Minnesota Cheapest Car Insurance & Best Insurance Options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

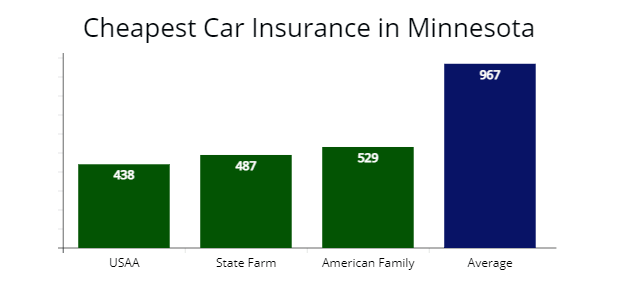

AutoInsureSavings.org licensed agents analyzed the cheapest car insurance in Minnesota and found State Farm provides the cheapest state minimum coverage at $487 per year or 50% less expensive than average rates of $967 per year.

At $1,468 per year, Auto-Owners provides cheap car insurance in Minnesota for drivers who need full coverage or 29% cheaper than state average rates of $2,048 per year.

Cheapest Auto Insurance in Minnesota

Minnesota car insurance shoppers should compare quotes with the same coverage level with at least three insurance companies to find the best rate and save more on their car insurance premiums.

| Cheapest Car Insurance in Minnesota - Key Takeaways |

|---|

The cheapest Minnesota car insurance options are: The cheapest Minnesota car insurance options are:Cheapest for minimum coverage: State Farm Cheapest for full coverage: Auto-Owners Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Auto-Owners Cheapest after a DWI: Geico Cheapest with poor credit history: Geico Cheapest for young drivers: Geico For younger drivers with a speeding violation: State Farm For younger drivers with an at-fault accident: State Farm |

Enter your Zip Code or use this practical Minnesota auto insurance guide which is the best way to find top car insurance providers in your area regardless of driving type or age group.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Minnesota for Minimum Coverage

State Farm offers the cheapest minimum coverage rates for drivers in Minnesota with good driving records, which provided us a $487 per year rate or $480 cheaper than the $967 average rates for our 30-year-old sample driver.

Service members or a family member of military personnel can find the best car insurance rates with USAA, which offered our agents an $438 per year quote or $37 per month for minimum coverage liability insurance.

Cheapest Minnesota car insurance companies for minimum coverage, by quote

| Insurer | Average Annual Rate |

|---|---|

| USAA | $438 |

| State Farm | $487 |

| American Family | $529 |

| Travelers | $586 |

| Auto-Owners Insurance | $745 |

| Geico | $824 |

| Farm Bureau Mutual | $932 |

| Allstate | $1,035 |

| Farmers Insurance | $1,265 |

*USAA is for qualified military members, their spouses, and direct family members. Your auto insurance rates may vary based on your driver profile.

Buying a minimum coverage policy is the cheapest way to meet Minnesota car insurance requirements to ensure you stay legal.

State minimum coverage may not have sufficient coverage with the amount of bodily injury coverage and property damage coverage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

A state minimum auto policy in Minnesota only covers up to $60,000 per accident in bodily injury liability and $10,000 per accident in property damage liability with $40,000 in personal injury protection (PIP) and $50,000 per accident of uninsured motorist coverage.

Cheapest Full Coverage Car Insurance in Minnesota

Auto-Owners offers the cheapest auto insurance rates for drivers in Minnesota with good driving records for full coverage. Auto-Owners’ $1,468 per year rate is 29% less expensive than state average rates of $2,048 per year.

Cheapest Minnesota car insurance companies for full coverage, by quote

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Auto-Owners Insurance | $1,468 | $122 |

| State Farm | $1,662 | $138 |

| Geico | $1,781 | $148 |

| Minnesota average | $2,048 | $170 |

A full-coverage policy for drivers in Minnesota costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included. Your motor vehicle is protected no matter who is at fault or property damage from hitting a street sign or fallen tree branch.

Cheapest Car Insurance in Minnesota with a Speeding Ticket

Auto-Owners offers the cheapest car insurance for Minnesota drivers with speeding tickets on their driving records. Auto-Owners’ $1,587 per year rate is 33% or $779 less expensive than state average rates.

Cheapest Minnesota insurance companies for full coverage after a speeding ticket, by quote

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Auto-Owners Insurance | $1,587 | $132 |

| Geico | $1,754 | $146 |

| American Family | $2,061 | $171 |

| Minnesota average | $2,366 | $197 |

According to the Minnesota Office of Traffic Safety, your auto insurance rates can increase by $318 per year or 14% with one traffic violation for speeding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Most auto insurers will increase car insurance rates after traffic tickets, so you want to make sure to shop around for cheaper insurance companies after any traffic violation on driving records.

Cheapest Car Insurance in Minnesota With a Car Accident

According to our analysis, State Farm offers the cheapest insurance for Minnesota drivers with an at-fault accident with a $1,890 per year car insurance premium for our sample driver.

State Farm’s rate is 37% less expensive than Minnesota’s average rates for drivers with one accident in their driving history.

Cheapest Minnesota insurance companies for full coverage after an accident, by quote

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,890 | $157 |

| Geico | $2,465 | $205 |

| American Family | $2,571 | $214 |

| Minnesota average | $2,965 | $247 |

Getting into an at-fault accident may cause a rate increase of 31% or $917 per year for three years, showing the importance of shopping for cheaper auto insurance in Minnesota if you have a change on your driving record.

To make sure you get the best rates, be sure to shop around and compare auto insurance quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance in Minnesota with a DWI

Drivers in Minnesota with DWI offenses on their driving records can find the cheapest insurance with Geico, which provided our insurance agents a quote at $2,625 per year or a $218 monthly rate for full coverage.

The average annual rate increase for drivers in Minnesota with DUI violations is $1,419 per year, making Geico’s rate 25% cheaper than Minnesota’s average DUI rate.

Cheapest Minnesota insurance companies for full coverage after a DUI, by quote

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $2,625 | $218 |

| State Farm | $2,794 | $232 |

| Travelers | $2,971 | $247 |

| Minnesota average | $3,467 | $289 |

According to the Insurance Information Institute, car insurance premiums increase by 41% on average for Minnesota drivers with driving while intoxicated violations (DWI’s) in Minnesota.

Along with significantly higher car insurance rates, the Minnesota Office of Traffic Safety states you will have a suspended driver’s license for 30 days to a year with costs as high as $20,000 when factoring legal and court fees.

Cheapest Car Insurance in Minnesota for Drivers With Poor Credit

Geico offers the least expensive insurance premiums for Minnesota drivers with a poor credit score. Geico provides a savings of over $725 per year or 27% less expensive, with an insurance premium of $2,026 per year for full coverage.

American Family is the second cheapest car insurance option for a poor credit score at $2,250 per year or 19% cheaper than average Minnesota poor credit rates.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $2,026 | $168 |

| American Family | $2,250 | $187 |

| State Farm | $2,362 | $196 |

| Minnesota average | $2,751 | $229 |

Cheapest Car Insurance in Minnesota for Young Drivers

We found young drivers in Minnesota with a good driving record looking for the cheapest full coverage insurance is with Geico, which provided our agents a $2,965 per year quote or 43% less expensive than our sample young driver’s average car insurance rates in Minnesota.

The cheapest state minimum coverage in Minnesota for teenage drivers is Geico, which offered us a quote at $1,054 per year or 41% cheaper than average rates. The next best option for younger drivers is State Farm, with a $1,143 per year rate for minimum liability insurance.

| Insurer | Full Coverage | Minimum Coverage |

|---|---|---|

| USAA | $2,840 | $987 |

| Geico | $2,965 | $1,054 |

| State Farm | $3,365 | $1,143 |

| Travelers | $3,670 | $1,655 |

| Auto-Owners | $3,843 | $2,032 |

| American Family | $4,629 | $1,780 |

| Farm Bureau Mutual | $4,971 | $2,065 |

| Allstate | $6,938 | $1,816 |

| Farmers | $7,347 | $2,783 |

*USAA is for qualified military members, their spouses, and direct family members. Your car insurance rates may be different based on your driver profile.

Statistics show a teen driver is more prone to car accidents than older experience drivers, making car insurance rates higher. Our licensed agents recommend younger drivers in Minnesota buy full coverage auto insurance policies to have motor vehicle coverage in an auto accident as an added layer of protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance in Minnesota for Young Drivers with a Speeding Ticket

Young drivers in Minnesota with a speeding violation should look to State Farm for the cheapest auto insurance. State Farm’s average car insurance cost is $3,369 per year or 44% less per year for car insurance policies in Minnesota with comprehensive and collision coverage.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $3,369 | $280 |

| American Family | $4,641 | $386 |

| Auto-Owners Insurance | $4,792 | $399 |

| Minnesota average | $5,981 | $498 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Young drivers in Minnesota with an accident history can find the best car insurance premiums with State Farm, which provided our agents a $3,540 per year rate for full coverage insurance.

State Farm’s at-fault accident rate is 51% cheaper than Minnesota’s average rates of $7,138 per year for teen drivers with a car accident.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $3,540 | $295 |

| Geico | $4,237 | $353 |

| American Family | $5,243 | $436 |

| Minnesota average | $7,138 | $594 |

Best Car Insurance Companies in Minnesota

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Minnesota by customer satisfaction, insurance surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Auto-Owners Insurance and American Family are the best car insurance companies based on excellent customer satisfaction, claims service, and NAIC’s complaint index.

AutoInsureSavings.org licensed agents had similar results from ValuePenguin’s recent Minnesota car insurance customer survey, with Auto-Owners and American Family scoring 100% and 86% respectfully with customers in claims satisfaction.

| Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| American Family | 86% | 50% |

| USAA | 78% | 62% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

| Geico | 64% | 42% |

Our licensed insurance agents also collected information on each car insurer in Minnesota from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The company with the lowest NAIC complaint ratio is Progressive, with a 0.14 complaint ratio compared to their market share and below the national average of 1.00. Auto-Owners is below the national average with a 0.44 NAIC complaint ratio, and American Family (AmFam) is 0.45.

| Insurer | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating |

|---|---|---|---|

| Progressive | 0.14 | 856 | A+ |

| Auto-Owners Insurance | 0.44 | 890 | A++ |

| American Family Insurance | 0.45 | 862 | A |

| State Farm | 0.66 | 881 | A++ |

| Farmers | 0.74 | 872 | A |

| USAA | 0.98 | 890 | A++ |

| Geico | 1.01 | 871 | A++ |

| Allstate | 1.12 | 876 | A+ |

The NAIC’s complaint ratio compares the number of complaints a car insurer has based on the Minnesota market share. Any car insurance provider below 1.00 is better than the national average.

Auto-Owners and USAA have the highest J.D. Power claims satisfaction scores of 890 each.

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While comparison shopping for car insurance companies in Minnesota, it is essential to remember that many factors contribute to your premium cost. Your age, driving experience, and vehicle type can influence your total monthly or annual cost.

It is always best for drivers in Minnesota to compare car insurance plans to find the best insurance company that offers the lowest insurance rate.

Average Cost of Car Insurance by City in Minnesota

We collected insurance quotes from Minnesota zip codes from top insurance companies and found average rates can vary by $437 per year.

Typically, you will pay higher auto insurance rates if you live in urban cities rather than the state’s rural areas.

Your Minnesota insurance rate is based not only on your zip code but also on the type of vehicle, driver history, credit score, liability limits, and many other risk factors.

Cheapest Car Insurance in Minneapolis, MN

Drivers in Minneapolis, Minnesota, can find the cheapest insurance quotes with USAA, which provided AutoInsureSavings.org agents a rate of $1,540 per year with $500 deductibles for comprehensive and collision coverage. USAA’s quote is 37% less expensive than Minneapolis’ average rates.

| Minneapolis insurance | Average Premium |

|---|---|

| USAA | $1,540 |

| American Family | $1,639 |

| State Farm | $1,670 |

| Minneapolis average | $2,431 |

Cheapest Car Insurance in St. Paul, MN

Drivers in St. Paul can look to State Farm for the cheapest auto quotes, with a rate of $1,498 per year with full coverage insurance. State Farm’s rate is 36% cheaper than St. Paul’s $2,357 average rates for 30-year-old drivers.

| St. Paul insurance | Average Premium |

|---|---|

| State Farm | $1,498 |

| Geico | $1,575 |

| Travelers | $1,641 |

| St. Paul average | $2,357 |

Cheapest Car Insurance in Rochester, MN

Good drivers in Rochester, Minnesota, can find the cheapest full coverage with Auto-Owners Insurance, which offered us a $1,480 per year rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles. Auto-Owners’ car insurance rate is 37% less per year than Rochester’s average rates of $2,340 per year.

| Rochester insurance | Average Premium |

|---|---|

| Auto-Owners | $1,480 |

| State Farm | $1,563 |

| American Family | $1,682 |

| Rochester average | $2,340 |

Cheapest Car Insurance in Duluth, MN

Our insurance agents found the cheapest auto insurance rate in Duluth, Minnesota, is Geico, with a $1,535 per year rate for a full coverage auto policy. Geico’s quote is 35% less expensive than Duluth’s average rates.

| Duluth insurance | Average Premium |

|---|---|

| Geico | $1,535 |

| State Farm | $1,590 |

| Travelers | $1,748 |

| Duluth average | $2,412 |

Cheapest Auto Insurance in Bloomington, MN

Drivers in Bloomington can get cheaper car insurance rates with American Family (AmFam), which provided our licensed agents a $1,387 per year rate for full coverage with $100,000 in liability insurance. AmFam’s quote is 42% less expensive than the average rates in Bloomington, MN.

| Bloomington insurance | Average Premium |

|---|---|

| American Family | $1,387 |

| Travelers | $1,466 |

| Auto-Owners Insurance | $1,714 |

| Bloomington average | $2,363 |

Cheapest Auto Insurance in Brooklyn Park, MN

Good drivers in Brooklyn Park can find the least expensive policy with State Farm, which offered us a $1,317 per year rate for our sample 30-year-old male driver. State Farm’s full coverage quote is 46% cheaper than Brooklyn Park’s average rates per year.

| Brooklyn Park insurance | Average Premium |

|---|---|

| State Farm | $1,317 |

| Geico | $1,431 |

| Auto-Owners Insurance | $1,560 |

| Brooklyn Park average | $2,402 |

Cheapest Car Insurance in Maple Grove, MN

Drivers in Maple Grove can shop around and get cheap auto insurance with USAA, which provided our licensed agents a $1,187 annual rate for a full coverage policy with $100,000 in liability insurance. USAA’s quote is 45% less expensive than the average rates in Maple Grove.

| Maple Grove insurance | Average Premium |

|---|---|

| USAA | $1,187 |

| Geico | $1,324 |

| State Farm | $1,372 |

| Maple Grove average | $2,180 |

Average Car Insurance Cost for All Cities in Minnesota

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Minneapolis | $2,431 | Newport | $1,860 |

| St. Paul | $2,357 | Two Harbors | $1,899 |

| Rochester | $2,340 | Mora | $1,845 |

| Duluth | $2,412 | Perham | $1,853 |

| Bloomington | $2,363 | Zumbrota | $1,878 |

| Brooklyn Park | $2,402 | Sleepy Eye | $1,897 |

| Plymouth | $2,415 | Ely | $1,924 |

| Maple Grove | $2,180 | Annandale | $1,943 |

| Woodbury | $2,255 | Long Prairie | $1,965 |

| St. Cloud | $2,247 | Hanover | $1,890 |

| Eagan | $1,853 | Plainview | $1,894 |

| Eden Prairie | $1,999 | Jackson | $1,987 |

| Blaine | $2,242 | Breckenridge | $1,949 |

| Lakeville | $2,043 | Montrose | $1,890 |

| Coon Rapids | $2,187 | Rush City | $1,860 |

| Burnsville | $2,194 | Blue Earth | $1,866 |

| Minnetonka | $1,845 | Pine City | $1,878 |

| Apple Valley | $2,160 | Staples | $1,924 |

| Edina | $1,954 | Benson | $1,980 |

| St. Louis Park | $2,250 | Proctor | $2,015 |

| Moorhead | $1,890 | Eagle Lake | $1,860 |

| Mankato | $2,268 | Afton | $1,853 |

| Shakopee | $1,943 | Chatfield | $1,924 |

| Maplewood | $1,878 | Greenfield | $1,845 |

| Cottage Grove | $2,017 | Montgomery | $1,965 |

| Richfield | $2,233 | Milaca | $1,890 |

| Roseville | $1,860 | Mountain Iron | $1,866 |

| Inver Grove Heights | $2,019 | Moose Lake | $1,915 |

| Andover | $2,117 | Caledonia | $1,878 |

| Savage | $2,132 | Osseo | $1,924 |

| Brooklyn Center | $1,845 | Crosby | $1,974 |

| Oakdale | $2,164 | Cokato | $2,024 |

| Fridley | $2,041 | Dodge Center | $1,860 |

| Winona | $1,853 | Roseau | $1,924 |

| Shoreview | $1,890 | Wabasha | $2,041 |

| Ramsey | $1,915 | Sandstone | $1,977 |

| Chaska | $1,878 | Granite Falls | $1,965 |

| Prior Lake | $2,024 | Foley | $2,053 |

| Owatonna | $1,866 | Madelia | $1,890 |

| White Bear Lake | $1,924 | Lake Crystal | $2,012 |

| Chanhassen | $2,063 | Barnesville | $1,878 |

| Austin | $1,943 | Glenwood | $1,989 |

| Champlin | $1,860 | Rockville | $1,845 |

| Elk River | $1,890 | Lauderdale | $1,853 |

| Rosemount | $2,053 | Janesville | $1,915 |

| Faribault | $2,081 | Paynesville | $2,024 |

| Crystal | $1,915 | Pelican Rapids | $1,860 |

| Farmington | $2,053 | Spring Valley | $1,924 |

| Hastings | $2,086 | Le Center | $1,890 |

| New Brighton | $2,063 | Olivia | $1,866 |

| Golden Valley | $1,943 | Arlington | $2,012 |

| Lino Lakes | $1,845 | Excelsior | $2,041 |

| New Hope | $1,878 | Wells | $2,086 |

| Northfield | $1,853 | Aitkin | $2,063 |

| South St. Paul | $1,890 | Tracy | $1,965 |

| Columbia Heights | $1,943 | Breezy Point | $1,845 |

| Forest Lake | $2,086 | Maple Lake | $1,915 |

| West St. Paul | $1,924 | Crosslake | $2,024 |

| Willmar | $1,860 | Winsted | $1,878 |

| Stillwater | $1,979 | Pequot Lakes | $1,890 |

| Hopkins | $1,866 | Lexington | $2,081 |

| Sartell | $2,012 | Hawley | $2,086 |

| Albert Lea | $2,092 | Mountain Lake | $2,024 |

| St. Michael | $2,055 | St. Bonifacius | $1,853 |

| Anoka | $1,845 | Hoyt Lakes | $1,860 |

| Otsego | $1,878 | Esko | $1,924 |

| Ham Lake | $1,890 | Eyota | $1,965 |

| Red Wing | $2,041 | Springfield | $1,978 |

| Buffalo | $1,915 | Slayton | $1,878 |

| Hibbing | $2,024 | Stacy | $1,866 |

| Bemidji | $2,063 | Ortonville | $2,012 |

| Hugo | $1,853 | Kenyon | $1,965 |

| Robbinsdale | $1,924 | Mayer | $1,977 |

| Hutchinson | $1,943 | Blooming Prairie | $2,011 |

| North Mankato | $1,860 | Spring Park | $1,845 |

| Fergus Falls | $2,081 | Waterville | $1,915 |

| Sauk Rapids | $1,890 | Maple Plain | $2,063 |

| Marshall | $1,878 | Clearwater | $1,965 |

| Monticello | $1,943 | Gilbert | $2,024 |

| Alexandria | $1,866 | Braham | $1,853 |

| Vadnais Heights | $1,965 | Nisswa | $1,860 |

| Brainerd | $2,010 | Lewiston | $1,878 |

| New Ulm | $1,915 | Lakeland | $1,924 |

| Worthington | $1,845 | Long Lake | $2,053 |

| Mounds View | $1,853 | Red Lake | $1,890 |

| Rogers | $1,977 | Aurora | $2,041 |

| North St. Paul | $2,370 | Gaylord | $1,845 |

| Waconia | $1,918 | Osakis | $1,965 |

| Cloquet | $1,943 | Rushford | $1,866 |

| East Bethel | $2,090 | Silver Bay | $1,890 |

| St. Peter | $2,021 | Mapleton | $1,977 |

| Mendota Heights | $1,943 | Warren | $2,024 |

| Grand Rapids | $1,878 | Pierz | $1,853 |

| Big Lake city | $1,924 | Avon | $1,890 |

| North Branch | $1,860 | Coleraine | $2,081 |

| Little Canada | $1,866 | Rice | $1,915 |

| Arden Hills | $1,845 | Madison | $2,012 |

| Fairmont | $1,890 | Hinckley | $1,878 |

| Hermantown | $2,058 | Canby | $1,949 |

| Mound | $2,041 | Richmond | $2,086 |

| Victoria | $1,853 | Dundas | $1,845 |

| Detroit Lakes | $2,024 | Oronoco | $2,063 |

| St. Anthony | $1,965 | Fosston | $1,860 |

| Waseca | $2,098 | Tonka Bay | $1,866 |

| Lake Elmo | $1,949 | Dassel | $1,890 |

| Thief River Falls | $1,878 | Wheaton | $1,977 |

| Cambridge | $2,086 | Hayfield | $1,965 |

| Oak Grove | $1,919 | Babbitt | $1,943 |

| Little Falls | $1,845 | Winnebago | $1,924 |

| East Grand Forks | $2,090 | Appleton | $1,853 |

| Virginia | $1,890 | Waverly | $2,024 |

| Baxter | $1,860 | Preston | $2,081 |

| Mahtomedi | $2,057 | Medford | $1,845 |

| Orono | $2,063 | Clara City | $2,041 |

| Wyoming | $1,866 | Bagley | $1,949 |

| New Prague | $2,081 | Starbuck | $2,097 |

| Shorewood | $1,924 | Winthrop | $1,860 |

| Crookston | $1,977 | Red Lake Falls | $1,878 |

| Waite Park | $2,012 | Fulda | $2,096 |

| St. Francis | $2,063 | Frazee | $1,890 |

| Minnetrista | $1,853 | Spring Grove | $2,053 |

| Albertville | $1,965 | Tyler | $1,943 |

| Belle Plaine | $1,845 | New York Mills | $1,915 |

| St. Joseph | $1,878 | Glyndon | $2,012 |

| Litchfield | $2,041 | Dellwood | $1,924 |

| Spring Lake Park | $2,064 | Mahnomen | $1,866 |

| Medina | $2,024 | Minneota | $1,845 |

| Kasson | $1,860 | Elgin | $1,949 |

| Jordan | $1,890 | Elbow Lake city | $1,853 |

| Stewartville | $1,845 | Goodhue | $1,878 |

| Delano | $1,924 | Nicollet | $2,086 |

| International Falls | $2,012 | Edgerton | $2,131 |

| Corcoran | $1,949 | Royalton | $2,053 |

| Dayton | $2,066 | Renville | $1,860 |

| Isanti | $1,845 | New London | $1,965 |

| Zimmerman | $1,853 | Spicer | $2,081 |

| Falcon Heights | $1,915 | Scanlon | $1,924 |

| Glencoe | $1,890 | Adrian | $2,041 |

| Byron | $1,878 | Shafer | $1,977 |

| St. Paul Park | $1,866 | Little Rock | $2,114 |

| Morris | $1,943 | Nashwauk | $1,915 |

| Lake City | $1,845 | Fairfax | $1,949 |

| North Oaks | $1,965 | Redby | $1,878 |

| La Crescent | $2,053 | Wanamingo | $1,853 |

| Montevideo | $1,860 | New Richland | $2,012 |

| Chisago City | $1,924 | Grand Meadow | $2,069 |

| Redwood Falls | $2,086 | Keewatin | $2,105 |

| Circle Pines | $1,915 | Carlton | $1,845 |

| Chisholm | $2,081 | Taylors Falls | $1,866 |

| Oak Park Heights | $1,977 | Parkers Prairie | $1,890 |

| Becker | $1,853 | Le Roy | $1,860 |

| Carver | $1,949 | Harris | $2,041 |

| Princeton | $2,024 | Hallock | $2,053 |

| Nowthen | $1,878 | Lake St. Croix Beach | $1,915 |

| Elko New Market | $2,067 | Hilltop | $1,943 |

| Lindstrom | $1,890 | Belgrade | $1,965 |

| Luverne | $1,860 | Sherburn and Houston | $2,081 |

| Wayzata | $2,044 | Baudette | $1,878 |

| Rockford | $1,866 | Mantorville | $2,081 |

| St. James | $2,086 | Atwater | $2,053 |

| Windom | $2,063 | East Gull Lake | $1,853 |

| Sauk Centre | $2,041 | Morristown | $2,069 |

| Dilworth | $1,845 | Hector | $2,024 |

| Watertown | $2,012 | Fertile | $1,890 |

| Cold Spring | $1,926 | Birchwood Village | $1,860 |

| Wadena | $1,915 | Deer River | $1,866 |

| Rice Lake city | $1,943 | Onamia | $1,845 |

| Goodview | $1,977 | Silver Lake | $1,949 |

| Scandia | $1,878 | Watkins | $2,063 |

| Grant | $1,853 | Walker | $2,080 |

| Pipestone | $2,014 | Kimball | $1,915 |

| Columbus | $1,965 | La Prairie | $1,943 |

| Le Sueur | $1,866 | Lilydale | $2,049 |

| Lonsdale | $1,860 | Pine River | $1,878 |

| Centerville | $2,048 | Clarkfield | $1,853 |

| Deephaven | $1,845 | Browerville | $1,977 |

| Independence | $1,890 | Henderson | $2,023 |

| St. Charles | $2,019 | Blackduck | $2,063 |

| Norwood | $1,915 | Morgan | $1,924 |

| Bayport | $1,878 | Vineland | $1,845 |

| St. Augusta | $1,943 | Bird Island | $1,860 |

| Melrose | $1,977 | Landfall | $1,949 |

| Eveleth | $1,924 | Henning | $1,890 |

| Pine Island | $1,853 | Rushford Village | $1,866 |

Minimum Auto Insurance Requirements in Minnesota

According to the Minnesota Department of Public Safety, all drivers in Minnesota must comply with state auto insurance laws and have the minimum bodily injury liability coverage, property damage liability, personal injury protection (PIP), and uninsured motorist coverage in their car insurance policies for vehicle registration and to drive legally on the roads.

Below are the Minnesota state requirements with minimum liability limits:

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability | $30,000 per person and $60,000 per accident |

| Property damage liability | $10,000 per accident |

| Uninsured/Underinsured motorist coverage | $25,000 per person / $50,000 per accident |

| Personal injury protection | $40,000 per accident |

AutoInsureSavings.org insurance agents recommend higher liability car insurance for drivers in Minnesota with collision and comprehensive coverage or full coverage.

You will be responsible for the extra costs in an at-fault auto accident in Minnesota if the cost of bodily injury and property damage exceeds the liability insurance requirements.

Frequently Asked Questions – Car Insurance in Minnesota

Who has the Cheapest Car Insurance in Minnesota?

State Farm offers the state minimum cheapest auto insurance rate at $487 per year for 30-year-old drivers. The average annual car insurance premiums for minimum coverage in Minnesota are $967 per year, and State Farm’s premium costs 50% less per year. Other good options for affordable car insurance are American Family at $529 per year and Auto-Travelers Insurance at $586 per year.

How Much is Car Insurance in Minnesota per Month?

The average car insurance costs $170 per month for full coverage in Minnesota and $80 per month for state minimum coverage for a 30-year-old driver with a clean driving record.

How Much Is Full Coverage Car Insurance in Minnesota?

The average cost of full coverage car insurance in Minnesota is $2,048 per year or $170 per month with $100,000 per accident in liability coverage. Auto-Owners’ average rate for full coverage is $1,468 per year or $122 per month or 29% less per year, while State Farm’s $1,662 rate is 19% below Minnesota state average rates.

How do I Save on Car Insurance in Minnesota?

The best way to save on your insurance premium in Minnesota is to find out from your car insurance provider if you are eligible for the company’s money-saving driver discounts. Many insurance providers in Minnesota will lower your overall insurance prices if you have more than one car insurance policy with them, such as life or home insurance policies.

Another way to save on car insurance premiums is to practice safe driving habits and maintain clean driving records. Many auto insurance companies offer good driving discounts for drivers in Minnesota that have clean driving records. One example is American Family, which offers good drivers a safe driver discount of up to 20% through the “KnowYourDrive” telematics car insurance program. Not only will you keep and your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

To learn more about affordable car insurance in Minnesota, enter your zip code or get expert advice at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used car insurance rates for Minnesota drivers with accident histories and other traffic violations for various age groups for rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Sources

– Minnesota Department of Public Safety, Office of Traffic Safety. “Auto Insurance Guide.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– Minnesota Office of Traffic Safety. “Impaired Driving Laws.”

– Minnesota Commerce Department. “Auto Insurance Basics.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.