Colorado Cheapest Car Insurance & Best Coverage Options

Colorado's cheapest car insurance policies can be found at Autowners and Nationwide. Autowners has the cheapest minimum insurance coverage for Colorado drivers, with an average rate of $40 per month. Nationwide, however, has the cheapest Colorado full coverage at an average rate of $120 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Auto-Owners Insurance provides the cheapest Colorado minimum auto insurance

- Nationwide provides the cheapest Colorado full coverage auto insurance

- USAA and State Farm also provide cheap Colorado auto insurance

Colorado cheapest car insurance policies can be found at Autowners, Nationwide, and many other companies. Read on to learn more about the cheap rates at the best auto insurance companies in Colorado.

To start shopping for the cheapest car insurance in Colorado right away, enter your ZIP code into our free quote comparison tool.

Affordable Car Insurance Rates in Colorado

Colorado car insurance shoppers should compare quotes with the same coverage levels with at least three insurance companies to find the best rate and save more on their insurance premiums.

| Cheapest Car Insurance in Colorado - Key Takeaways |

|---|

The cheapest Colorado car insurance options are: The cheapest Colorado car insurance options are:Cheapest for minimum coverage: Auto-Owners Insurance Cheapest for full coverage: Nationwide Cheapest after an at-fault accident: Nationwide Cheapest after a speeding ticket: State Farm Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: American Family For younger drivers with a speeding violation: Geico For younger drivers with an at-fault accident: American Family |

Enter your Zip Code or use this practical Colorado auto insurance guide which is the best way to find top car insurance carriers in your area regardless of your driving type.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Minimum Coverage in Colorado

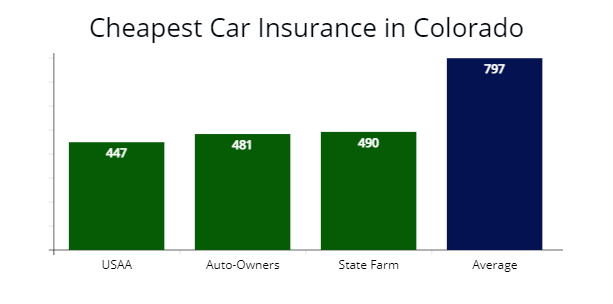

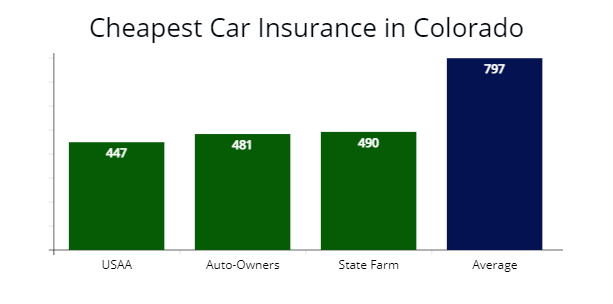

Auto-Owners Insurance offers the cheapest minimum coverage rates for Colorado drivers with a good driving record, which provided us a $481 annual rate or $316 cheaper than the $797 average quote for our 30-year-old sample driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Suppose you are a military member or a family member of military personnel. In that case, your best rates are with USAA, which offered our agents a $447 annual quote or $36 per month for minimum liability coverage.

| Company | Average annual rate | Monthly rate |

|---|---|---|

| USAA | $447 | $34 |

| Auto-Owners | $481 | $40 |

| State Farm | $490 | $41 |

| Geico | $527 | $43 |

| Progressive | $586 | $48 |

| Allstate | $703 | $58 |

| Nationwide | $746 | $62 |

| Farmers | $852 | $70 |

| American Family | $856 | $71 |

| Colorado average | $797 | $66 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

Buying a minimum coverage car insurance policy is the cheapest way to meet Colorado’s insurance requirements to ensure you stay legal.

State minimums may not have sufficient coverage with the amount of bodily injury and property damage liability you need if you are involved in an auto accident.

A Colorado state minimum auto policy only covers up to $50,000 per accident in bodily injury liability and $15,000 per accident in property damage liability.

Cheapest Full Coverage Colorado Car Insurance

Nationwide offers the cheapest car insurance rates for full coverage in Colorado. Nationwide’s $1,442 rate is 34% less expensive than the state average of $2,180 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,442 | $120 |

| State Farm | $1,655 | $137 |

| Auto-Owners | $1,703 | $141 |

| Colorado average | $2,180 | $181 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

A full coverage car insurance policy costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included.

Read more: Understanding Full Coverage Car Insurance: What You Need to Know

Your motor vehicle is protected with full coverage no matter who or any inclement weather caused the property damage.

Cheapest Car Insurance With One Speeding Ticket in Colorado

State Farm offers the cheapest insurance quotes for drivers in Colorado with a speeding violation on their driving record. State Farm’s $1,690 rate is 33% or $824 less expensive than the state average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,690 | $133 |

| Auto-Owners | $1,787 | $148 |

| Geico | $1,946 | $162 |

| Colorado average | $2,514 | $209 |

According to the Colorado General Assembly and The Zebra, your auto insurance rates can increase by $306 per year or 14% with one traffic violation for speeding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Most auto insurers will increase car insurance rates after traffic tickets, so you want to make sure to comparison shop for cheaper insurance companies in Colorado after any traffic violation on driving records.

Cheapest Car Insurance in Colorado With a Car Accident

According to our analysis, Nationwide offers the cheapest insurance rates for drivers in Colorado with one at-fault accident with a $2,268 per year insurance premium for our sample driver.

Nationwide’s rate is 29% less expensive than Colorado’s average ($3,157) insurance premium for drivers with one accident in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $2,268 | $189 |

| Auto-Owners | $2,340 | $195 |

| State Farm | $2,514 | $209 |

| Colorado average | $3,157 | $263 |

Getting into an at-fault accident may cause a rate increase of 34% or $977 per year, showing the importance of shopping for cheaper auto insurance if you have a change on your driving record.

To make sure you get the best rates, be sure to compare quotes with at least three car insurance companies after a car accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance With a DUI in Colorado

Drivers in Colorado with DUI offenses on their driving records can find the cheapest car insurance with Progressive, which provided our insurance agents a quote at $2,313 per year or a $192 monthly rate for full coverage.

Learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings

The average annual rate increase for drivers with DUI violations is $3,357, making Progressive’s rate 32% cheaper than Colorado’s average DUI rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,313 | $192 |

| Geico | $2,476 | $206 |

| State Farm | $2,836 | $236 |

| Colorado average | $3,357 | $279 |

According to the Colorado Department of Transportation, car insurance premiums increase by 47% on average for drivers with driving while intoxicated violations (DUI’s).

According to the Colorado Department of Revenue, you will need an SR-22 to reinstate your driver’s license. A Judge may order an ignition interlock device (BAIID) installed in your motor vehicle for one year.

Cheapest Car Insurance for Drivers With Poor Credit in Colorado

Geico provides the cheapest insurance for drivers with poor credit in Colorado with a $1,915 rate for full coverage or 28% less expensive than the average bad credit rate increase of $2,633 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,915 | $159 |

| State Farm | $2,047 | $170 |

| Nationwide | $2,278 | $189 |

| Colorado average | $2,633 | $219 |

AutoInsureSavings.org analysis shows drivers who have a poor credit score will pay on average 22% more for car insurance premiums. And drivers with poor credit are more likely to file a claim or get involved in an at-fault accident.

For that reason, their auto insurance costs are higher than average. Make sure to maintain good credit scores and pay credit cards on time to ensure your car insurance rates won’t increase at renewal.

Cheapest Car Insurance for Young Drivers in Colorado

We found young Colorado drivers looking for the cheapest full coverage insurance is with American Family, which provided our agents a $3,321 annual quote or 54% less expensive than our sample young driver’s average rates.

USAA is the best car insurance option for younger drivers who qualify, which offered AutoInsureSavings’ agents a $1,345 annual rate for state minimum coverage.

The cheapest state minimum coverage in Colorado for teenage drivers is Auto-Owners Insurance, which offered us a quote at $1,537 per year or 39% cheaper. The next best option for younger drivers is State Farm, with a $1,670 annual rate for liability insurance.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| American Family | $3,321 | $1,830 |

| State Farm | $3,565 | $1,670 |

| USAA | $3,698 | $1,345 |

| Auto-Owners | $3,895 | $1,537 |

| Geico | $4,478 | $1,811 |

| Allstate | $5,136 | $1,987 |

| Nationwide | $6,462 | $2,266 |

| Farmers | $7,934 | $2,947 |

| Progressive | $8,359 | $3,156 |

| Colorado average | $7,132 | $2,508 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may be different based on the driver’s profile.

Statistics show a teen driver is more prone to car accidents than older experience drivers, making insurance costs higher. Our licensed agents recommend young or teen drivers to buy full coverage auto policies, so they have motor vehicle coverage in an auto accident as an added layer of protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is best to find a company that offers the cheapest car insurance rates for young or teen drivers in The Centennial State, such as American Family or Auto-Owners, to cut down on your insurance costs.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young Colorado drivers with a speeding violation should look to Geico for the cheapest insurance coverage in Colorado. Geico’s average car insurance cost is $4,478 annually or $3,256 less per year for auto insurance policies with comprehensive and collision coverage.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $4,478 | $373 |

| State Farm | $4,652 | $387 |

| Liberty Mutual | $4,956 | $413 |

| Colorado average | $7,734 | $644 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Inexperienced drivers in Colorado with one at-fault accident can find the best car insurance with American Family, which provided our agents a $4,603 annual rate ($383 per month) for full coverage insurance.

American Family’s at-fault accident rate is 43% cheaper than Colorado’s teen driver accident rate of $7,956 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $4,603 | $383 |

| State Farm | $4,974 | $382 |

| Geico | $5,733 | $477 |

| Colorado average | $7,956 | $663 |

Best Auto Insurance Companies in Colorado

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Colorado by customer satisfaction, surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Nationwide, USAA, and American Family (AmFam) are the best insurance companies based on excellent customer service, claims satisfaction, and NAIC’s complaint index.

ValuePenguin had similar results from their recent Colorado customer survey, with AmFam scoring 86% with customers in claims satisfaction. USAA scores well in customer service ratings but has a higher than normal NAIC complaint index at 0.98, near the national average of 1.00.

| Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| American Family | 86% | 50% |

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| Auto-Owners | 74% | 46% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Liberty Mutual | 61% | 20% |

Our licensed insurance agents also collected information on each insurance company in Colorado from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The car insurance company with the lowest NAIC complaint ratio is AmFam, with a 0.44 complaint ratio compared to their market share and below the national average of 1.00.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction | A.M. Best rating |

|---|---|---|---|

| American Family (AmFam) | 0.44 | 862 | A |

| Allstate | 0.63 | 876 | A+ |

| Travelers | 0.65 | 861 | A++ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| Farmers | 0.74 | 872 | A |

| Liberty Mutual | 0.92 | 870 | A |

| USAA | 0.98 | 890 | A++ |

| Geico | 1.02 | 871 | A++ |

| Safeco | 1.34 | 870 | A |

The NAIC’s complaint ratio compares the number of complaints an auto insurer has based on Colorado’s market share. Any car insurance provider below 1.00 is better than the national average.

State Farm and USAA have the highest J.D. Power claims satisfaction scores of 890 and 891, respectfully.

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While comparison shopping for car insurance companies in Colorado, it is essential to remember that many factors contribute to your premium cost. Your age, driving experience, and even your credit rating can influence your total monthly or annual cost.

It is always best for Colorado drivers to compare car insurance plans to find the best company that offers the lowest insurance rate.

Average Car Insurance Costs by City in Colorado

We collected insurance quotes from Colorado zip codes from top insurance companies and found average rates can vary by $554. Typically, you will pay higher rates if you live in urban cities rather than the state’s rural areas. Your Colorado rate is based not only on your zip code but the type of vehicle, liability limits, marital status, plus many other factors.

Cheapest Car Insurance in Denver, CO

Drivers in Denver, CO can find the cheapest insurance quotes with Auto-Owners, which provided AutoInsureSavings.org agents a rate of $1,673 annually or $139 per month with $100,000 in liability insurance and $500 deductibles for comprehensive and collision coverage. Auto-Owner’s quote is 31% less expensive than the average Denver rate.

| Denver Company | Average Premium |

|---|---|

| Auto-Owners | $1,673 |

| Nationwide | $1,811 |

| AmFam | $1,951 |

| Denver average | $2,414 |

Cheapest Car Insurance in Colorado Springs, CO

Colorado Springs drivers can look to State Farm for the cheapest auto rates, with a quote at $1,530 per year with full coverage insurance. State Farm’s rate is 35% cheaper than Colorado Springs’s $2,352 average rates for similar driver profiles.

| Colorado Springs Company | Average Premium |

|---|---|

| State Farm | $1,530 |

| Nationwide | $1,648 |

| AmFam | $1,833 |

| Colorado Springs average | $2,352 |

Cheapest Auto Insurance in Aurora, CO

Good drivers in Aurora can find the cheapest full coverage insurance policy with Nationwide, which offered us a $1,484 annual rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles and uninsured motorist coverage.

Nationwide’s car insurance rate is $876 less per year than Aurora’s average of $2,360 per year.

| Aurora Company | Average Premium |

|---|---|

| Nationwide | $1,484 |

| AmFam | $1,566 |

| Geico | $1,738 |

| Aurora average | $2,360 |

Cheapest Car Insurance in Fort Collins, CO

Our insurance agents found the cheapest auto insurance rate in Fort Collins is Progressive, with a $1,563 per year rate for a full coverage insurance policy. Progressive’s quote is 34% less expensive than Fort Collins’s average rates.

| Fort Collins Company | Average Premium |

|---|---|

| Progressive | $1,563 |

| AmFam | $1,590 |

| Geico | $1,651 |

| Fort Collins average | $2,402 |

Cheapest Auto Insurance in Lakewood, CO

Drivers in Lakewood can get cheap car insurance with American Family, which provided our licensed agents a $1,487 annual rate for a full coverage insurance policy with $100,000 in liability insurance. AmFam’s quote is 39% less expensive than the average car insurance rates in Lakewood, Colorado.

| Lakewood Company | Average Premium |

|---|---|

| AmFam | $1,487 |

| State Farm | $1,553 |

| Geico | $1,700 |

| Lakewood average | $2,468 |

Cheapest Auto Insurance in Thornton, CO

Good drivers in Thornton can find the least expensive car insurance policy with Nationwide, which offered us a $1,377 per year rate for our sample 30-year-old male driver. Nationwide’s full coverage quote is 37% cheaper than the city of Thornton’s average rates.

| Thornton Company | Average Premium |

|---|---|

| Nationwide | $1,377 |

| AmFam | $1,504 |

| Geico | $1,671 |

| Thornton average | $2,170 |

Average Car Insurance Cost for All Cities in Colorado

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Denver | $2,414 | Salida | $1,860 |

| Colorado Springs | $2,352 | Dove Valley | $1,917 |

| Aurora | $2,360 | Dacono | $1,896 |

| Fort Collins | $2,402 | Shaw Heights | $1,938 |

| Lakewood | $2,468 | Vail | $1,903 |

| Thornton | $2,170 | Brush | $2,006 |

| Arvada | $2,347 | Edgewater | $1,957 |

| Westminster | $2,341 | Eaton | $2,054 |

| Pueblo | $2,266 | Manitou Springs | $1,887 |

| Centennial | $2,333 | Glendale | $1,911 |

| Boulder | $2,317 | West Pleasant View | $2,126 |

| Greeley | $1,860 | Battlement Mesa | $2,022 |

| Highlands Ranch | $1,989 | Breckenridge | $1,917 |

| Longmont | $1,957 | New Castle | $2,131 |

| Loveland | $1,903 | Severance | $1,934 |

| Broomfield | $2,028 | El Jebel | $2,142 |

| Castle Rock | $2,034 | Silverthorne | $1,887 |

| Grand Junction | $2,219 | Mead | $2,006 |

| Commerce City | $2,054 | Castle Pines Village | $2,029 |

| Parker | $2,142 | Todd Creek | $2,179 |

| Littleton | $2,186 | Monte Vista | $2,054 |

| Brighton | $1,922 | Genesee | $1,957 |

| Security-Widefield | $1,903 | Florence | $1,860 |

| Northglenn | $1,967 | Niwot | $1,903 |

| Dakota Ridge | $2,029 | Basalt | $1,911 |

| Englewood | $2,218 | Rocky Ford | $1,887 |

| Ken Caryl | $2,126 | Meridian | $1,934 |

| Pueblo West | $2,029 | Ponderosa Park | $1,922 |

| Wheat Ridge | $2,179 | Yuma | $2,006 |

| Fountain | $2,243 | Timnath | $2,034 |

| Lafayette | $1,860 | Burlington | $2,029 |

| Windsor | $1,922 | Lincoln Park | $2,179 |

| Columbine | $1,887 | Orchard City | $1,911 |

| Erie | $1,957 | Frisco | $2,215 |

| Louisville | $1,903 | Silt | $2,142 |

| Clifton | $2,188 | Acres Green | $2,126 |

| Golden | $2,014 | Penrose | $1,934 |

| Evans | $2,200 | Strasburg | $1,860 |

| Montrose | $2,142 | Walsenburg | $1,887 |

| Sherrelwood | $2,165 | Palmer Lake | $2,218 |

| Cimarron Hills | $1,911 | Holly Hills | $2,006 |

| Durango | $2,034 | Snowmass Village | $1,922 |

| Cañon City | $2,054 | Buena Vista | $2,188 |

| Welby | $2,286 | Platteville | $2,179 |

| Greenwood | $1,934 | Leadville | $1,887 |

| Fort Carson | $1,860 | La Salle | $2,211 |

| Johnstown | $2,029 | Palisade | $1,957 |

| Sterling | $2,296 | Bayfield | $1,903 |

| Black Forest | $2,179 | Hudson | $2,219 |

| Firestone | $1,903 | Wray | $1,860 |

| Fruita | $1,922 | Holyoke | $2,006 |

| Superior | $1,887 | Meeker | $1,934 |

| Steamboat Springs | $1,957 | Laporte | $1,911 |

| Lone Tree | $2,126 | Cedaredge | $2,029 |

| Frederick | $2,142 | Rangely | $2,126 |

| Federal Heights | $2,188 | Bennett | $2,034 |

| Cherry Creek | $1,911 | Colorado City | $2,208 |

| Berkley | $2,006 | Coal Creek | $2,214 |

| Fort Morgan | $2,029 | Las Animas | $1,985 |

| The Pinery | $1,860 | Leadville North | $1,887 |

| Castle Pines | $2,205 | Lyons | $1,957 |

| Gunbarrel | $2,188 | Center | $1,903 |

| Glenwood Springs | $1,934 | Hayden | $2,054 |

| Stonegate | $2,216 | Pagosa Springs | $1,860 |

| Rifle | $1,887 | Akron | $1,922 |

| Roxborough Park | $2,205 | Granby | $2,129 |

| Alamosa | $1,903 | Perry Park | $2,029 |

| Edwards | $2,034 | Telluride | $1,887 |

| Woodmoor | $2,029 | Ault | $1,926 |

| Wellington | $2,142 | Idaho Springs | $1,911 |

| Derby | $2,215 | Kersey | $1,985 |

| Craig | $1,860 | Mountain Village | $2,205 |

| Evergreen | $2,128 | Kremmling | $2,188 |

| Delta | $1,922 | Ordway | $1,903 |

| Redlands | $1,911 | Olathe | $1,887 |

| Cortez | $2,205 | Mancos | $2,190 |

| Fairmount | $2,054 | Inverness | $2,034 |

| Twin Lakes | $1,957 | Del Norte | $1,860 |

| Fort Lupton | $1,926 | Fraser | $1,911 |

| Applewood | $1,903 | Aristocrat Ranchettes | $1,887 |

| Trinidad | $1,985 | Aetna Estates | $2,126 |

| Fruitvale | $2,186 | Indian Hills | $2,054 |

| Lamar | $1,860 | Byers | $2,142 |

| Woodland Park | $2,277 | Crested Butte | $2,205 |

| Aspen | $1,887 | Nederland | $1,903 |

| Monument | $2,126 | Springfield | $1,922 |

| Berthoud | $2,034 | Keenesburg | $2,111 |

| Milliken | $1,911 | Parachute | $1,860 |

| Gypsum | $2,188 | Paonia | $2,029 |

| La Junta | $2,225 | Alamosa East | $1,957 |

| Gleneagle | $2,205 | Ignacio | $1,926 |

| Eagle | $2,029 | Julesburg | $1,911 |

| Carbondale | $1,903 | Columbine Valley | $1,985 |

| Orchard Mesa | $2,142 | Cascade-Chipita Park | $2,100 |

| Cherry Hills Village | $1,922 | Fowler | $2,149 |

| Avon | $1,860 | Log Lane Village | $1,887 |

| Air Force Academy | $1,926 | Wiggins | $2,126 |

| Stratmoor | $2,029 | Towaoc | $1,903 |

| Gunnison | $2,126 | Georgetown | $2,034 |

| Lochbuie | $1,911 | Elizabeth | $1,860 |

| Estes Park | $1,985 | Limon | $1,926 |

| Sheridan | $1,887 | Floyd Hill | $1,909 |

Minimum Auto Insurance Coverage Requirements in Colorado

According to the Colorado General Assembly, all drivers in Colorado must comply with state laws and have the minimum bodily injury liability and property damage liability limits in their auto insurance policies.

| Liability insurance | Colorado minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $15,000 per accident |

Our licensed insurance agents recommend uninsured motorist coverage in Colorado since the uninsured motorist rate is 13.3%, according to the Insurance Information Institute (III.org) and the Rocky Mountain Insurance Information Association (RMIIA.org).

AutoInsureSavings.org agents also recommend higher liability limits with collision and comprehensive coverage or a full coverage policy. You will be responsible for the extra costs in an at-fault auto accident if the cost of bodily injury and property damage exceed liability limits.

To learn more about Colorado’s most affordable car insurance options, enter your zip code or contact the auto insurance experts at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Colorado rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Frequently Asked Questions

How do I save on car insurance in Colorado?

The best way to save on your insurance premium in Colorado is to find out from your car insurance provider if you are eligible for a money-saving driver discount offered by the company. Many insurance providers in Colorado will lower your overall insurance prices if you have more than one policy with them, such as life or home insurance policies.

Another way to save on car insurance premiums is to practice safe driving habits and maintain clean driving records. Many insurance companies offer good driving discounts for Colorado drivers with clean driving records for three to five years.

One example is Nationwide, which offers good drivers a safe driver discount for being moving-violation-free for five years. Not only will you keep your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

How much is full coverage car insurance in Colorado?

The average cost of full coverage car insurance in Colorado is $2,180 per year or $181 per month with $100,000 per accident in liability coverage. Nationwide’s average rate for full coverage is $1,442 per year or $120 per month or 34% less per year, while State Farm’s $1,665 rate is 25% below Colorado’s state average.

How much is Colorado car insurance per month?

The average car insurance costs $2,180 in Colorado for full coverage insurance and $797 per year for state minimum coverage for a 30-year-old driver with a clean driving record.

Who has the cheapest car insurance in Colorado?

Auto-Owners Insurance offers the state minimum’s cheapest auto insurance rate at $481 per year for non-military members. The average annual car insurance premiums for minimum coverage in Colorado are $797, and Auto-Owners premium costs 40% less per year. Other good options for affordable car insurance are USAA at $447 and State Farm at $490 per year.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.