AutoInsureSavings.org Press Room & Media Mentions

Benzinga

March 2021

Car Insurance in Arizona (AZ)

Ready to visit the Grand Canyon and beyond? Make sure you know the rules of the road in Arizona. Check out our quick guide to car insurance minimums and requirements in Arizona before you drive.

BuyAutoInsurance.com

Jan 2021

HOW TO GET INSURANCE AFTER A DUI

For many people facing a DUI, your license may be temporarily revoked, and your insurance rates will likely be affected when your policy renews. Your insurance company will not raise your rates mid-policy, so depending on your policy renewal date, you will have a little bit of time to make financial adjustments and to work out a plan.

NadaGuides

December 2020

Do You Need A Driver’s License To Get Car Insurance

If you’re curious whether you can get a car insured without a license; the answer is yes, but it may be more difficult. There are a few factors you will need to discuss with a potential insurance company, such as who the primary driver of the vehicle will be, whether the automobile needs to be co-titled, for instance, with a teen child who will be driving the car, or if the vehicle is a collector’s item that will be kept in storage.

4AutoInsuranceQuote.com

November 2020

The High Costs of Car Insurance DUI Rates

Do DUIs raise insurance rates? One conviction can double, or even triple your existing rates, and affect your rates for years. In worst-case scenarios, your insurance provider may even cancel your existing policy. You could be stuck paying $1500 or more extra on your car insurance premium each year that the offense stays on your record.

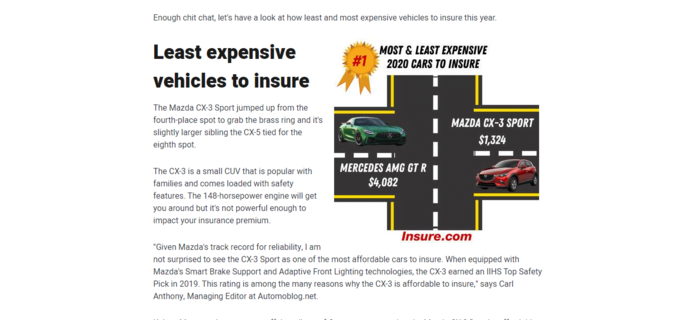

Insure.com

April 2020

Insure.com’s 2020 most and least expensive vehicles to insure

Every year, Insure.com compares car insurance rates in every state for approximately 3,000 different vehicle models to find both the cheapest and most expensive vehicles to insure.

We pulled insurance quotes from six major insurance companies and averaged the premiums, so you have an accurate estimate of what it costs to insure the car of your dreams.

Yahoo

MEMPHIS, TN / ACCESSWIRE / March 18, 2020 / AutoInsureSavings LLC, a top insurance provider in Tennessee and Wyoming, today announced new research revealing that the average cost of an auto insurance premium is 30 to 40% higher in the Memphis and Nashville metropolitan areas. However, the firm is able to help drivers find the lowest possible rates in these locations, as well as in Tennessee and Wyoming overall.

Lawyer.com

October 2018

Distracted drivers: Is there one in your midst?

How many times a day do you drive somewhere? If you’re similar to the average Tennessee motorist, you may have to get behind the wheel two, three or more times in a single day. Every time you drive, there’s a certain amount of risk involved, although you likely expect to arrive safely to your destination if you are cautious and alert at all times, as well as adherent to all traffic regulations.

Yahoo

October 2014

AutoInsureSavings Publishes New Car Life Hacks

AutoInsureSavings.org has become so effective at providing the very best quotes for insurance to people in every state of the US that they have now expanded their remit to include getting the best from cars in a variety of other ways.