | $1,536 | Island City | $1,409 |

| Veneta | $1,493 | Coburg | $1,579 |

| Philomath | $1,426 | Halsey | $1,664 |

| Phoenix | $1,458 | Maywood Park | $1,536 |

| Mount Hood Village | $1,724 | Joseph | $1,699 |

| King City | $1,543 | Ruch | $1,727 |

| Tri-City | $1,438 | Lookingglass | $1,493 |

| Lafayette | $1,727 | South Lebanon | $1,724 |

| Aumsville | $1,680 | Metolius | $1,614 |

| Reedsport | $1,604 | Chiloquin | $1,513 |

| Beavercreek | $1,409 | Port Orford | $1,424 |

| Wood Village | $1,540 | Scio | $1,548 |

| Crooked River Ranch | $1,513 | Bayside Gardens | $1,458 |

| Coquille | $1,422 | Malin | $1,409 |

Minimum Car Insurance Requirements in Oregon

Drivers in Oregon must carry the state minimum auto insurance requirements for vehicle registration. State law mandates drivers have at least $25,000 per person and up to $50,000 per accident of bodily injury liability coverage. They also require at least $25,000 per accident of property damage liability coverage.

| Liability insurance | State minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $20,000 per accident |

| Uninsured/Underinsured motorist bodily injury insurance | $25,000 per person / $50,000 per accident |

| Personal injury protection (PIP) | $15,000 |

Oregon is a no-fault state, so drivers must carry personal injury protection in their car insurance premiums along with uninsured motorist bodily injury coverage.

AutoInsureSavings.org licensed agents recommend buying coverage with higher liability limits with comprehensive and collision coverage in Oregon for the average driver with multiple assets, such as houses or multiple vehicles.

According to the Insurance Information Institute (III.org), we recommend higher uninsured motorist coverage limits since Oregon’s uninsured motorist rate is 10.2%.

To learn more about finding the best rates and car insurance options in Oregon, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord in Oregon with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used car insurance rates for drivers in Oregon with accident histories, credit scores, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates will vary when you get quotes.

Sources

– Oregon Division of Financial Regulation. “A consumer’s guide to auto insurance.”

– Oregon DMV. “Minimum Insurance Requirements.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Oregon.gov. “Oregon Driver & Motor Vehicle Services.”

Frequently Asked Questions

Who has the cheapest car insurance in Oregon?

We found the top car insurance companies that offer the lowest Oregon driver’s average rates are Progressive at $543 per year, State Farm at $580 per year, and American Family at $715 per year for a state minimum car insurance policy for a 30-year-old with clean driving history.

How much is car insurance in Oregon per month?

On average, drivers pay around $77 per month for state minimum coverage in Oregon and $153 per month for full coverage insurance. Based on our research of the average cost of car insurance in Oregon, State Farm, at $1,217 per year, is one of the state’s most affordable car insurance companies. Most driver’s average annual rate is around $924 per year for state minimums and $1,847 per year, including comprehensive and collision coverage.

How much is full coverage car insurance in Oregon?

On average, most drivers in Oregon pay for full coverage insurance is $153 per month or $1,847 per year. Oregon’s top insurance companies that offer the lowest rate for drivers interested in full coverage auto insurance policies include State Farm and Progressive. Both insurers provide auto insurance quotes 21% lower than average rates, depending on your driver profile.

How can I save on car insurance in Oregon?

There are many things drivers can do to help save money on their car insurance rates in Oregon. First, you will need to compare quotes from multiple insurance providers to find the right insurance company that offers the exact level of coverage in Oregon you need at the most affordable price.

Another thing drivers in Oregon can do to help them save more on their car insurance rates is to ask their auto insurance provider about a money-saving driver discount they may be eligible for. Many companies offer car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their driving records. Consider Usage-Based car insurance, such as American Family’s KnowYourDrive Program. You can get long-term savings up to 20%, depending on your safe driving habits and driver behavior.

Is Oregon a no-fault state?

Yes, Oregon is a no-fault state, so drivers will need to have the best auto insurance in Oregon to fully protect themselves.

Why is Oregon car insurance so high?

Oregon is a no-fault state, so drivers must carry higher levels of insurance that cost more.

Is Oregon a PIP state?

Yes, Oregon drivers must carry PIP auto insurance.

Is it illegal to drive without car insurance in Oregon?

Yes, all drivers in Oregon must carry auto insurance to drive legally in the state.

What is the best Oregon car insurance?

Full coverage will provide the best protection to drivers in Oregon. Shopping around for Oregon auto insurance quotes will help keep full coverage rates affordable.

What happens if you don’t have car insurance in Oregon?

Oregon drivers can face fines, suspended licenses, and more for driving without car insurance in Oregon.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.