Tennessee Cheapest Car Insurance and Best Car Insurance Options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

When you need to purchase car insurance in Tennessee and find the most affordable coverage, the best way is to compare several insurance companies’ rates.

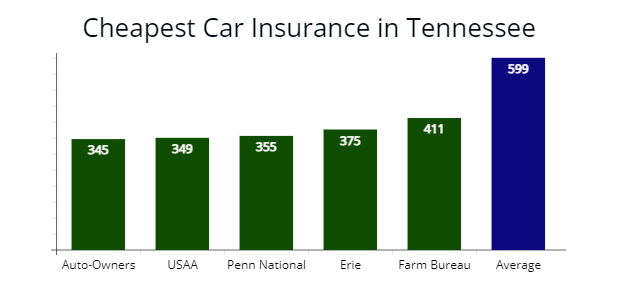

AutoInsureSavings.org licensed insurance agents found the company offering the cheapest minimum liability insurance coverage in Tennessee is Auto-Owners, with a quote at $345, which is 43% less expensive than the statewide average rate of $599.

For the cheapest full coverage policy, the auto insurer is Penn National providing quotes at $998 per year or 37% cheaper than the statewide average rate of $1,575.

In this guide, we will provide you with statistics on the best car insurance in Tennessee and help you understand what factors influence the price of your insurance rates.

Cheapest Car Insurance in Tennessee

| Tennessee Cheapest Car Insurance - Key Considerations |

|---|

The cheapest car insurance companies in Tennessee for minimum coverage are Auto-Owners, Penn National, and Erie. All three auto insurers are 27% less expensive than minimum liability insurance rates. The cheapest car insurance companies in Tennessee for minimum coverage are Auto-Owners, Penn National, and Erie. All three auto insurers are 27% less expensive than minimum liability insurance rates. |

| The most affordable insurers for full coverage in Tennessee are Penn National and Erie. Penn National has an average monthly rate of $83, and Erie's is $95. Both 29% lower than the $131 average Tennessee rate. |

| The best-rated insurers in Tennessee based on the National Association of Insurance Commissioners (NAIC) complaint index and A.M. Best's ratings are Farmers Mutual of Tennessee, Nationwide, and Progressive. |

| Drivers with a clean driving record in Tennessee will see an average of 51% in savings. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Tennessee for Minimum Coverage

According to TN.gov, drivers in Tennessee are required to have at least the minimum amount of insurance coverage.

AutoInsureSavings.org comparison shopping study found Auto-Owners provides the most affordable minimum liability insurance in Tennessee.

Minimum liability coverage is the cheapest form of coverage in the Volunteer State, providing bodily injury and property damage coverage. The average state minimum insurance premiums from Auto-Owners is $345 per year or $29 per month.

Minimum liability coverage is the cheapest form of coverage in the Volunteer State, providing bodily injury and property damage coverage. The average state minimum insurance premiums from Auto-Owners is $345 per year or $29 per month.

The average cost of minimum auto insurance in Tennessee is $599 annually, making Auto-Owners 43% less expensive than the statewide average liability premium.

| Insurance Company | Average annual rate |

|---|---|

| Auto-Owners | $345 |

| USAA | $349 |

| Penn National | $355 |

| Erie | $375 |

| Tennessee Farmers Mutual | $411 |

| Progressive | $445 |

| Travelers | $514 |

| State Auto | $523 |

| Tennessee average | $599 |

*USAA is for military members, their spouses, and family members.

**Your rates may vary when you get quotes.

While most insurance providers have affordable options for minimum coverage, if you require more insurance coverage or have suspended driver’s license violations in your driving history, you’ll need to make sure to compare auto insurance quotes from several companies to find the one that’s right for you.

Tennessee military members, spouses, and family members can get insurance coverage cheaper through USAA.

AutoInsureSavings.org licensed agents found liability policies from USAA cost $349 annually or 42% cheaper than state average rates.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheap insurance premiums make liability-only insurance requirements appear to be the best option. Still, if you are in an at-fault car accident, your auto insurer will only cover you up to liability limits.

With minimum liability coverage, you could have a financial burden if costs exceed your liability limits.

For this reason, our agents recommend getting full coverage with higher liability limits where possible.

Who has the Cheapest Car Insurance for Full Coverage in Tennessee?

After researching car insurance quotes from several companies, we found the average cost of full coverage in Tennessee is $1,575 per year or $131 monthly.

Out of all the rates we analyzed, we found that Penn National offered the lowest rates for full coverage insurance. Their average annual rate is $998, and their monthly rate is $83. That is 37% less expensive than the average rate in the state.

| Insurance Company | Annual cost | Monthly cost |

|---|---|---|

| Penn National | $998 | $83 |

| Erie | $1,133 | $95 |

| Auto-Owners | $1,302 | $108 |

| Tennessee Farmers Mutual | $1,597 | $133 |

| Geico | $1,625 | $135 |

| Tennessee average | $1,575 | $131 |

When you have full coverage insurance, you are almost guaranteed the insurance company will protect your vehicle in the event of a severe accident that causes damage.

Bodily injury and property damage liability coverage, which is the minimum amount required in the state, only pays for damages to the other car in the accident.

But by adding comprehensive and collision insurance, you can enjoy the peace of mind in knowing your vehicle will be protected both on and off the road.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Who has the Cheapest Car Insurance for Good Drivers?

To be considered a good driver by your insurance company, you will need to make sure to maintain a clean driving record with no speeding violations, at-fault accidents, or DUI offenses.

Being a driver with safe driving habits can do more than keep you and other people safe on the road. It can be the best way to help you save money on your premium, 26% on average, compared to drivers with one at-fault accident on their driving record or poor driving habits.

| Rating Factor | $ Savings | % Savings |

|---|---|---|

| No Traffic Tickets | $238 | 15.49% |

| No Accidents | $464 | 26.30% |

| Good Credit | $1,379 | 51.48% |

Credit: TheZebra.com

Along with the cheapest insurance rates, some good drivers may also qualify for additional driver discounts from certain companies, such as a safe driving bonus or a good student discount.

The national average for good drivers’ savings is 36%, while drivers with safe driving habits and excellent credit in Tennessee save 51%.

| Rating Factor | Good Drivers Insurance Quotes | Bad Drivers Insurance Quotes |

|---|---|---|

| Auto-Owners | $1,302 | $1,954 |

| State Farm | $1,466 | $2,181 |

| Geico | $1,625 | $2,320 |

Cheap Car Insurance with Previous At-fault Violations

Drivers who have had one at-fault accident will see a significant rise in their insurance rates following a car crash.

Because of how much insurance rates increase following an accident, auto insurers base risk with driver profiles and previous driving history.

According to the Insurance Information Institute (III.org), a DUI or multiple speeding tickets makes you appear as a higher risk to insurers.

Depending on the severity of the violation, the state of Tennessee may require an SR-22 form or ignition interlock device to restore driving privileges.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Below we review the cheapest full coverage car insurance for Tennessee drivers who have an accident, multiple speeding tickets, and a DUI on their driving record.

Cheapest Car Insurance for Drivers with an Accident?

We found that the least expensive auto insurance provider for drivers with one accident is Auto-Owners in Tennessee.

Their full coverage policies, on average, came to $1,493 annually. While the average rate for drivers with an at-fault accident is $2,510 annually or $209 per month, Auto-Owner’s policyholders will pay 41% less than the state average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Auto-Owners | $1,493 | $124 |

| State Farm | $1,590 | $133 |

| Tennessee Farmers Mutual | $1,643 | $136 |

| Tennessee average | $2,510 | $209 |

AutoInsureSavings.org licensed agents found rates increase 45% on average for drivers with an at-fault accident in their driver history. Car insurance shoppers should realize each auto insurer takes a different approach when evaluating at-fault accidents.

For instance, Tennessee Farmer’s Mutual only raises insurance costs by about 10%. In comparison, State Farm increases rates by 15% on average, and Geico will raise rates by 56%.

Because of the considerable variance in rates following an accident, our agents recommend that comparison shoppers use quote tools to find the best rates. Doing so is the best way to help ensure you are getting the best value for your insurance coverage and staying within the means of your budget.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance for Drivers with a Speeding Ticket?

Drivers in Tennessee can expect to pay more for their annual premiums after receiving a speeding ticket. On the national average, drivers will spend at least 13% more on their premiums following a traffic violation.

The insurance company with the best rates for drivers who’ve had a speeding ticket is Auto-Owners. Their annual premiums for drivers with traffic tickets are $1,366, which is around $677 less than the state average for these drivers, estimated to be about $2,043.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Auto-Owners | $1,366 | $130 |

| State Farm | $1,529 | $127 |

| Tennessee Farmers Mutual | $1,597 | $133 |

| Tennessee average | $2,043 | $170 |

Cheapest Car Insurance for Drivers with a DUI in Tennessee

Driving under the influence can raise your insurance rates more than other violations in Tennessee. In some instances, you may get a driver’s license suspension, need an SR-22 form, required ignition interlock device, or be required to take a defensive driving course.

AutoInsureSavings.org licensed agents found the average rate hike in Tennessee for a DUI is 63%.

Compared to a speeding ticket at 13% and 39% for an at-fault accident.

Our analysis found Progressive provides the best rates for drivers with a DUI in Tennessee.

Progressive specializes in non-standard car insurance, and we found they offer insurance quotes at $2,109 or 53% lower than the state average rate of $3,111 for drivers with a DUI.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,109 | $176 |

| State Farm | $2,233 | $186 |

| Tennessee Farmers Mutual | $2,682 | $224 |

| Tennessee average | $3,111 | $259 |

Cheapest Car Insurance for People with Poor Credit

Tennessee insurance companies may use your credit score to determine your risk profile and charging drivers more for auto insurance coverage if they have a low credit score than those with a high credit score.

For drivers in Tennessee with a poor credit score, AutoInsureSavings.org agents found the average cost of car insurance can be 35% more expensive.

State Farm and Geico offer the best rates for those types of drivers. State Farm increased rates by 6% at $1,553 per year, and Geico increased rates by 7% at $1,738 annually.

| Insurance Company | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,553 | $129 |

| Geico | $1,738 | $144 |

| Tennessee Farmers Mutual | $1,790 | $149 |

| Tennessee average | $2,535 | $211 |

Cheapest Car Insurance for Young Drivers

Young Tennessee drivers may pay triple what 30-year-olds pay for full coverage. An 18-year-old driver’s average annual insurance premiums are $5,987 per year, while our sample 30-year-old pays $1,875 annually.

Accident-prone teen drivers pose more risk to auto insurers, and car insurance companies reflect that risk at a higher rate.

Our agents found that Erie Insurance provides the cheapest car insurance quote for our teen driver for full coverage, with rates averaging $3,980 annually or $334 per month.

They also provide minimum car insurance requirements at $812 annually, 68% cheaper than the state minimum average rate of $1,903 per year.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Erie | $3,980 | $812 |

| Penn National | $4,112 | $1,026 |

| Auto-Owners | $4,270 | $1,311 |

| Geico | $5,200 | $1,400 |

| Tennessee Farmers Mutual | $5,411 | $1,510 |

| Nationwide | $6,329 | $2,111 |

| Liberty Mutual | $7,360 | $2,238 |

| Allstate | $9,230 | $2,244 |

| Tennessee average | $5,987 | $1,903 |

Though it is tempting to get a minimum liability auto insurance policy for teen drivers, our licensed agents recommend young drivers maintain full coverage insurance since it fixes their car damages from an accident. Statistically, teen drivers are more likely to be in an auto accident.

Auto insurers cover only repairs and damages to other vehicles with a minimum insurance coverage policy.

Cheapest Car Insurance for Young Drivers with One Accident

Young Tennessee drivers already pay a high rate for auto insurance costs. Still, an at-fault accident will cause them to go up more, usually by 20%, according to our licensed insurance agent research.

If you are looking for the best insurance rates in this situation, we recommend comparing quotes with State Farm.

The average cost of car insurance for young Tennessean drivers with an at-fault accident is over $7,000 annually, and State Farm provides auto insurance quotes 28% cheaper at $5,434 per year. Geico provides quotes 26% less expensive at $5,588 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $5,434 | $452 |

| Geico | $5,588 | $465 |

| Erie | $5,600 | $466 |

| Tennessee Farmers Mutual | $5,623 | $468 |

| Tennessee average | $7,475 | $622 |

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young Tennessean drivers with speeding tickets can see their auto insurance rates increase by 18% or $712 per year.

AutoInsureSavings.org licensed agents found young shoppers with a single speeding ticket on their driving record can find the cheapest car insurance rates with State Farm.

Their insurance premiums at $4,321 annually are 34% cheaper than the state average insurance rates at $6,744 per year for young motorists in similar situations.

| Insurance Company | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,321 | $360 |

| Geico | $4,655 | $387 |

| Erie | $4,788 | $399 |

| Tennessee Farmers Mutual | $4,965 | $413 |

| Tennessee average | $6,477 | $539 |

Best Car Insurance Companies in Tennessee

Finding the best insurance premiums in Tennessee can help make sure if you are ever involved in a severe accident, your claims process will be as smooth and stress-free as possible.

If customer service is a high priority, you may want to consider Tennessee Farmers Mutual and Nationwide Insurance since both companies have the lowest complaint ratio from the National Association of Insurance Commissioners (NAIC) index.

| Best auto insurance company | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Tennessee Farmers Mutual | 0.12 | N/A | A+ |

| Nationwide | 0.37 | 876 | A+ |

| Progressive | 0.40 | 856 | A+ |

| Farmers | 0.66 | 801 | B++ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Geico | 1.01 | 871 | A++ |

| Erie | 1.10 | 880 | A+ |

Except for Farmers, all insurance companies have at least an “A” rating with A.M. Best, indicating a superior ability to pay out claims. All insurers are higher than the national average.

It would be best if you found an insurance carrier that offers affordable rates and excellent coverage and is responsive and reliable enough to provide you with quality customer service and support in your time of need.

According to the most recent study performed by J.D. Power & Associates, here are the top car insurance companies in Tennessee:

#1: USAA

USAA’s average annual premium for a full coverage auto insurance policy is $1,206. They rank first in J.D. Power’s customer satisfaction rating and have an A++ Superior Financial Strength Rating from AM Best. They also have an A- rating with the Better Business Bureau.

#2 Farm Bureau Insurance of Tennessee

Farm Bureau has an average annual premium of $1,597 for full coverage insurance. Their J.D. Power customer satisfaction rating is 2, and their AM Best Financial Strength Rating is A+ Superior. They also have an A+ rating with the BBB.

#3 Erie Insurance

Erie Insurance’s average annual premium for a full coverage policy is $1,133. They rank at number 3 with J.D. Power’s customer satisfaction rating and have an AM Best Financial Strength Rating of A+ Superior. The company also has an A+ rating with the BBB.

#4 Geico

Geico has an average annual premium of $1,625 for their full coverage insurance policy. They rank at number 4 with their J.D. Power Customer Satisfaction Rating and have an AM Best Financial Strength Rating of A++ Superior. They also have a BBB Rating of A+.

According to ValuePenguin’s survey of the best auto insurance companies for claims processing and customer service, the top car insurance carriers are USAA, Nationwide, and State Farm, as illustrated below.

| Company | % extremely satisfied with recent claim | % rated as excellent customer service |

|---|---|---|

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Erie | 67% | 50% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Tennessee Farmers Mutual | N/A | N/A |

Average Car Insurance Cost by City in Tennessee

Tennessee car insurance companies factor in your location when determining your rates, as well as your driving history, credit score, and type of motor vehicle.

Our insurance agents found Memphis had the highest Tennessee car insurance rates paying $2,358 per year. And Johnson City had the lowest rates, residents paying $1,514 annually.

Generally, car insurance costs more in large, densely populated cities than less populated rural areas near the smoky mountains. In densely populated urban areas of the Volunteer State, car theft and accidents tend to happen often. Your rate may vary when you compare quotes.

| City | Average Insurance Rate | City | Average Insurance Rate |

|---|---|---|---|

| Altamont | $1,869 | Lookout Mountain | $1,700 |

| Ardmore | $2,222 | Loretto | $1,862 |

| Arlington | $2,116 | Loudon | $1,869 |

| Ashland City | $1,910 | Louisville | $2,155 |

| Athens | $1,755 | Luttrell | $1,920 |

| Atoka | $1,869 | Lynchburg | $1,803 |

| Bartlett | $1,700 | Madisonville | $1,769 |

| Baxter | $2,296 | Manchester | $1,869 |

| Bean Station | $1,869 | Martin | $1,700 |

| Belle Meade | $1,940 | Maryville | $1,800 |

| Bells | $1,700 | Mason | $2,040 |

| Benton | $1,803 | Maynardville | $1,869 |

| Blaine | $2,040 | McEwen | $2,018 |

| Bluff City | $1,700 | McKenzie | $1,858 |

| Bolivar | $1,621 | McMinnville | $2,112 |

| Bradford | $1,982 | Medina | $1,700 |

| Brentwood | $1,830 | Memphis | $2,358 |

| Brighton | $1,700 | Milan | $1,621 |

| Bristol | $1,567 | Millersville | $2,129 |

| Brownsville | $1,996 | Millington | $2,300 |

| Bruceton | $1,621 | Monteagle | $1,982 |

| Burns | $1,871 | Monterey | $1,795 |

| Camden | $2,296 | Morristown | $2,032 |

| Carthage | $1,982 | Mosheim | $1,621 |

| Caryville | $2,128 | Mount Carmel | $2,296 |

| Celina | $1,621 | Mount Juliet | $1,990 |

| Centerville | $1,845 | Mount Pleasant | $1,621 |

| Chapel Hill | $2,040 | Mountain City | $2,022 |

| Charlotte | $1,700 | Munford | $1,516 |

| Chattanooga | $2,296 | Murfreesboro | $2,042 |

| Church Hill | $1,589 | Nashville | $1,956 |

| Clarksville | $2,042 | New Hope | $1,798 |

| Cleveland | $1,777 | New Johnsonville | $1,599 |

| Clifton | $1,855 | New Market | $1,768 |

| Clinton | $1,599 | New Tazewell | $1,985 |

| Collegedale | $1,800 | Newbern | $1,907 |

| Collierville | $2,032 | Newport | $1,599 |

| Columbia | $1,982 | Nolensville | $1,902 |

| Cookeville | $1,850 | Norris | $1,700 |

| Coopertown | $2,040 | Oak Hill | $2,009 |

| Cornersville | $1,621 | Oak Ridge | $1,621 |

| Covington | $1,700 | Oakland | $2,040 |

| Cowan | $2,040 | Obion | $1,765 |

| Cross Plains | $1,764 | Oliver Springs | $1,621 |

| Crossville | $1,790 | Oneida | $2,100 |

| Crump | $1,621 | Paris | $1,870 |

| Dandridge | $2,013 | Parsons | $1,986 |

| Dayton | $1,772 | Pegram | $1,621 |

| Decatur | $1,700 | Pigeon Forge | $1,982 |

| Decherd | $1,982 | Pikeville | $1,700 |

| Dickson | $1,621 | Piperton | $1,825 |

| Dover | $1,700 | Pittman Center | $2,040 |

| Dresden | $1,984 | Plainview | $1,621 |

| Dunlap | $2,040 | Pleasant View | $1,900 |

| Dyer | $1,621 | Portland | $2,004 |

| Dyersburg | $1,825 | Powell's Crossroads | $1,825 |

| East Ridge | $1,888 | Pulaski | $1,881 |

| Elizabethton | $2,040 | Red Bank | $1,621 |

| Englewood | $1,982 | Red Boiling Springs | $1,825 |

| Erin | $1,621 | Ridgely | $1,879 |

| Erwin | $2,040 | Ridgetop | $1,982 |

| Estill Springs | $2,070 | Ripley | $2,008 |

| Etowah | $2,027 | Rockwood | $2,074 |

| Fairview | $1,870 | Rocky Top | $1,868 |

| Farragut | $1,710 | Rogersville | $1,667 |

| Fayetteville | $1,986 | Rutherford | $1,710 |

| Forest Hills | $1,879 | Rutledge | $2,040 |

| Franklin | $1,801 | Savannah | $2,296 |

| Gallatin | $1,799 | Scotts Hill | $1,621 |

| Gatlinburg | $1,870 | Selmer | $1,667 |

| Germantown | $2,074 | Sevierville | $1,989 |

| Goodlettsville | $1,915 | Shelbyville | $1,873 |

| Gordonsville | $1,990 | Signal Mountain | $2,074 |

| Graysville | $1,621 | Smithville | $1,825 |

| Greenback | $1,667 | Smyrna | $1,826 |

| Greenbrier | $1,877 | Sneedville | $1,870 |

| Greeneville | $1,870 | Soddy-Daisy | $1,800 |

| Greenfield | $1,754 | Somerville | $1,879 |

| Gruetli-Laager | $1,966 | South Carthage | $1,806 |

| Halls | $1,879 | South Fulton | $1,667 |

| Harriman | $2,032 | South Pittsburg | $1,879 |

| Harrogate | $1,870 | Sparta | $1,827 |

| Hartsville | $1,667 | Spencer | $1,914 |

| Henderson | $1,830 | Spring City | $1,870 |

| Hendersonville | $1,667 | Spring Hill | $1,830 |

| Hohenwald | $1,879 | Springfield | $1,761 |

| Humboldt | $1,760 | Surgoinsville | $1,683 |

| Huntingdon | $1,826 | Sweetwater | $2,032 |

| Huntsville | $2,032 | Tazewell | $1,890 |

| Jacksboro | $2,296 | Tennessee Ridge | $1,667 |

| Jackson | $1,870 | Thompson's Station | $1,884 |

| Jamestown | $1,973 | Three Way | $1,738 |

| Jasper | $1,667 | Tiptonville | $1,870 |

| Jefferson City | $1,844 | Tracy City | $1,667 |

| Jellico | $1,870 | Trenton | $2,032 |

| Johnson City | $1,512 | Troy | $1,879 |

| Jonesborough | $1,599 | Tullahoma | $2,296 |

| Kenton | $2,214 | Tusculum | $1,879 |

| Kimball | $1,667 | Unicoi | $2,296 |

| Kingsport | $1,901 | Union City | $1,667 |

| Kingston | $2,296 | Vonore | $1,911 |

| Kingston Springs | $1,700 | Walden | $1,825 |

| Knoxville | $1,877 | Watertown | $1,825 |

| Lafayette | $1,913 | Waverly | $2,032 |

| La Follette | $2,130 | Waynesboro | $1,825 |

| Lakeland | $1,772 | Westmoreland | $1,772 |

| Lakesite | $1,879 | White Bluff | $1,890 |

| La Vergne | $1,825 | White House | $1,870 |

| Lawrenceburg | $1,879 | White Pine | $1,799 |

| Lebanon | $1,729 | Whiteville | $1,799 |

| Lenoir City | $2,032 | Whitwell | $1,668 |

| Lewisburg | $1,744 | Winchester | $1,870 |

| Lexington | $1,825 | Woodbury | $1,901 |

Cheapest Car Insurance in Nashville, TN

Drivers in Nashville can find the cheapest insurance rates with Erie Insurance. They provide quotes at $1,579 annually or 20% less expensive than Nashville’s average rate of $1,956. Both Penn National and State Farm provide car insurance quotes 12% cheaper than average at $1,632 and $1,738.

| Nashville Company | Average Premium |

|---|---|

| Erie | $1,579 |

| Penn National | $1,632 |

| State Farm | $1,738 |

| Nashville average | $1,956 |

Cheapest Car Insurance in Memphis, TN

Auto-Owners provides the cheapest car insurance for drivers in Memphis. They offer quotes at $1,905 per year or 20% lower than the $2,358 Memphis rate. The next most affordable option for Tennessee car insurance is Farmers Mutual providing quotes at $1,987 or 16% lower than average.

| Memphis Company | Average Premium |

|---|---|

| Auto-Owners | $1,905 |

| Tennessee Farmers Mutual | $1,987 |

| Geico | $2,173 |

| Mempis average | $2,358 |

Cheapest Auto Insurance in Knoxville, TN

Our agents found that Knoxville residents can get the cheapest car insurance coverage with Farmers Mutual and Auto-Owners. Both insurers provide quotes at $1,311 and 1,499 for full coverage, which is 21% cheaper than Knoxville’s average rate.

| Knoxville Company | Average Premium |

|---|---|

| Farmers Mutual of TN | $1,311 |

| Auto-Owners | $1,499 |

| Erie | $1,532 |

| Knoxville average | $1,877 |

Cheapest Car Insurance in Chattanooga, TN

Chattanooga’s most affordable rates are with State Farm ($1,470) and Auto-Owners ($1,581) with full coverage levels. Both insurers are 32% than Chattanooga’s average rate.

| Chattanooga Company | Average Premium |

|---|---|

| State Farm | $1,470 |

| Auto-Owners | $1,581 |

| Geico | $1,740 |

| Chattanooga average | $2,296 |

Cheapest Car Insurance in Clarksville, TN

The auto insurers with the cheapest car insurance quotes in Clarksville are Farmers Mutual ($1,368), Auto-Owners ($1,524), and State Farm ($1,586). All three are at least 23% cheaper than Clarksville’s average premium.

| Clarksville Company | Average Premium |

|---|---|

| Farmers Mutual | $1,368 |

| Auto-Owners | $1,524 |

| State Farm | $1,586 |

| Clarksville average | $2,042 |

Cheapest Car Insurance in Murfreesboro, TN

Drivers in Murfreesboro can find the best rates with Farmers Mutual, which provided quotes at $1,466 annually for our sample 30-year-old driver, which is 29% lower than the citywide average rate.

| Murfreesboro Company | Average Premium |

|---|---|

| Farmers Mutual | $1,466 |

| Erie | $1,533 |

| Geico | $1,690 |

| Murfreesboro average | $2,042 |

Cheapest Car Insurance in Jackson, TN

Jackson, TN has an average rate of $1,870, and Erie can provide the cheapest insurance quotes at $1,299 per year for full coverage for drivers with good driving history. The next best insurance option is Penn National, which can provide quotes at $1,374 annually with equal coverage levels.

| Jackson Company | Average Premium |

|---|---|

| Erie | $1,299 |

| Penn National | $1,374 |

| State Farm | $1,511 |

| Jackson average | $1,870 |

Minimum Car Insurance Requirements in Tennessee

A minimum bodily injury and property damage policy in Tennessee include the following insurance coverages:

| Liability Insurance | Minimum coverage |

|---|---|

| Bodily injury liability (BI) | $25,000 per person and $50,000 per accident |

| Property damage liability (PD) | $15,000 per accident |

Bodily injury liability coverage will pay for injuries to other drivers in a car accident where you at fault.

Property damage liability pays for repairs and damages to the other driver’s vehicle.

Minimum liability in Tennessee doesn’t pay for damages to your car.

AutoInsureSavings.org licensed agents recommend getting full coverage car insurance to cover you and your vehicle in a car crash. It is recommended to buy uninsured motorist coverage in Tennessee too.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Tennessee Car Insurance FAQs

Who has the Cheapest Car Insurance in Tennessee?

After comparing rates from dozens of insurance companies in Tennessee, we found that Auto-Owners offered the most consistent affordable rates. For example, Auto-Owner’s liability-only policy would cost drivers in Tennessee just $345 per year or $29 monthly. The company’s rates are 43% less than the average rate for car insurance in the state, which is $599 per year.

Your next cheapest insurers are Penn National and Erie Insurance. Both auto insurers provide coverage at $355 and $375, respectfully.

Who has the Cheapest Full Coverage Insurance in Tennessee?

With AutoInsureSavings.org comparison shopping study in Tennessee, we found regional insurers are cheaper. Penn National provides full coverage at $998 annually, or 37% less expensive than the statewide average rate.

Erie provides insurance quotes at $1,133, and Auto-Owners offers less than the average rate at $1,302 annually. Both car insurers are 29% and 18% cheaper than the average full coverage rate.

Why is Car Insurance so Expensive in Tennessee?

Tennessee auto insurance may be higher than it is in other states. That is because of the high number of uninsured motorists in the state. Around 20% of all Tennessee uninsured motorists do not have the minimum requirements of insurance. While it may vary or be higher than some states, the average amount of an insurance premium in Tennessee is lower than the national average, $1,500 per year for full coverage and around $600 per year for state minimum.

How Much is Car Insurance per Month in Tennessee?

On average, Tennessee drivers will pay around $50 per month for car insurance or $599 per year. A full-coverage policy is $131 per month or $1,575 annually. Tennessee currently ranks at 22 out of 50 for the most affordable car insurance in the United States.

Here are the average annual costs for car insurance in Tennessee and other states in comparison:

— Tennessee: $1,575 per year

— Kentucky: $1,850 per year

— Georgia: $1,829 per year

— Michigan: $2,297 per year

While the cost of car insurance in Tennessee may be higher than in other states, it is lower than states with large metro areas with parked cars on busy downtown streets, and crashes occur more often on crowded highways.

How do State Laws Affect Tennessee Car Insurance Rates?

The state laws in Tennessee will affect how much you pay for car insurance. Drivers in Tennessee have fewer insurance requirements to abide by than many other states. That means that their rates are slightly less expensive.

Tennessee is an at-fault state, and that is one reason why some drivers will have insurance premiums that are less than they would be in another state. Most no-fault insurance states will often see a large amount of fraud, which tends to raise their insurance costs.

There are several other factors statewide that will also affect insurance costs. These factors include the driver’s personal information if they have any violations on their driving record, credit score, and marital status. A driver who has no credit will usually pay 88% more on average than a driver who has good credit in Tennessee.

Good drivers in Tennessee and those who have violations on their record should both consider comparing several insurance rates before making a final decision on their new policy. It would be best if you always shopped around to find the best deal that suits your budget and your demographic.

To learn more about the best car insurance options by Zip Code in Tennessee, contact the experts at AutoInsureSavings.org. Or enter your zip code at the top of the page.

Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings Coverage Methodology

| AutoInsureSavings.org used insurance data provided by Quadrant Information Services. Rates were publicly sourced from insurer filings and are intended for comparative purposes as your premiums could differ. Our sample driver a 30-year-old male drives 12,000 miles each year in a 2018 Honda Accord. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.